Sony's new media empire

Entertainment emerges as Sony's primary income source, transitioning the consumer electronics firm to a media juggernaut

The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

As a knowledge worker in a late-stage capitalist economy, it is restorative to work the land on the weekends.

I’m not talking about actual farming, of course, but just its simulation. Hauling my big red tractor around is cool. And I admit to being encouraged by phrases like “Don’t wish for it. Work for it!” and “If you want a rainbow, you need to put up with the rain.”

But lately, I’m starting to feel that it merely offers an incomplete glamorization of agriculture.

Growing up in the Netherlands meant riding a bike (a lot) and being always near or in a stretch of farmland. I can smell the manure just thinking about it. When it comes to farming, one of the Dutch paradoxes is that more than half of the country is dedicated to agriculture, despite only contributing 2 percent of GDP and being one the most densely populated countries in the world with 508 people per square kilometer compared to 36 in the US. The Netherlands is Europe’s biggest exporter of meat and the second-largest agricultural exporter in the world after the U.S. But farming is a critical piece of the economy.

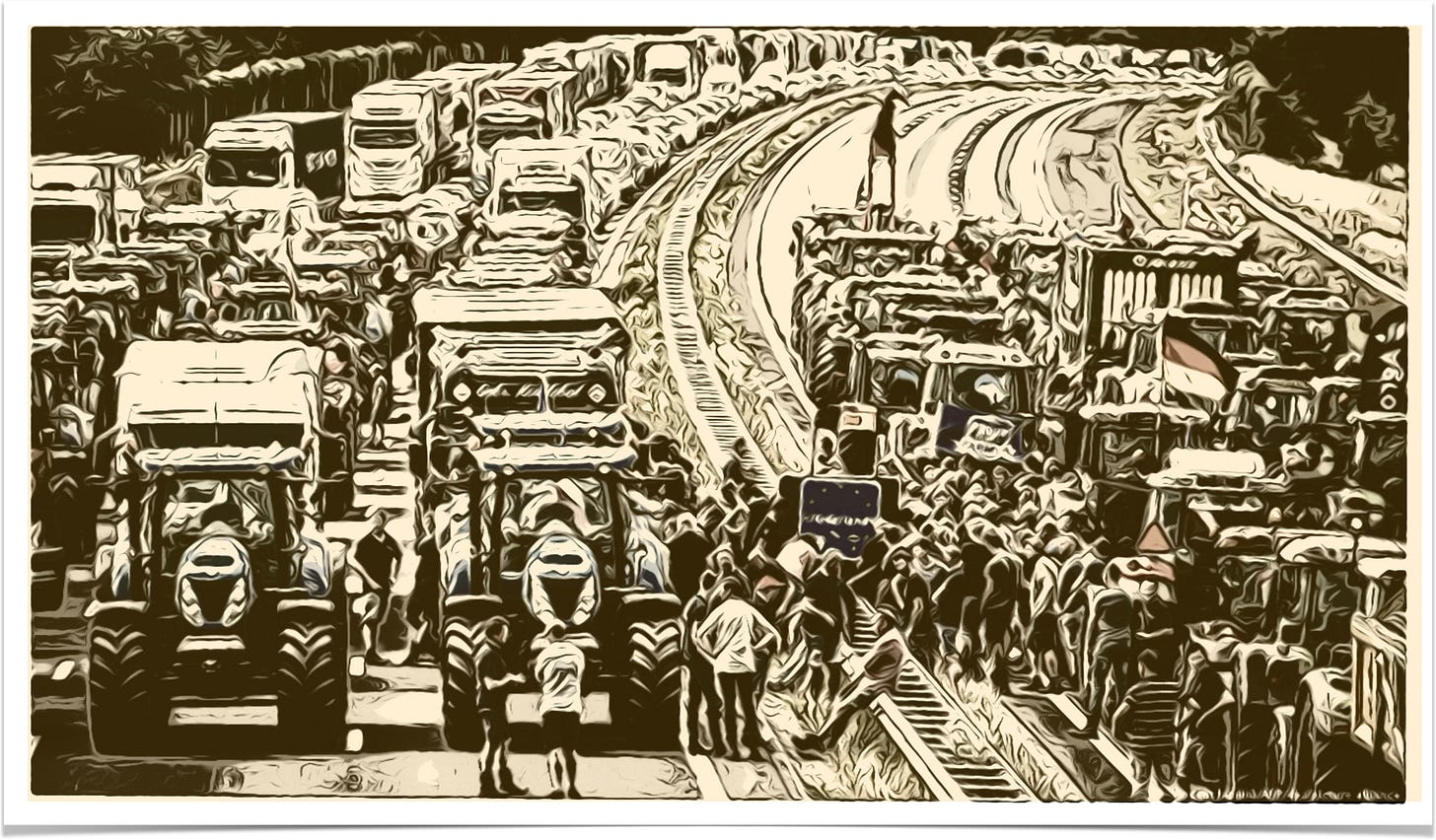

Farming’s role has changed, however. Now that the EU has restricted nitrogen emissions, a potent contributor to climate change, the Netherlands is trying to negotiate how to continue building infrastructure and other necessities at the expense of farming. Having pledged to cut its emissions to half by 2030, the Dutch government is trying to convince farmers to reduce livestock and its use of crop fertilizers. Farmers, understandably, don’t like that very much. They dislike it so much, in fact, that they took to the streets last summer to protest and treated the country to flaming bales of hay, manure dumped on streets and highways, blockades at supermarkets, and showing up at the private residence of the Dutch minister of agriculture. No one liked that.

Preciously little of what’s happening in the real world has so far made it into farm sims. Farming games paint a kinder, more naive universe. Instead, there is a “Government Subsidy Mod” available for Farming Simulator 22 to “get some subsidies for your farm to help you along in a bad year” up to a whopping $100 million per year. Not surprisingly, the subsidy mod is also the most popular download.

But I’m a realist. What I’d love to see is an agricultural protesting mod. Where can I download a piece of software to drive around town centers and yell “No farm. No food.” to passersby and block their entry to the grocery store? I want to drive my aforementioned big red tractor and congest traffic, damnit. Let’s go fling cow poo at city folk. As a virtual farmer, I want to exercise my right to protest against an overly intrusive government that has no legitimate right to set limitations on my carbon footprint.

Sometimes art needs to imitate life a bit better.

On to this week’s update.

BIG READ: Sony’s new media empire

The success of The Last of Us is, according to analysts, more than just a successful adaptation of a gaming franchise; it is the culmination of Sony’s gradual transition to becoming a media company.

For years I’ve characterized the Japanese powerhouse predominantly as a consumer electronics manufacturer. Different from Microsoft, which develops operating and application software, and Nintendo, which considers itself a toymaker, Sony has long focused on building high-quality media devices. The difference in DNA helps to better understand each firm’s strategic decision-making.

In Sony’s case, to help sell its headphones and television sets it ensures there is ample content available that showcases the full capability (e.g., Blu-Ray) of its devices. To get people to buy your TVs, it makes sense to own a film production arm. Building all that hardware, however, is costly and slow. Despite publicly denying that it lowered its expectations of the very expensive PSVR 2, it is no secret that the virtual reality market hasn’t really taken off just yet. Sony currently maintains its dominant position in console gaming with a 2-to-1 ratio for installed devices compared to its main rival Microsoft. In its most recent earnings report, the combined revenue for digital software, add-on content, and network services was $5 billion. It outsold hardware sales at $4.7 billion, which was up +122 percent. You can see where this is going.

More broadly, Sony's combined operating income for games, music, and pictures accounts for roughly 48 percent of its total. The remainder is made up of Imaging and Sensing Solutions, Entertainment Technology, and Financial Services. But that’s expected to change. Over time the entertainment business has grown to become more than just a useful complementary asset and will account for over 60 percent of revenue by 2026 according to some estimates.

It offers some insight into Sony’s future. Different from Microsoft whose acquisition strategy has squarely centered on buying gaming IP, Sony has made a more diverse set of purchases. Specifically, it bought Insomniac Games for $229 million in 2019, invested a $400 million stake in Chinese live streaming service Bilibili in 2020, increased its position in Epic Games to $200 million, acquired Crunchyroll in August 2021 for $1.2 billion, took minority stakes in Discord, Scopely, and Devolver Digital, bought Jade Raymond’s Haven within a year of its founding and, finally, acquired Savage Game Studios.

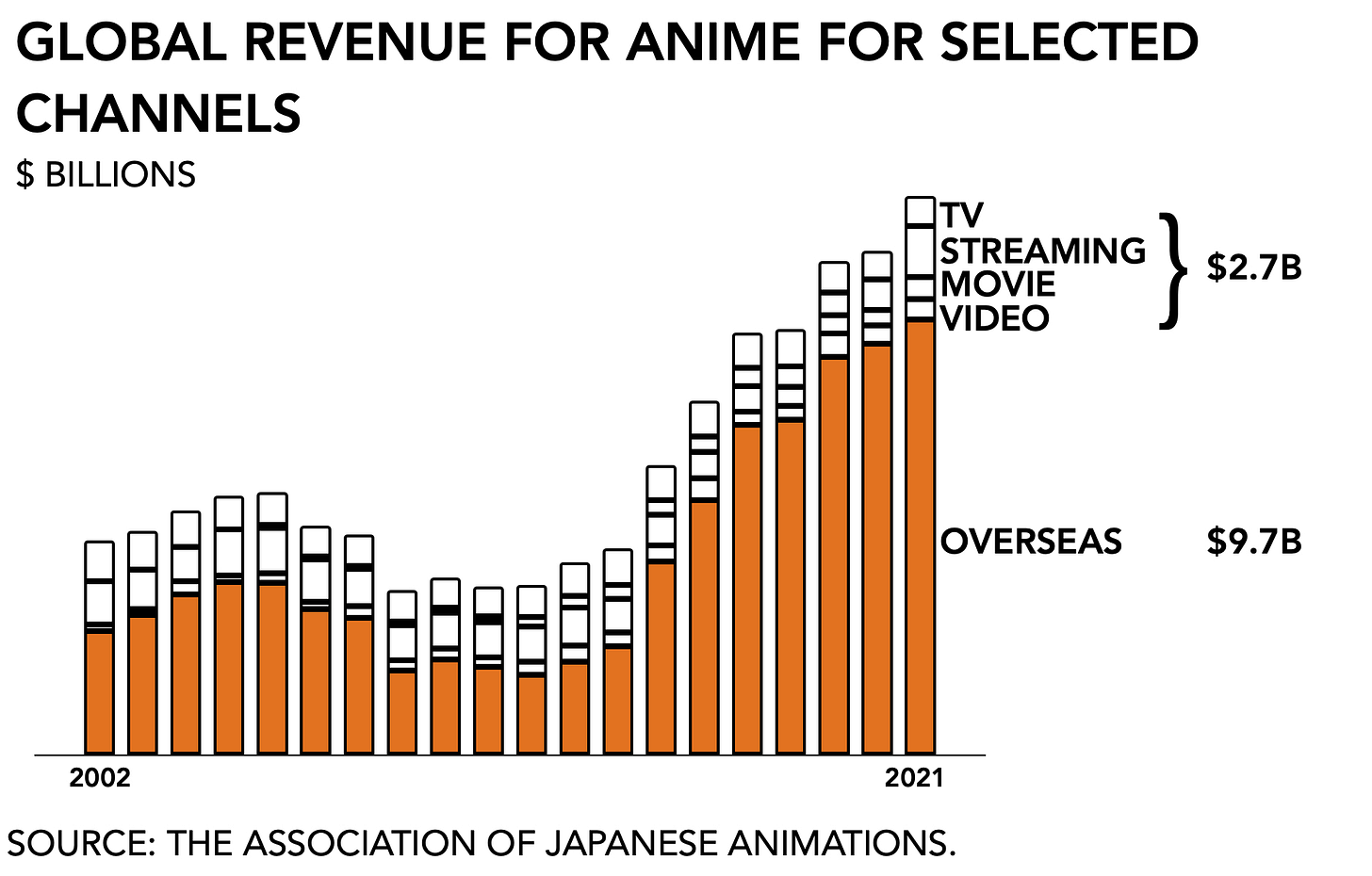

Beyond its gaming assets, Sony has managed to establish a strong presence in other growing content categories as well. Crunchyroll, its anime-focused video service, has evolved into the world’s largest portfolio of anime content and now counts 10 million paying subscribers. It is but one example of Sony’s broader portfolio of interrelated properties that will offset the risk conventionally associated with singular, high-profile successes. Especially against a background of chipset shortages and a consolidating games market where rivals like Tencent, a powerhouse in mobile that is actively building console game dev studios, and Microsoft, which is redefining the console market, leveraging IP will be a sound strategy.

In its most recent earnings, Sony reported strong figures across the board. But with a changing of the guard at the top, the unilateral strategy of hoping to come up with another Walkman will slowly fade to give way to a strong content portfolio and distribution network.

Does that mean Sony will go the same way as Sega, which got out of the console business following the disappointing release of its Dreamcast (I miss you ❤️) to become an IP powerhouse with Sonic instead? No. Sony will always keep a foot in electronics. But as the profitability of its media and content portfolio will soon outstrip its hardware business, change will be coming faster than you can say ‘PlayStation 6’.

NEWS

Hogwarts Legacy sells 12 million copies

Warner Bros announced that its Harry Potter-based video game generated $850 million in global sales with sell-through topping more than 12 million units in its first two weeks post-launch on the PS5, Xbox Series X|S, and PC. That makes it the biggest global launch in the publisher’s history and puts Harry in the same league as blockbuster hits like Call of Duty which recently broke its own franchise record by racking up $800 million in sales in three days. It is evidence of the appeal of strong intellectual property to mainstream gaming audiences.

I continue to question, however, the longevity of the game since it lacks a multiplayer component. I’m not trying to rain on this parade but, it seems odd to release an open-world game and not have some kind of multiplayer component on the schedule. Sure enough, the game will probably sell between 15 to 18 million units this year. But sales numbers will likely drop as people burn through the content and move on, especially now that developer Avalanche has also already announced that there are no DLC expansions in the works.

Finally, after all the hubbub, all those sold copies tell you precisely how much consumers cared about the hurtful language used by its author: zero. In fact, if nothing else, it was reason enough for the NY Times to run a piece titled “In Defense of J.K. Rowling” because rich, white women really are the victim here. Sigh. For a more nuanced discussion, check my conversation with Laine from two weeks ago. Politics aside, it suggests that press coverage for the tension between Rowling’s hateful views and the love fans have for her work had the adverse intended effect and, in fact, boosted sales. Hate, like sex, sells games, too.

Team Xbox had a busy week

Microsoft continued its charm offensive by announcing two major licensing deals, rolling out its GamePass service in an additional 40 countries (now totaling 86), and sending the tip of its legal spear, Brad Smith, to Brussels to showcase the merits of the proposed acquisition of Activision Blizzard. Together with Carol Ann Brown, he published a book during the pandemic, titled Tools & Weapons: The Promise and the Peril of the Digital Age. They conclude with the observation that tech firms are so busy trying to push back against the threat of over-regulation, which he argues is more bark than bite, that everyone is losing track of how to shape the role of technology in society at large, arguing for better collaboration across institutional boundaries.

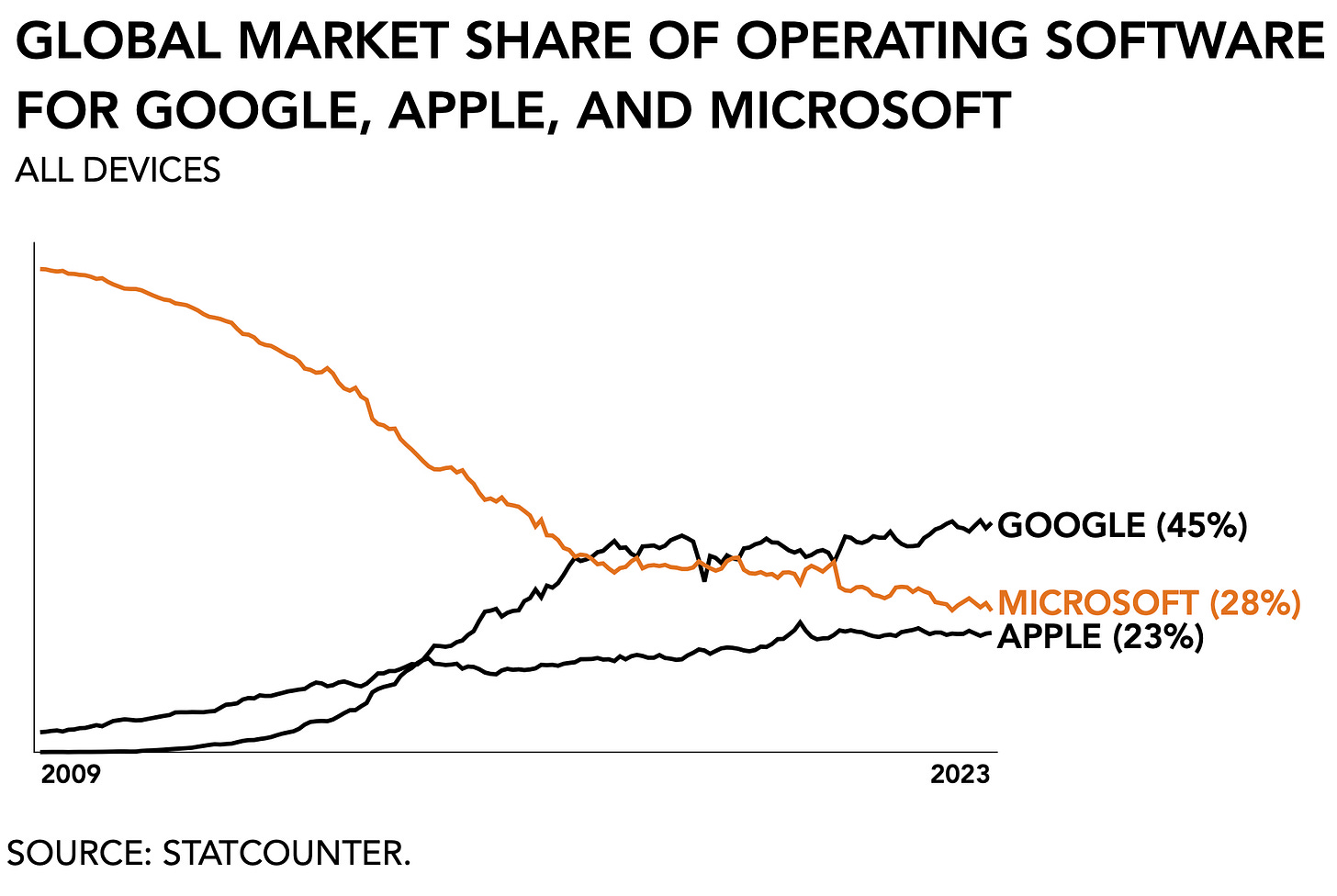

Mr. Smith has been part of Microsoft’s legal team since way back when regulators cracked down on it for bundling Internet Explorer into its operating system and behaving like a monopolist. After initially being ordered to break up the company, Microsoft eventually managed to persuade the FTC to issue a penalty instead, arguing that it would be impossible to divest its application software development operations from its operating software activities.

Since then its dominance has declined from 95 percent in 2009 to 28 percent in February 2023 as rivals like Google and Apple released their own operating software bundled with their hardware, claiming a combined 45 percent and 23 percent market share across all devices, respectively.

At the time it was regarded as a dangerous precedent for anti-trust regulators to try and break up large conglomerates, as big-name economists argued against such “intrusion” by the government. The political winds have notably changed since then, of course, and after decades of relative freedom to build whatever, large tech firms have clearly taken advantage.

Regulators, too, are adjusting their approach, with the CMA’s chief executive arguing that post-Brexit the anti-trust body is, in fact, not “over-reaching on jurisdiction." And in the US, the FTC announced the opening of a new Office of Technology (who comes up with these names?) which it hopes to populate with experienced people to produce “studies, reports, requests for information, policy statements, congressional briefings.”

Nevertheless, Microsoft remains confident. Putting the ATVI/MSFT deal in context with the existential crisis it nearly suffered in the early 2000s, it is probably not as worried as headlines would have it. In fact, Phil Spencer flat-out stated that the deal “is not some linchpin to the long term—Xbox will exist if this deal doesn’t go through.” From the sound of it, Microsoft has been patiently catering to everyone’s comments and criticism around the deal. But its sights are clearly fixed on the long term.

PLAY/PASS

Pass. In light of the recent layoffs at media firms, is the games industry going boom while its journalists go bust?

Play. Here’s an academic study asking: Did Amazon raise the price of toys following the collapse of Toys “R” Us? Yes, its prices did increase, but it is difficult to ascertain if that was done algorithmically or by simply changing the rules of the algorithm. More of this, please.