The joy of six

Take-Two bets on GTA6 to deliver an $2.7B+ payday and offset mobile gaming struggles

The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

In the wake of its recently released trailer, the continued success of the Grand Theft Auto franchise seems self-evident. A closer investigation of how the game managed to become as popular as it is today, however, tells the story of a publisher that had to overcome key strategic difficulties. The following looks at challenges Take-Two Interactive encountered over the past decade and what obstacles may be on the road to the release of Grand Theft Auto VI.

TL;DR

Based on a historical comparison and an anticipated install base of 130 million in 2025, GTA6 should sell around 38 million copies in its first twelve months.

At an average selling price of $70, the new title would generate $2.7 billion via digital and physical channels, which is consistent with Take-Two’s forecasts.

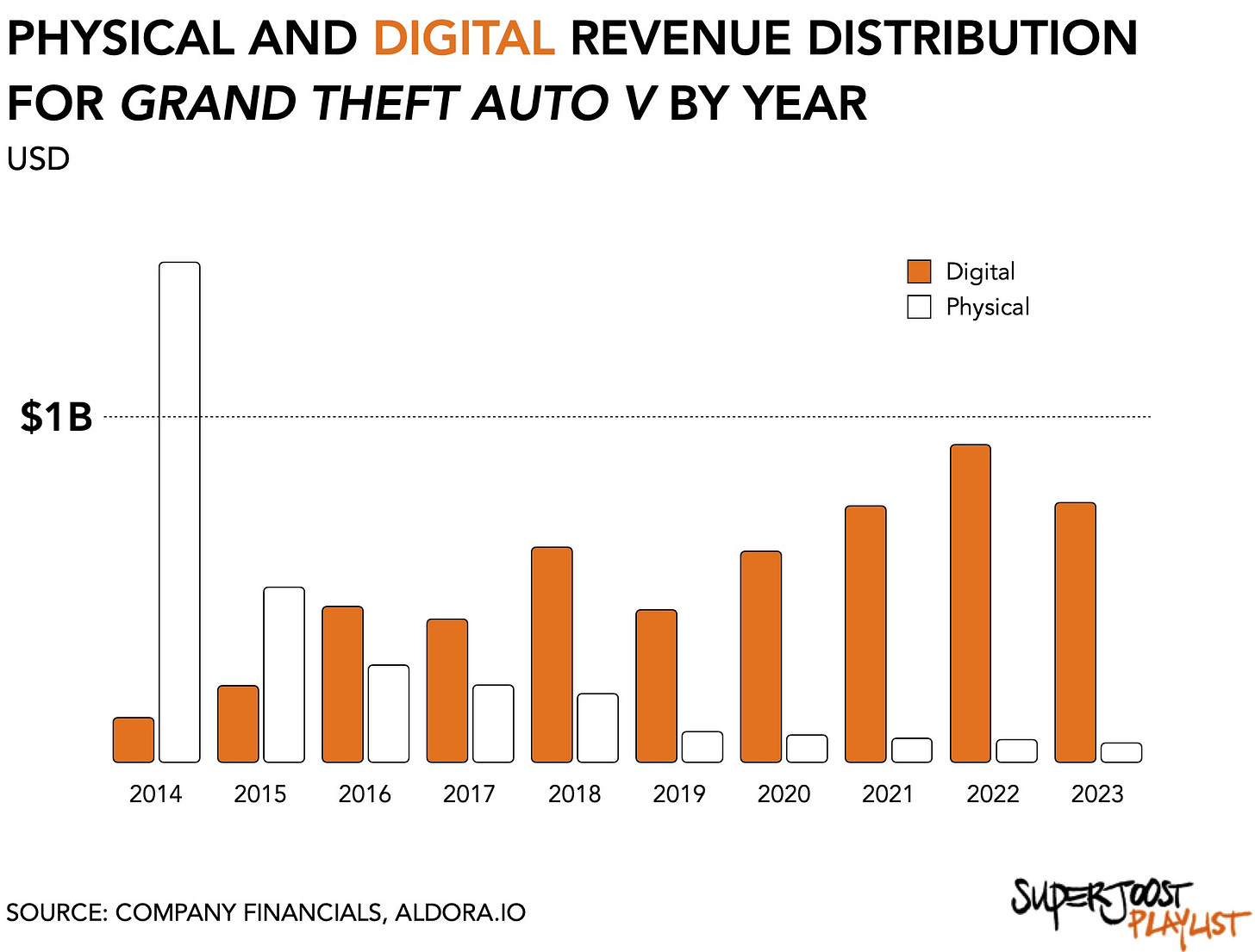

Since its launch a decade ago, GTA5 has generated $5.2 billion in digital revenues compared to $3.1 billion in physical sales.

On average, the GTA franchise accounts for 30 percent of Take-Two’s annual revenue. The publisher’s continued success to closely tied to that of GTA6.

Back in February 2022, a two-word acknowledgment from publisher Take-Two Interactive that the development for Grand Theft Auto IV (GTA6) was “well underway” set off a firestorm of speculation among gamers and investors. Bolstered by the firm’s increase of anticipated net bookings from $5.5 billion for 2024 to $8 billion in 2025, a long-awaited sequel was finally coming closer to release. Gamers responded enthusiastically. Garnering over 110 million views within a day on YouTube, the next installment’s trailer promises to be another blockbuster success.

And for good reason.

Take-Two has a history of delivering high-quality titles, for one. Every major release in the series has outperformed its predecessor. Grand Theft Auto III (2001) shipped a million units in under a year. Launched only a year later, Grand Theft Auto Vice City sold 5 million units in that same time frame. Following, Grand Theft Auto: San Andreas (2004) became the best-selling title of all time on the PlayStation with 12 million shipped units within four months. The 2008 release of Grand Theft Auto IV did even better when it sold 11 million copies within just its first month and rang up $500 million in sales in its first week. The biggest release so far was Grand Theft Auto V (2013) which exceeded $1 billion in sales within its first three days and 29 million copies within its first six weeks. In just a few weeks it had sold more units than its predecessor had over five years.

Such success wasn’t always self-evident.

In the lead-up to the 2013 release of GTA5 expectations of Take-Two, and the console gaming market more generally, had softened. The transition to digital distribution posed new challenges for popular titles. Worse, mobile gaming had started to grow rapidly. After Apple approved in-game monetization in the form of free-to-play and micro-transactions in its ecosystem, a growing number of game makers, investors, and consumers started to exclusively focus on the new device category. Mobile gaming was going to disrupt the console games industry which called into question the longevity of even existing franchises. Take-Two’s reliance on console gaming combined with having no meaningful presence on mobile made it appear vulnerable to digital changes.

These anxieties initially seemed validated when Take-Two initially struggled to facilitate online gameplay. Despite a successful launch, switching on its online mode, Grand Theft Auto V Online, proved disastrous when the bulk of its player base simultaneously tried to log in. Unable to accommodate demand, GTA’s server infrastructure crashed and remained offline for several weeks. Gamers were understandably disappointed and it suggested to investors that Take-Two wasn’t quite ready for digital prime time. (The comparison with other live-services games was unfair, of course. Online multiplayer games generally grow their user base over time and expand their server infrastructure gradually instead of instantly.) One of its developers told me at the time:

“We simply underestimated the impact on our servers of 25 million players all going online at once.” — Excerpt taken from One Up.

Despite these issues, GTA had managed to cultivate a loyal following. The fact that it is one of the pioneers of the open-world action/adventure genre is only a partial explanation. Take-Two’s studio, Rockstar Games, also managed to tap into the prevailing mindset among its core audience.

Largely labeled a misfit, interactive entertainment has long been regarded with suspicion by parents, politicians, and rival forms of amusement. That has become part of the industry’s marketing vernacular where game makers like Rockstar have positioned themselves as rebels kicking against the establishment by producing titles that aggravated and challenged existing ideas and beliefs.

A game like Doom, for instance, with its deliberate ultra-violent sci-fi fantasy gameplay, is meant to agitate common notions of what entertainment should look like. Similar to punk and grunge in music or the relentless reliance on gangsters and criminals in movies and TV productions, GTA offers players an alternative space where the bad guys are the heroes. It affords players a virtual environment in which they explore and experiment with the fantasy of being a destructive good-for-nothing.

And this wasn’t just based on gameplay. Rockstar has slowly cultivated a specific counter-establishment personality. It is well-known, for instance, for its guerilla-style marketing campaigns. Whenever it releases a new expansion, the downtown New York City area where its studio is based is blanketed with stickers that carry its characteristic R* logo. Similarly, it has come up with some of the most ridiculous types of merchandise and swag in the industry. I hosted a guest speaker several years ago, who showed up with both a large bag containing t-shirts for my students and a box of “key chains.” The latter turned out to be (very obviously) fake hand grenades, but NYU security didn’t appreciate the sentiment. And that, precisely, is the point.

“I always felt GTA was equal opportunity offensive. I remember playing it as a young woman and thinking while it didn't correspond at all to how I felt in real life, this transgressive ethos of being cruel and condescending towards everything was considered really liberating.” — Leigh Alexander

It established loyalty among its player base that afforded Take-Two the time necessary to sort out both its infrastructure and economics.

Grand plan digital

After generating close to $1.5 billion in physical sales in its first year, GTA5 quickly dropped off. By the end of the following year, it generated an estimated $500 million. The industry’s value chain was still rooted in its conventional ‘product’ model, which meant that publishers faced an increasingly shortened sales window to break even on several years of work and millions in investment.

To counter this effect, Take-Two successfully ensured the ubiquity of its franchise. As an independent publisher, the publisher sells its games as widely as possible to offset its dependence on the comparatively narrow audience on consoles, its slower adoption of mobile, and its reservations around digital distribution on PC.

That ubiquity extends across different console generations. Take-Two had cleverly launched its biggest title toward the end of the seventh-generation console’s cycle. The combined install base for the PS3 and Xbox 360 was at its peak and most of its competitors were already building up buzz for their new titles to release on the next hardware generation. To them, it made no sense to invest in a market that was about to be replaced in its entirety.

As demand approaches saturation, a growing cohort of cost-conscious players looks for a good deal on a proven console and a cool title. Take-Two successfully capitalized on catering to these latecomers on the PS3 and Xbox360, followed by a release on the PS4 and Xbox One. As of August 2023, the entire GTA series has sold more than 405 million copies across 16 titles since its debut in 1997.

In addition, Take-Two also ramped up its digital efforts.

By releasing content expansions regularly it ensured the game’s momentum. For example, the Doomsday Heists Update in December 2017 returned a focus on the multi-step ‘heists’ missions and added more complex narratives to the experience. As a result, Take-Two reported GTA Online reaching 33.8 million simultaneously logged-in players (roughly the size of the population of Canada).

Take-Two managed to capitalize on the growth of digital distribution by building up a massive inventory of additional content that could be distributed in smaller updates over time. As part of its development process for its main title, developer Rockstar also created a lot of additional content, such as missions, side stories, and vehicles. Rather than continuing development post-release, it had a vast resource of add-on content and simply analyzed in-game behavior for clues about when to release the next expansion. Rockstar maintained the franchise’s momentum by removing the strain on the production team and focusing on marketing intelligence.

Since its launch, GTA5 has generated $5.2 billion in digital revenues (split between $1.9 billion in full-game downloads and $3.3 billion in micro-transactions) compared to $3.1 billion in physical sales.

Return to Vice City

The GTA6 trailer suggests that the franchise is returning to where it all started. Set in the same colorful microcosm riddled with corruption, cops, and crime, the first impression suggests another commentary on the contemporary American experience. The game’s invitation to behave without consequence inside a delicately rendered and detailed environment creates a tension that sits at the heart of the franchise. Players are free to act their worst in a paradisiac setting and I can think of no better place than Florida Vice City as a better backdrop to confront the current state of the United States.

A common question in this context is what GTA6’s impact will be on the industry.

With the $69 billion acquisition of Activision-Blizzard by Microsoft now completed, Take-Two is one of the last remaining independent publishers. Platform holders have greatly increased their market power and dominate the industry. A firm like Apple, which is the fourth-largest game company in the world, does not make games. More so, it is highly unlikely that the trillion-dollar-sized platform firms that currently rule the video games industry would ever produce a franchise as controversial as Grand Theft Auto.

It is similarly hard to exaggerate the importance of the franchise for Take-Two. For one, GTA represents the lion’s share of the company’s value. The firm depends on it for 15 percent of total earnings in 2023. Now, ten years later, it is only second to NBA 2K, which accounts for 20 percent of total bookings. By comparison, Red Dead Redemption amounts to just 4 percent. Over the past decade, GTA5 accounted, on average, for 30 percent of Take-Two’s revenue. Suffice it to say that Take-Two’s continued success depends on that of GTA6.

Wall Street is well aware, of course. When Take-Two notified the world that it was planning to release a trailer for an upcoming title that has yet to set a date, its share price promptly jumped 6 percent. Delivering another successful installment in the series will be key to the firm’s success.

Building excitement about the upcoming release also conveniently diverts attention away from the lower-than-expected performance of Zynga, Take-Two’s recent $13 billion purchase. Following the example of Activision-Blizzard buying King Digital in 2014 for $4.9 billion and Electronic Arts’ purchase of Glu Mobile for $2.1 billion in 2021, Take-Two couldn’t stay behind. America’s third-largest independent game maker acquired one of the best-known mobile publishers in 2022 at more than a 60 percent premium at the time.

It has yet to deliver on some of the initial expectations. In its most recent earnings, in-app spending for Zynga fell 7 percent year-over-year and its advertising revenue broke an 18-month streak of growth with a 2 percent decline. Take-Two had earlier acquired Barcelona-based game maker SocialPoint, which was initially touted as its big push into mobile but failed to materialize. Its relatively late entry into the largest games market has not been without challenges.

I’ve always thought of Strauss Zelnick having a big red button in his office that when pressed would issue an update on the arrival of GTA6. I doubt that he has orchestrated things in this way, but the announcement certainly calms anxieties around the firm’s mobile push.

It brings us to the most rudimentary question of all: how many copies will GTA6 be able to sell?

Currently, several market signals point toward a success that is at least on equal footing with that of its predecessor. At its 2013 release, 35 million console gamers bought a copy of GTA5 (29 percent). If we assume a similar share of players will buy the game, among an anticipated install base of 130 million in 2025 for the current console generation, GTA6 could sell around 38 million copies in its first twelve months.

Set at an average selling price of $70, an estimated 38 million copies sold both via digital and physical channels would generate $2.7 billion. That’s roughly in the same ballpark as the anticipated increase in Take-Two’s total earnings for 2025. Based on the franchise’s history, a PC version of GTA6 will likely come out around seven months following the console release.

Can Take-Two repeat the magic?

Yes, I think so.

I expect both audiences and investors to be pleasantly surprised when it finally releases GTA6, whenever that may be. The franchise has a rich history of releasing much later than planned because, well, its player base may complain but will happily put up with it. And making sure that everyone is happy will be critical to another decade of success.