Revise and resubmit

Microsoft's restructured proposal to buy Activision Blizzard

The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

My FOMO around Gamescom has officially kicked in.

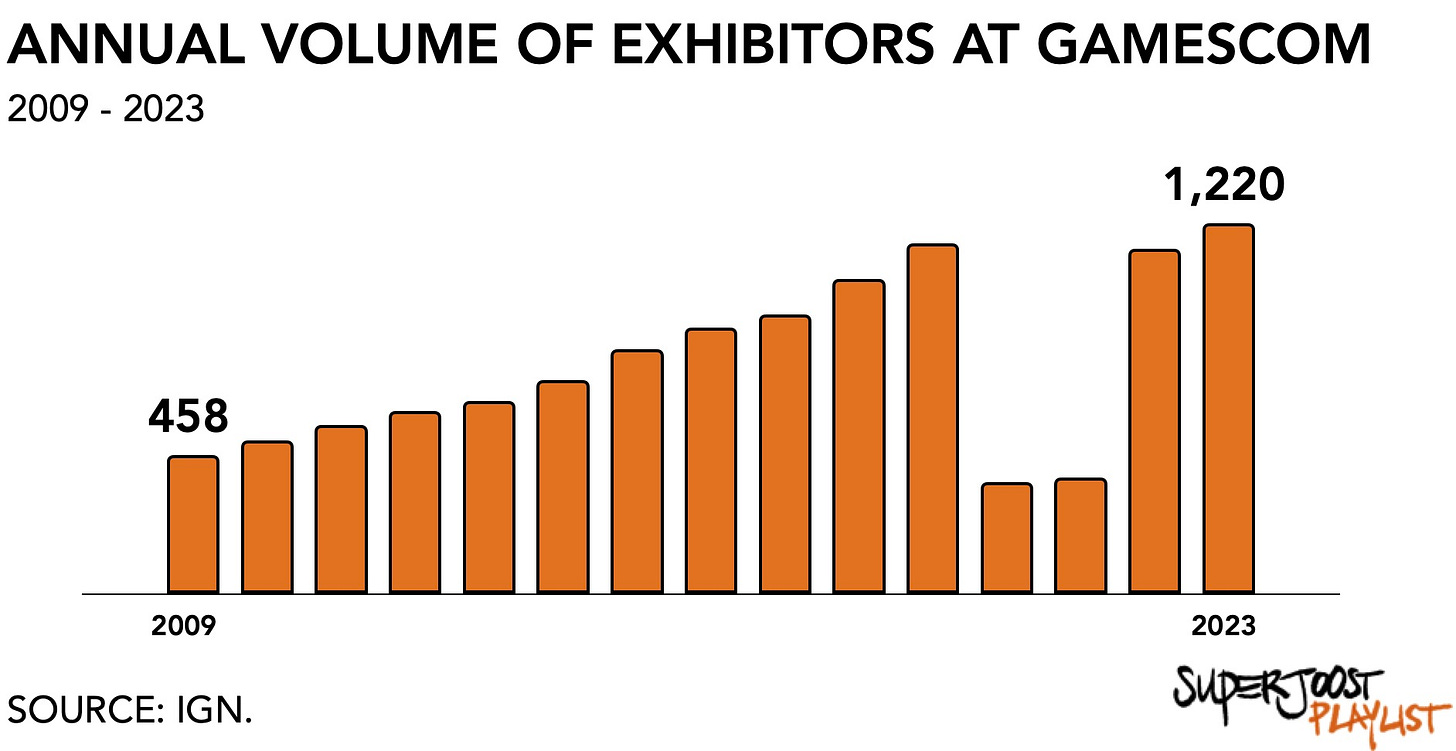

The Cologne-based conference that takes place in the late summer has been a staple for years. It offers that ultra-productive one-day of business-only attendance before opening things up to an airport-sized event space. It reached a peak of 373,000 visitors in 2019. It is easily Europe’s foremost event and the number of companies hoping to reach new players and industry partners has tripled since 2009, from 452 to 1,220. Oh, and Cologne is of course known for its carnival, ample sausages, and beer.

Sure enough, the pandemic has changed the face of industry events forever. It is encouraging to watch the endless stream of LinkedIn notifications of people advertising their presence this week in Cologne. Yes, I’m a little envious. But I’m also very happy to not be stuck as the only non-Twitch employee in a hotel filled with Twitch employees.

More so, the European market can use the boost (see below). Both its competitive position and the strength of its consumer market have eroded over the past year. But since E3 is on life-support, Cologne may very well emerge as the next hotspot for major releases. It would make for a welcome change of venue and conferencing style that, perhaps, provides more visibility to smaller and emerging studios. Capital has become more scarce and it has resulted in an army of small fries setting its sights on Gamescom to close publisher and investor commitments.

A carnival, indeed. Los geht's!

On to this week’s update.

BIG READ: Revise and resubmit

With a few days left before the deadline set by the UK’s antitrust regulator, the Competition and Markets Authority (CMA) Microsoft issued a ‘revise and resubmit’ proposal for its intended $69 billion acquisition of US game maker Activision Blizzard.

The CMA's initial prohibition of the Activision-Microsoft merger remains, yet they acknowledge the possibility of a new proposal that addresses their concerns and permits the merger. The watchdog’s original apprehensions centered on Microsoft gaining an unjust competitive edge in cloud gaming due to its ownership of Activision games, potentially favoring its Game Pass service, with the UK authority finding Microsoft's proposed remedy insufficient to alter their prohibition stance. Despite some superfluous fighting words from the CMA’s leadership, the new proposal is expected to, finally, get the deal done.

As part of its commitment, Microsoft has also agreed to grant Ubisoft exclusive worldwide cloud gaming rights to all Activision titles, except in the European Economic Area (EEA) where the rights will be nonexclusive. This move follows Microsoft's original plan to offer Activision games on its Game Pass cloud streaming service upon release, but now it will share those rights with Ubisoft. While some of Microsoft's estimated 8 million Game Pass subscribers might be at risk of shifting to PlayStation Plus due to Ubisoft's potential deal with Sony, analysts predict that the impact will likely be minimal as the same titles will still be available through Game Pass.

“Ubisoft will compensate Microsoft for the cloud streaming rights to Activision Blizzard’s games through a one-off payment and through a market-based wholesale pricing mechanism, including an option that supports pricing based on usage.”

At first sight, I was excited for the French game maker. It somehow managed to insert itself into the largest heavy-weight conversation currently in gaming to play a crucial part in Microsoft’s ability to proceed with its acquisition and compete with rival Sony.

This ensures wider distribution. Microsoft is ultimately focused on becoming a relevant content owner and cloud gaming provider but knows it cannot operate in a vacuum. Ubisoft is a value-added service provider that doesn’t own its infrastructure. The deal has merit. Especially for multiplayer content like Call of Duty, both players and game providers benefit from wide distribution and access. The former because it ensures there’s always plenty of people to play with (or, soon, generate and sell content to); the latter because it provides access to the largest possible audience.

But then I had a café au lait and woke up to three observations.

The first is that mobile game streaming is excluded. Specifically, the agreement states that “Microsoft retains control over the development of games and rights to mobile game streaming.” Excluding King Digital makes the deal substantially less valuable, both commercially and politically. More so, according to Phil Spencer, “Xbox must have a mobile presence.”

Second, after talking to a few people familiar with such deals, I estimate that Ubisoft spent around $100 million to obtain the rights from Microsoft to drive traffic to its fledging cloud service, Ubisoft Plus. As the number of different services continues to expand, its subscription offering is having a harder time retaining subscribers. According to one study, 32 percent of its subscribers regularly consider canceling the service.

By inserting itself into the Microsoft/Sony rivalry, Ubisoft bolsters its position. However, I don’t anticipate this to bring in more than what it spent on getting here, making it a marketing play rather than a revenue driver. And so I have to agree with Michael Pachter, for instance, that the arrangement between Microsoft and Ubisoft is merely money shifting around. It does not materially change things.

Third, such deal-making warrants a closer look into the European games market. Since Embracer’s Saudi-financed empire started to crumble, game-making in the Old World is having a hard time. After advocating a laissez-faire management approach to its growing stable of studios, Embracer is now clearly focused on centralization and consolidation instead. Its press office may not tell us as much, but since its access to capital has become harder, it’s going to have to emphasize cost reductions (e.g., lay-offs) to maintain profitability. As long as it can fire people faster than its business is devaluing, Embracer can attract investors eager for profit margin.

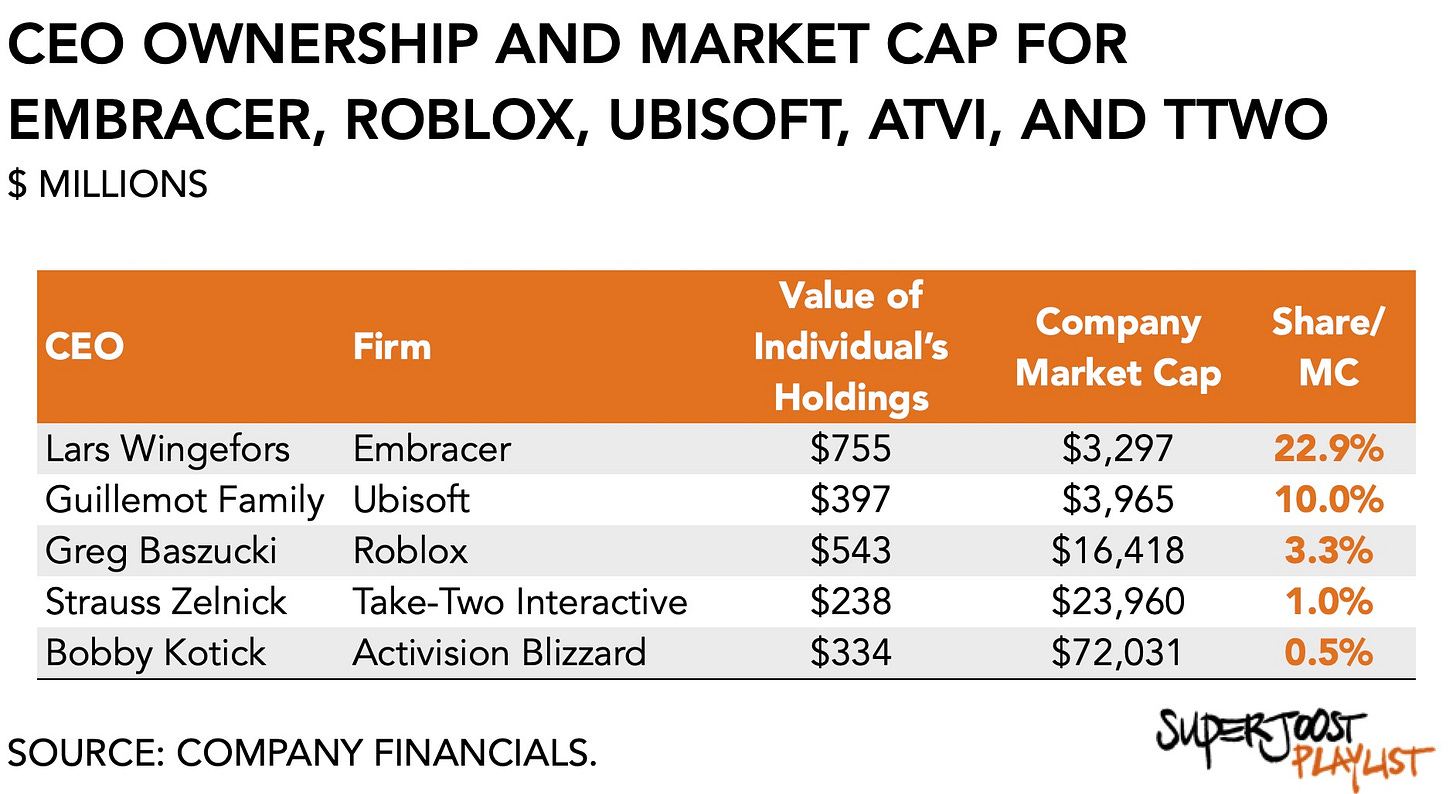

What connects the dots here for me is the disproportionate degree of individual ownership over Europe’s most visible game makers. Specifically, European leadership tends to command a much larger share than comparable individual insider owners in the US.

For instance, Embracer’s CEO, Lars Wingefors, is the firm’s largest shareholder, with a current share value of $755 million. That is equivalent to 23 percent of the firm’s current market cap. By comparison, that’s more than double that of Bobby Kotick’s $355 million, who is at the red hot center of the imminent payout following the ABK/MSFT deal. It is also still less than Ubisoft’s patriarchial owners, the Guillemot family, who maintain firm control over the French publisher to the tune of $397 million, or 10 percent of Ubisoft’s value.

It raises the question of whether a quasi-autocratic rule over Europe’s major game makers is the competitive market landscape regulators hope to protect.

Okay, but does selling the non-European cloud streaming rights to Ubisoft make sense for Microsoft? Yes, it is a good move because it addresses both the concerns expressed by the UK and US regulators and will make Activision Blizzard’s content available to a wider audience. However, such a concession needs to be valued against a longer timeline. Cloud gaming is still nascent and empowering other publishers may come to haunt Microsoft down the line.

Microsoft is bigger than the ABK/MSFT deal

The disproportionate attention to the proposed purchase of Activision Blizzard makes it easy to forget that Microsoft has a long-term corporate incentive. Yes, Microsoft wants to get the current deal approved. It is also working to position itself as a tough but fair firm when it comes to acquisitions. Since Microsoft's gaming strategy relies, in part, on subscriptions, we can expect it to make both gaming and non-gaming acquisitions. As it rolls out more infrastructure, it needs to stay on speaking terms with relevant antitrust regulators to ensure success down the road.

I have previously speculated on different types of divestitures as part of the merger. One centered on content and would have seen the spin-off of Blizzard into a separate entity. More likely, however, is one around distribution as is now evident with the Ubisoft agreement. For the UK market, I anticipate an announcement with a local telecom provider (e.g., Vodafone, EE) to be the cloud distributor for the UK market. It echoes a similar logic as we find in China, where foreign game makers must team up with a local partner (e.g., NetEase, Tencent) to release their titles.

So, will this restructured proposal get the green light? Yes, I believe it will. It speaks directly to the CMA’s concerns and starts another 40-day review period. It renders moot the previous decision and provides an opportunity for the watchdog to evidence its efficacy. We’ll just overlook the fact that it was the European Commission that provided the blueprint for the solution the CMA now claims its own. Regardless, Microsoft gets its cake. The CMA gets its pound of flesh. Everyone’s happy. Right?

PLAY/PASS

Pass. Gillette’s cutting-edge collaboration with gaming lifestyle brand Razer to make a gaming razor.

Play. Electronics Arts decided to not contest a ruling in Austria and instead to just eat the €10,800 ($11,800) fine for its loot boxes violating gambling laws. In light of growing attention to video game addiction, the ruling marks a small but significant victory.

Great work Joost! Your analysis and information are top-notch.