The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

Linear TV and broadcast radio stopped being part of my life years ago.

In part because city life takes place outside. Brooklyn is beautiful and riddled with parks. And whenever I do find myself at home, I overwhelmingly prefer to, well, play video games.

But I continue to cling to a portfolio of newspapers and magazines.

I currently subscribe to the New York Times (for its local news and city drama), the Wall Street Journal (excellent financial analysis), the Financial Times (concise view on macroeconomics), the Economist (snooty write-ups on politics and market economics), and Bloomberg Businessweek (detailed analysis of large trends).

Each of them offers its own uniquely flawed perspective.

Am I a huge Gen X nerd who romanticizes the written word by surrounding himself with dead media? Yes. Is this the reading equivalent of some insufferable Brooklyn hipster listening to vinyl records? Also yes.

Standing over my kitchen counter reading a physical paper and drinking coffee is one of my favorite things to do, still. I know I can get “The News” faster and more condensed digitally. But it seems to me that the effort involved in getting a story written, edited, approved, printed, and then shipped to my doorstep together with an array of other stories involves so much curation that only the absolute best possible articles arrive. Writing is hard and doing it well, and on a tight deadline, is an incredible human achievement.

As large tech firms positioned themselves in the center of our media consumption, they initially sold us on the idea that online news was somehow objectively filtered and rationalized. Their proposed modes of distribution via search engines and social networks were ‘better’ than human-made physical media.

None of that is true, of course, and we’ve learned the hard way that algorithms and rankings serve corporate and political interests rather than consumers and citizens. Much of what we learn about the world is littered with deliberately orchestrated pseudo-events meant to dominate headlines, or, conversely, stay out of sight. The digitalization of media has removed a lot of necessary gatekeepers to fact-check and verify before it reaches us. And as we enter the age of generative AI, we are about to confront a deluge of hallucinating gibberish that will fill media outlets. Brrrr.

It’s precisely because some modes of communication are not efficient and fail to meet the economic requirements of rationalization that make them useful and valuable. We know this to be true of art, music, and theater. Some of the most worthwhile human experiences necessarily live outside of economic logic and technological efficiency. It takes time, money, and effort.

I should read more.

On to this week’s update.

NEWS

Under Microsoft leadership, Blizzard and NetEase make up

Microsoft and NetEase have announced the return of game maker Blizzard’s most popular franchises to China.

In November 2022, the firms confirmed the termination of their agreement which resulted in the distribution shutdown of several major titles. In China, foreign game makers are required to partner with a domestic publisher.

The original agreement dates back to 2008 when Blizzard and NetEase created a joint venture. But two years ago, both parties decided against renewing the agreement because, according to Blizzard, it would not be “consistent with Blizzard’s operating principles and commitments to players and employees.” According to NetEase, “there were material differences on key terms, and we could not reach an agreement.”

The lack of specificity in both statements tells you it was about money. Following its acquisition of Activision Blizzard, Microsoft is the third-largest game company in the world with $23 billion in 2023 revenues. NetEase is the fifth-largest game company in the world with $12 billion.

Meanwhile, Chinese players were left in the cold and shut out from their favorite franchises.

The renewal is good news all around.

It is befitting for Microsoft to ensure the continued access and widespread distribution of major franchises. Internally it faces mounting scrutiny around growing revenue and profitability following the $69 billion acquisition of Activision Blizzard. It also campaigns heavily with ‘everyone’s a gamer now’ and excluding China would make zero sense.

The new agreement also brings a closer collaboration between Microsoft and NetEase. Specifically, the firms have agreed to explore bringing new NetEase titles to the Xbox ecosystem. The largest Chinese game makers are keen on establishing a foothold in Europe and North America. In June 2022, NetEase launched its first console title on the Xbox, Naraka Bladepoint, which continues to be among the top 25 most-played free-to-play titles on Xbox. Its overseas subsidiaries also have several other titles in development, including Marvel Rivals and Project Mugen.

Moreover, China is a huge market, and a lack of access means decreased revenue prospects. Investors expect the return of Blizzard to China to boost revenues for NetEase by $415 million annually, which equates to about 4 percent of its annual income and 12 percent of its PC games revenue in 2023, respectively.

And, most importantly, players will get access back to their games.

[Promo] Audiobook for One Up releases next week

On April 16, we’ll see the release of the official One Up audiobook. That’s exciting for a few reasons.

First, One Up continues to do really well. I’m told that most academic publications sell a few hundred copies and are part of a broader application package compiled to obtain tenure. At a recent book signing, I was incredibly flattered, and surprised, to see a long row of people waiting to talk to me for a few minutes. For me personally, writing, both on- and offline, is a way to have a thought-out conversation with a lot of people at the same time. I’m grateful that there are so many out there curious about the same things that interest me.

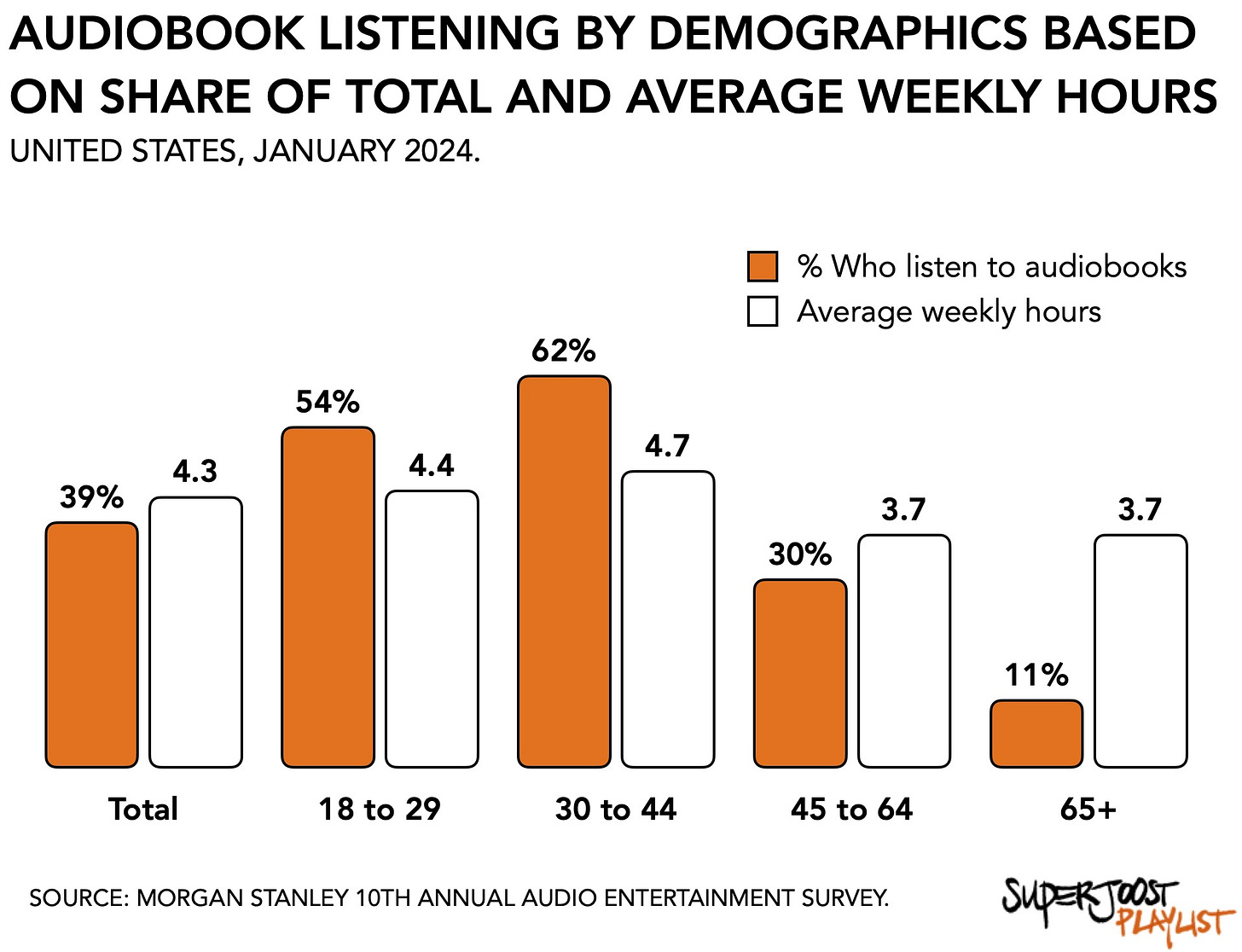

Second, audiobooks are the way of the future, apparently. According to a recent survey by Morgan Stanley, 54 percent of people between the ages of 18 to 29 years listen to audiobooks at an average of 4.4 hours per week. That percentage is 62 percent among readers (listeners?) between 30 to 44 for a total of 4.7 hours. At a length of 9 hours and 19 minutes, it should take both groups about two weeks to get through my book.

BTW, if you’re interested in more data, I did a full analysis of my book’s sales over its first 500 days here.

Finally, yes, I’m writing my next book. Gamesbeat’s Dean Takahashi and I recently sat down and talked about it in more detail. Succinctly, it picks up where One Up left off. I look at how interactive entertainment has changed over the past few years, and what it suggests for the future of the entertainment. It builds on the writing I do for the SuperJoost Playlist, obviously. But it’s different in that a book offers a much better format for large data sets necessary to identify long-term patterns. Stay tuned.

As always, I am grateful for the support. Thank you.

BIG READ: The New York Times, a Wordle company

Last week a chart circulated that suggested one of the world’s most prominent news organizations now identifies as a game company.

Specifically, the ever-observant Matthew Ball found a chart in an analysis by ValueAct on Disney that argued the growing importance of games for non-gaming companies (p.14). Among all the apps owned and operated by the New York Times Company, its gaming app accounts for a disproportionately large share of overall user time spent. According to Ball, the New York Times “is now a gaming company.”

That’s a remarkable observation.

First, it suggests an incredible return on the NY Times’ low seven-figure purchase of Wordle, the daily five-letter word puzzle game it bought in January 2022. But the success isn’t the result of *just* Wordle, of course.

The mobile category has had a tough few years and all eyes are on the first signs of a return to growth and profitability. Based on the average cost per install, a metric that indicates what app developers are willing to pay for new users, the mobile ecosystems have been flat (iOS) or in decline (Android). The combined popularity of games like Connections, Sudoku, Crosswords, Mini, and Wordle has allowed the New York Times to remain insulated from the broader market decline.

The symbolism speaks volumes, too.

One of the world’s most prominent news organizations has come to rely on interactive entertainment. It is likely a learning experience for many of its own employees. Reporters covering games often face an uphill battle internally due to the perception of video games as low-brow entertainment. It is part of the reason why we recently saw a string of layoffs among games journalists at both trade press and mainstream news organizations over the past year. And it speaks directly to one of my favorite hobby horses, namely the blatant mental inertia that prevents organizations from adapting to a new strategy when market conditions shift.

With a strong, engaging mobile title in its portfolio, the New York Times has managed to offset the secular decline suffered by rivals. The paper added 300,000 net digital subscribers in 23Q4 and crossed $1 billion in annual digital subscription revenue for the first time. It contrasted starkly with competing outlets which instead announced layoffs resulting from declining advertising revenue and social media traffic.

Finding a random chart in a freely circulated report makes for a great talking point. But is Matt right that the NY Times is now a gaming company?

Well, kind of.

Certainly, the NY Times is on the right track and evidences the yet-untapped potential of combining different forms of information and entertainment into a more potent mix for contemporary audiences. It has proven adept at creating bundles of news, entertainment, and amusement to draw, retain, and monetize audiences.

But the current success of its gaming effort isn’t developed enough to call it a deliberate effort. More likely the Wordle acquisition, which I’d consider the crown jewel in the bunch was a brilliant yet minor initiative to give its app a boost. The NY Times has not stated in its past earnings reports that it is investing heavily in interactive entertainment to become a games company. Unless I missed it, the firm never once says it is going to offset a decline in advertising and print revenues by launching head-first into games.

Moreover, time spent does not necessarily equate to money spent. According to its 2023 annual report, the NY Times earned $2.4 billion in 2023, up from $2.3 billion y/y. Subscriptions account for $1.6 billion of its total, compared to $505 million from advertising. For years now, news has been a commodity. It’s abundant and freely available, which makes it difficult to charge for it. Subsequently, “news-only average digital-only subscribers decreased 860,000, or 20.6%.”

[BTW, its annual report is beautiful, as you’d expect from a firm that makes a living selling words. Its font and typesetting standards should be mandatory for all SEC filings. Would it be too much to ask billion-dollar corporations to spend a bit of effort on making these 200+ page documents easier to read?]

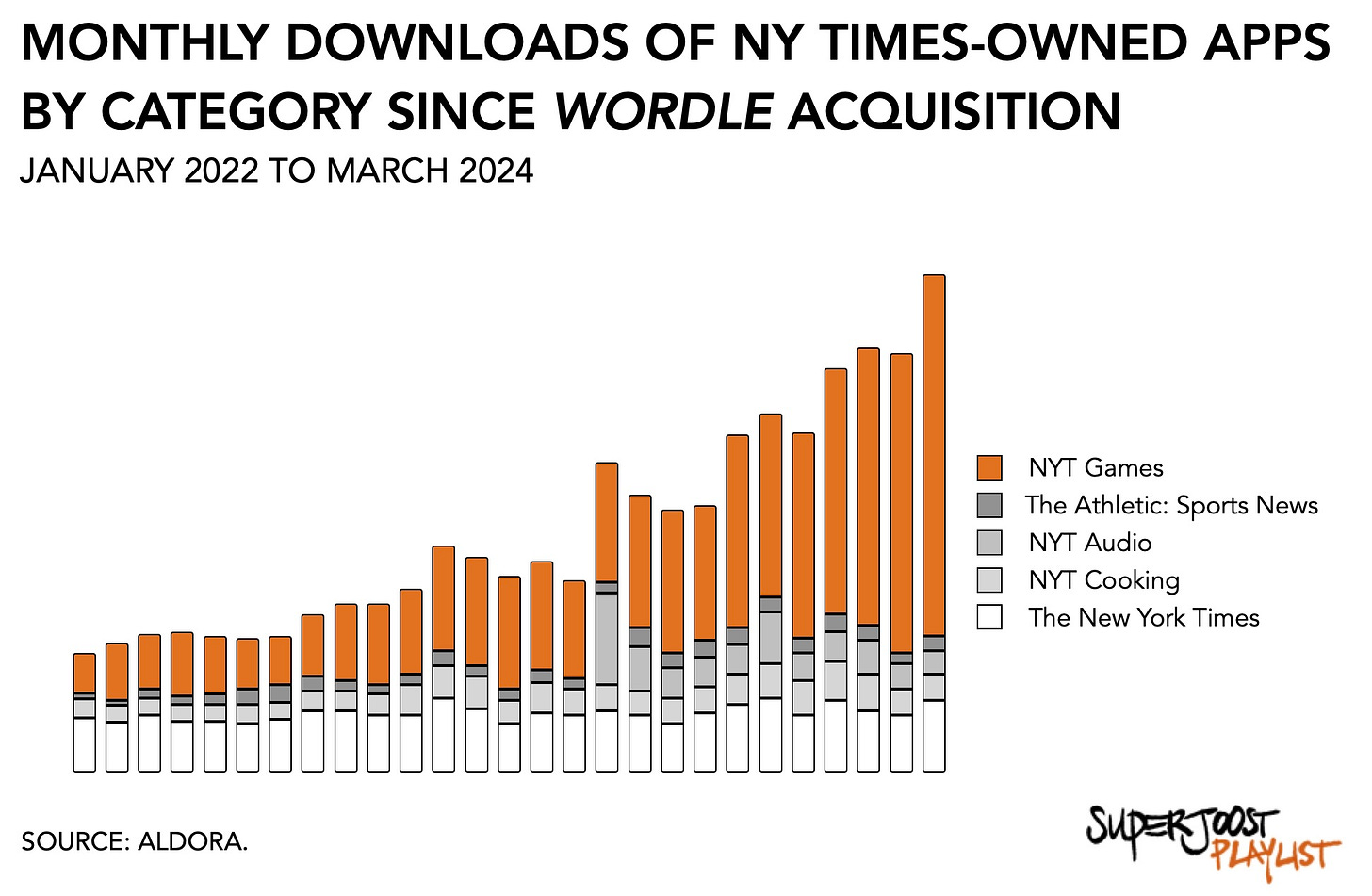

Looking at downloads creates the following graph.

Yes, I realize that starting the timeline at the Wordle acquisition implies that the increase is singularly the result of one game, but that is not the case. I do believe that Wordle signifies an intuitive milestone in the newspaper’s history.

Beyond the growth in games, there is also the comparatively modest consumption of other categories. Sports is a tried-and-true news category. Reporting the latest athletic results is central to the news business. And the push into podcasts and audio is an intuitive strategic move for any serious print publication.

The final observation here is that most of the app-based revenue still comes from the NY Times App. It has earned around $215 million over its lifetime, roughly triple the $71 million generated by the NYT Games: Word Games & Sudoko app. The NY Times’ flywheel depends on drawing audiences into its eco-system and finding novel strategies for engagement and monetization. Come for the games, pay for the news.

One of the most respected news organizations in the world got a scoop on what strategy for traditional media companies will look like in the years to come.

PLAY/PASS

Play. Saber Interactive’s founder, Matthew Karch, accidentally confirmed what we already knew, namely that it was Savvy pulled out of the $2 billion deal that sent Embracer on a layoff campaign.

Pass. New York’s Metropolitan Transit Authority demands the NYC Marathon pays $750,000 for the lost toll revenue from the Verrazzano-Narrows Bridge, which is closed for runners on the day of the race.