The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

Transitions ran rampant this week.

First, there was John Riccitiello’s sudden exit, Many applauded the move, because, frankly, they do not know for what they clap (see below).

There was also the changing role of CD Projekt’s CEO, Adam Kiciński, now that the Polish powerhouse is starting to deliver on its original vision for its Cyberpunk franchise. It’s a masterclass in IP development, really.

And there was Ubisoft, which did not announce any change of the guard but prided itself on reducing workplace toxicity. In its case, even a modicum of change is blown out to be a massive shift in corporate culture.

We’ll see about that.

On to this week’s update.

BIG READ: Shareholder fall guy

Following several weeks of turmoil at game engine maker Unity, the announcement of its CEO John Riccitiello leaving the firm feels like an unsatisfying sacrifice. It also doesn’t bode well for everyone else.

After first revealing its new pricing structure for game developers, which didn’t go over well, Unity was forced to walk it all back and apologize. But to many the damage had been done and the trust was gone.

How quickly a culprit was found.

Despite the notable absence of Riccitiello throughout the entire saga, a string of previously incriminating decisions and comments made him the obvious corporate bad guy to many. It earned him the moniker “most hated man in gaming,” which tells you the games industry’s deep-seated toxicity is thriving. (Question: does this mean there’s also a ‘most hated woman’ in gaming?)

The suggestion that it was Riccitiello who single-handedly came up with and forced the decision around Unity’s new revenue model is naive. Yes, leaders should be accountable. But they don’t operate in a vacuum.

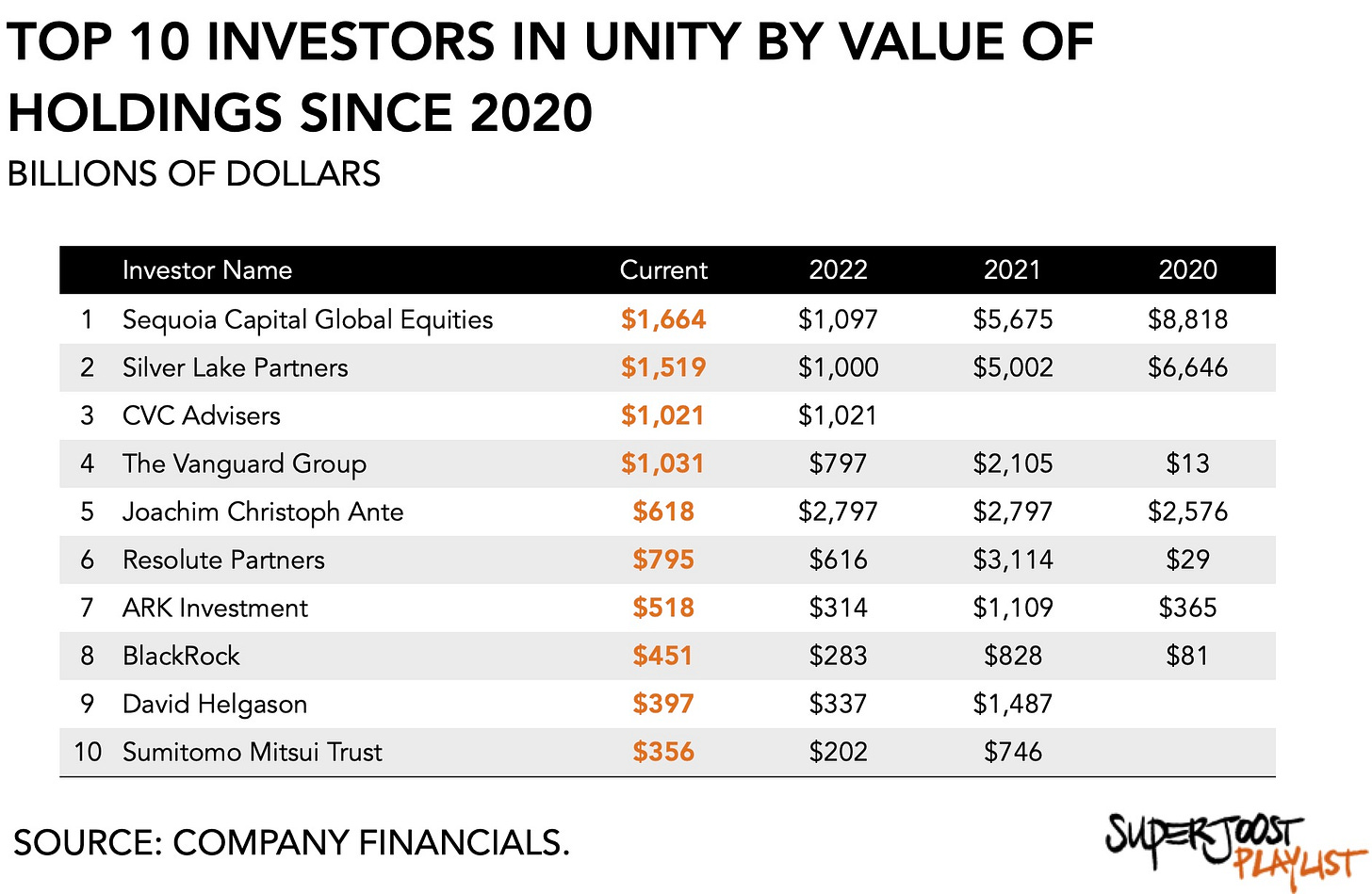

Consider this: the three largest shareholders of Unity shares are one venture capital firm and two private equity funds: Sequoia Capital Global Equities with a position currently worth $1.7 billion, Silver Lake Partners ($1.5 billion), and CVC Advisers ($1.0 billion). Combined they control $4.2 billion, roughly 31 percent, of the $13.4 billion in total outstanding shares.

Next, two of these firms have lost substantial amounts of money since Unity’s initial public offering in September 2020. Over the past two years, Sequoia Capital has held a position of roughly 38 million shares in Unity, whose value has declined -70 percent from $5.7 billion in late 2021 to $1.7 billion today.

Similarly, Silver Lake has held around 35 million shares and saw its value drop by $3.5 billion during the same period. Between them, Sequoia Capital and Silver Lake have lost $7.5 billion in value.

To maintain momentum, Unity has deployed a variety of strategies.

One involved a string of acquisitions, including Vivox for $123 million in 2019, deltaDNA for $53 million, Artomatix ($49 million), Finger Food Advanced Technology Group ($47 million), Parsec ($320 million), Weta Digital ($1.6 billion), and ironSource ($4.4 billion).

Another was its push into novel technologies, including XR, the metaverse, and AI. This approach amounted to little. And that’s likely where its largest shareholders started to get nervous. Despite spending ample amounts of cash on acquisitions and innovation, Unity had yet to clearly define its path to profitability.

Either Unity is a shining example of a well-functioning market economy in which even the marbled office of the CEO is subject to scrutiny and the consequences of their leadership, or things are about to get worse.

Across the board, developers accepted the blood offering and called it a step in the right direction. But pay attention: the interim CEO, Marc Whitehurst, is also a special advisor at Silver Lake. Basically, the second-largest shareholder appointed one of their own to run Unity in the meantime. Wall Street analysts aren’t so sure. Despite a 5 percent increase in Unity’s share price, some analysts downgraded the stock.

I expect the incoming CEO to start by making deep cuts in Unity’s senior management, accompanied by spin-offs of assets considered unprofitable or not quite delivering the synergies once hoped. The money spent on R&D will likely be reduced as will hiring and M&A activity. While likely more profitable, it will also render Unity more vulnerable. Already there are emerging rumors of competitor AppLovin revisiting the idea of acquiring Unity. It tried in August last year but withdrew the offer once it became clear that it was, in fact, a stupid idea. Hell, it’s possible even that Apple scoops up part of Unity, because of its importance in mobile game development. It is already working on a beta program for visionOS, the operating software for Apple’s upcoming Vision Pro, and entry into a new device category.

Maybe.

The sudden exit of Riccitiello may satisfy the call for blood. But with “the most hated man in gaming” gone, Unity now sits at the intersection of imminent cuts, spin-offs, reduced R&D spending, and a possible take-over. All of those push the interests of shareholders and platform holders but not those of creators and consumers. I think gamemakers are going to hate the underlying issue of predatory venture capital even more.

NEWS

Cyberpunk vision of the future

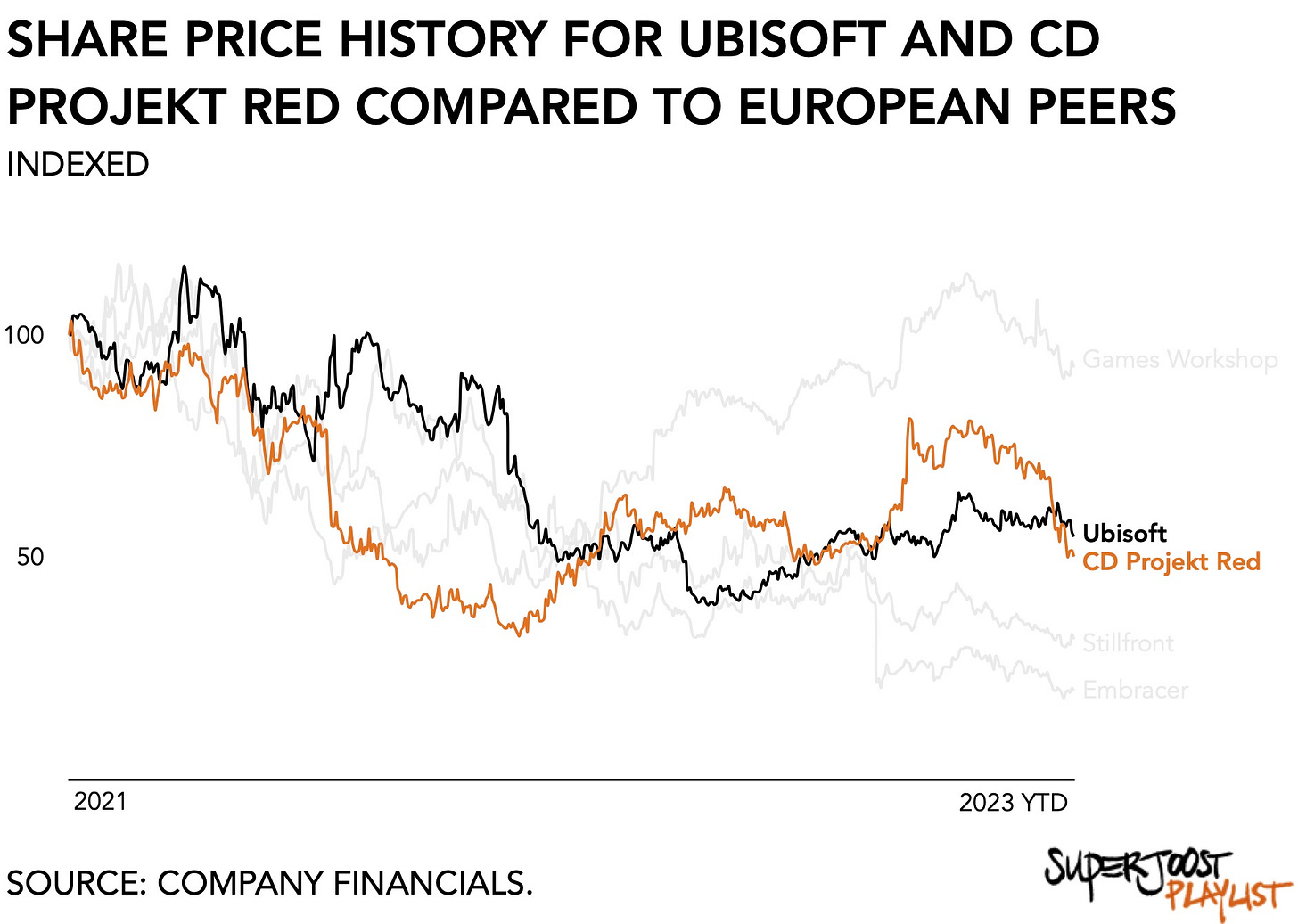

Following its Investor Day event and the release of Phantom Liberty, the long-awaited expansion for its Cyberpunk franchise, Polish game maker CD Projekt Red seems to be on the mend finally.

The expansion is off to a strong start. According to management, Phantom Liberty sold 3 million units in its first week and further boosted the franchise as Cyberpunk 2077 surpassed a total of 25 million sold copies since its release. Approximately 20 million copies sold for current generation consoles and PCs, indicating a 15 percent attach rate for Phantom Liberty (which isn’t available on older generation hardware). Around two-thirds (68 percent) were sold for PC and the firm’s own digital distribution platform, GOG.com, accounted for 10 percent of total sales. The franchise enjoys strong loyalty from a dedicated player base, evidenced by a whopping 3,300 ‘very positive’ reviews on Steam and 225,000 concurrent players on its expansion’s release day.

One notable observation is the $86 million CD Projekt Red spent on its expansion split between $64 million for development and $22 million for marketing. Such capital expenditure and resource allocation is, as it states, “equivalent to a game in itself. It's similar in size to a standalone game." Triple AAA development depends heavily on access to capital as both expectations and costs continue to rise.

It’s no surprise then that the firm is looking to build momentum by extending the scope of its activities. After meeting its CMO, Jeremiah Cohn, at a conference earlier this year, I am optimistic about the publisher’s ability to move beyond pure play. Cohn impressed on me with a broad perspective and a focus on franchise development more so than merely selling copies. With the retirement of sitting CEO, Adam Kicinski, leadership will now be in the hands of Adam Badowski, current Chief Creative Officer, and Michal Nowakowski, current Chief Commercial Officer. Nowakowski joined in 2005 and developed the firm’s strategy around its "franchise flywheel."

Timing is another question. CD Projekt Red is in the early stages with Anonymous Content, a production company known for shows like True Detective and Mr. Robot, to develop live-action projects based on Cyberpunk IP. The anime series, Edgerunners, which previously appeared on Netflix did really well. But based on comments that such a rollout is "not something that is going to happen overnight” it seems fans will have to wait a while longer. CD Projekt Red’s botched launch in 2020 has clearly made it more prudent and caters to a fanbase that will thank them for it.

For investors, who like to see regular content releases and rapid expansion of popular IP, that may all be a bit too far out. That’s why it is probably good that the firm’s leadership controls most of the outstanding shares. CD Projekt Red is emerging as one of Europe’s most prominent game makers. Others, like Ubisoft and Embracer, have so far been unable to leverage their access to established IP and vast financial resources. Like other European publishers, CD Projekt Red’s major shareholders are its executives. Exiting CEO, Adam Kiciński, is the largest shareholder with a total stake of $525 million, followed by Michał Kiciński ($425 million) and Piotr Nielubowicz (CFO) with $280 million. Common investors like Vanguard, Fidelity, and BlackRock hold much smaller positions: $71 million, $47 million, and $35 million, respectively.

CD Projekt Red currently trades at $6.10 a share, down from a peak of $31 in late 2020.

Ubisoft says it’s on the right path

For all the world-building that game publishers do, many are only now connecting the dots between the work environments they provide and the play environments they create.

According to a talk by Ubisoft’s chief people officer, Anika Grant, the firm is healing. Grant highlighted her employer’s progress by sharing that the statement "I am treated with respect and dignity" was the second highest-scoring question at 85 points in its internal survey among employees.

Most recently, five former Ubisoft execs were arrested following a year-long investigation into sexual assault and harassment within the company. Ubisoft is certainly not unique in this regard but now believes that it is getting to the other side of things.

It revamped its internal reporting system to make it easier and quicker to deal with issues, implemented a new code of conduct, and required mandatory training in anti-discrimination and anti-harassment. Finally, the firm also hosts global town hall meetings and “local listening sessions.”

More generally, the games industry’s rising profile and broader presence as a cultural industry is exposing all of its terrible habits. A lack of unions, a chronic absence of job security, crunch time, booth babes at conferences, and rampant inaction when it comes to providing a healthy work environment have all surfaced as games became more popular.

But in only nine months, a single ‘people person’ accomplished something remarkable. After visiting over 30 of its studios, redrafting an internal code of conduct, and hiring a new vendor to manage internal surveys, the publisher says things are looking up. Grant stated:

"The work that's needed to foster a safe and caring workspace is something that never really ends, and something that we continue to focus on and be invested in, but at least for now, we've heard directly from our teams that we're on the right path and that progress has been made."

Applause all around.

Unfortunately, it also suggests that Ubisoft could have addressed its systemic workplace toxicity and sexual harassment practices quickly and effectively years ago by making some really obvious changes and spending a bit of money, but didn’t.

I understand Ubisoft’s need to claim there’s nothing to see here but undoing decades of bad behavior with a crash course in not being a jerk is hardly credible. Integrity means keeping your promises when nobody is watching.

PLAY/PASS

Play. I thoroughly enjoyed the almost two-hour-long interview with Take-Two Interactive’s CEO, Strauss Zelnick.

Pass. Here’s a solid, but sad, data resource on industry layoffs. Over 6,100 gaming jobs have been cut so far in 2023 with September seeing a total of 17 companies issue layoffs.

So, are you telling me one of the most popular game engines isn't making a profit and is about to be torn apart by corporate raiders? That's a scary prospect and doesn't say much about the general maturity of the gaming market.

It does, though, explain why there are so many non-gaming executives making cash-grabbing decisions over triple-A games. And gamers keep lapping it up. Sure they complain and say they won't get Big Title X or Y, but then release day rolls out and they arrive in droves.