The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author Joost van Dreunen.

How’s your summer going?

Here in Brooklyn, the renovation of our local playground is finally complete. Took only 15 months, but it’s nice.

With mom and her brother out of town, the three-year-old and I were stoked and ran out at the first chance we had. It was a beautiful Sunday afternoon in Brooklyn. Within five minutes, everything’s on fire.

First, she demands to change out of her Elsa dress and into a bathing suit—sorry, her ‘baby suit’. Which sounds adorable. Except she’s already in the splashpad. I’m now half-soaked, trying to peel a soaking wet princess dress off a feral toddler.

I finally sit down. Good job, Dad. We survived that. Then another kid walks up, looks me dead in the eye, and pees herself. Just like that. I guess that’s how dominance works in the playground ecosystem.

Her mom strolls over, gives her a once-over, and goes: ‘Oh, you already went? Oh well, it’ll dry.’ Shrugs and goes to sit back down. Alrighty. Seems it’s a regular thing.

Just as I’m trying to emotionally recover, my kid comes back asking for a snack. I’ve got nothing. No crackers. No juice box. No backup plan. I was too excited to leave the house—I forgot snacks, sunscreen, wipes, the works. She gives me that toddler look that says, “You’ve failed me,” and bolts.

Then she returns. Holding a single potato chip. From the ground. Like she’s discovered fire. She raises it to the sky like it’s a communion wafer. I tell her not to eat it. She locks eyes with me. Runs off. Full sprint. Like a tiny fugitive. And eats it.

That’s how my summer is going.

On to this week’s update.

BIG READ: Xbox firing on all cylinders

Last week, Microsoft cut 9,000 jobs—roughly 8% of its total workforce. While the layoffs span the broader organization, the Xbox division wasn’t spared. Two of its crown jewels, King Digital and ZeniMax, saw their headcount reduced, triggering a wave of predictable outrage. Even the Communications Workers of America Union, Microsoft’s freshly minted labor ally since the Activision acquisition, was “deeply disappointed,” a sentiment that Xbox’s follow-up actions did little to alleviate.

For context, this isn’t the first time the company has trimmed its ranks. After acquiring Nokia in 2014, it eliminated 18,000 roles. In 2023, it cut 10,000 employees amid an AI-driven realignment. What stings is the fact that Xbox is actually performing well. In April, it was the top third-party publisher on PlayStation, with 2.45 million copies sold across titles like Forza Horizon 5, Minecraft, and Oblivion Remastered. And King, acquired as part of the $69 billion purchase of Activision Blizzard in 2023, has historically been one of mobile gaming’s most reliable cash cows.

So why the cuts?

The first clue is to look at the overall market. Yes, spending is down. And in response, firms are adjusting. Microsoft’s layoffs reflect a broader shift in gaming from expansion to efficiency.

A few weeks ago, we learned that growth for the biggest firms in gaming has slowed despite previously remaining relatively insulated from the overall market trend. After years of outperforming the rest of the industry, the top ten companies are now experiencing declining growth. Between 2020 and 2024, smaller publishers saw their growth swing from +30% to –14%. But in 2024, even the top dogs posted only modest gains. It signals that scale and IP depth are no longer sufficient moats in a post-pandemic, cost-rationalized market, forcing even the bigger game makers to tighten their belts.

It gets worse, though.

The fact that the crown jewel in the Activision Blizzard acquisition, King Digital, is now laying off people, too, should tell you as much. One interpretation is that it has reached the limits of performance marketing as a growth engine. Annual revenue declined slightly from $2.1 billion in 2023 to $2.0 billion in 2024—a modest drop of -0.5%, but directionally significant. Mobile marketing costs have increased while returns have decreased. For years, King thrived by mastering ad-driven user acquisition. But now that strategy has lost its efficacy.

Competitors like Dream Games and Scopely, backed by aggressive capital and new tactics, are winning the user acquisitions arms race. The relative newcomers compete on their ability to acquire, retain, and monetize users more effectively. It’s giving King and other incumbents like Supercell a run for their money.

Candy Crush still pulls in plenty of revenue, but don’t mistake cash flow for momentum. It dominates mobile engagement and ranks high on traditional play metrics like monthly active users, but that dominance is narrowly confined. Its presence across the broader entertainment stack—streaming platforms, creator communities, online fandoms—is virtually nonexistent.

King was originally Xbox’s mobile beachhead. That said, its ability to sustain engagement at scale over a decade is no small feat in mobile. However, unlike franchises like Genshin Impact and Roblox, which have invested in narrative world-building and participatory ecosystems, Candy Crush has stayed one-dimensional. It lacks cross-platform synergies, under-leverages its IP, and hasn’t developed a surrounding culture or content universe.

Put simply, it reaches a massive audience, but struggles to establish cultural or emotional resonance beyond the game itself. Without an ecosystem strategy, the franchise risks becoming a legacy asset—profitable, yes, but increasingly out of sync with where the market is headed.

It means that while Candy Crush continues to dominate in sheer reach, its brand remains underdeveloped. Unlike peers that have started to diversify into community engagement and fan-driven content, Candy Crush shows minimal presence beyond the core game loop. Compared to other mobile hits, Candy Crush barely exists outside the app. It scores highly in terms of people playing the game but flatlines across other increasingly critical channels, including live-streaming, online socializing, and user-generated content. It clings to a brand architecture built almost entirely on performance marketing.

Over the past year, the company has emphasized the diversity of its 500 million monthly active users to attract brand partners. Positioning its well-known titles—and better articulating its underleveraged IP—would strengthen its push into advertising. But its pivot from pure performance marketing to building a more coherent brand identity remains early-stage and underdeveloped. Strengthening this effort is key to reigniting growth.

Unfortunately, the correction isn’t over. Not by a long shot.

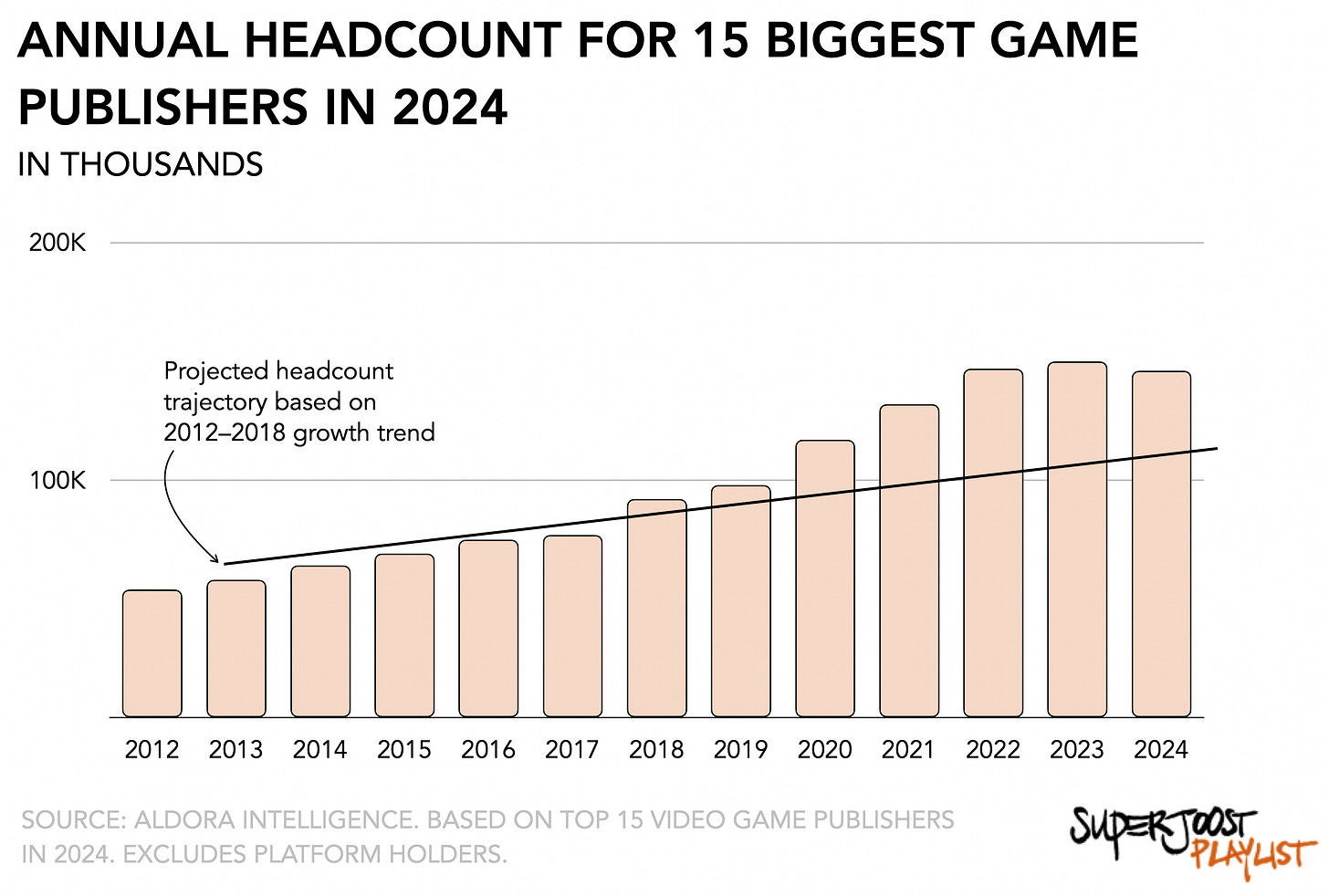

Looking at the headcount for top firms over a longer period suggests there are more layoffs to come. The industry is still responding to the push for efficiency. When gaming had its moment during the pandemic, everyone piled on, trying to get as big as possible as quickly as possible. Much like the tech firms they seek to emulate, the drive for doing more with less has replaced the ‘growth above all’ mantra fueled by cheap capital.

Between 2012 and 2024, the 15 biggest game publishers increased their headcount far beyond historical trends. Using a linear projection based on the years before the pandemic (2012 through 2018), this subset of industry participants should have reached around 122,411 employees by 2024. Instead, it hit 146,108—a 19% overshoot. That surplus reflects a content-first era, during which firms bulked up to feed growing portfolios and meet pandemic-era demand. But now that the model has reached its limits, growth is slowing, and we can expect more people to lose their jobs.

These cuts align with a broader transition in gaming from content innovation to distribution innovation. For a decade, publishers raced to produce more, buy more, and grow headcount. Now, they’re focused on reach, efficiency, and platform leverage.

What’s next for Xbox

The Xbox layoffs have reignited a debate over whether the platform’s struggles reflect broader industry trends or deeper strategic missteps. The question isn’t just whether Xbox is cutting for efficiency—it’s whether it’s run out of narrative runway. Because in platform wars, storytelling is infrastructure.

On one side, the firm’s restructuring appears consistent with the macro-level correction across gaming. To a degree, it is consistent with the broader market’s labor surplus. In this view, Microsoft’s cuts are less a crisis than a rational response to a broader overextension—a delayed but, according to its finance team, necessary step toward cost discipline as the market reverts to its long-term mean. The layoffs are positioned as a financial reset rather than a creative retreat.

It's not the only one under pressure, of course.

Rival Sony is also focused on efficiency despite reporting high platform activity and increasing monthly engagement. PlayStation’s current strategy centers on incremental gains rather than disruptive change. It, too, has both shut down key projects and eliminated studios over the past two years. The CEO shuffle from a year ago suggested a moment of strategy uncertainty as the firm seeks to futureproof itself for the next decade. If the macro environment persists, Sony may soon face similar pressures, especially as its live service pivot matures and platform spending normalizes. Despite its incumbency and relatively robust recent performance, it will yet face its own reckoning.

That said, Xbox’s direction looks increasingly adrift. Critics argue that the platform’s leadership has mismanaged both talent and IP, diluting its portfolio with misfires like Everwild and underwhelming releases such as Doom: The Dark Ages. The Game Pass strategy—centered on day-and-date launches—has come under scrutiny for undermining premium pricing models and eroding long-term value. Where competitors like Nintendo treat games as cultural events, Xbox has leaned into commodification, relying on distribution innovation without corresponding content quality. From this angle, the layoffs aren’t just about right-sizing—they’re an admission of creative and strategic drift.

There are potential winners from this turmoil, too.

Amazon, one of Microsoft’s big rivals, would be wise to scoop up all the talent that is now coming available. It has been slowly but surely encroaching on gaming over the years, and should not waste a good opportunity to fill its ranks with experienced people. It bragged a few months ago that it had snagged former Turn 10 designer, Mike Brown, to make their own racing game. After Xbox halved the studio, I’d imagine Amazon would take advantage.

And Apple should take a closer look at developing a first-party strategy. Now that revenues from its App Store fee have plateaued and are coming under increasing pressure from regulators, one growth strategy would be to put some of its $48 billion in cash to work.

These job cuts are undeniably painful. Behind each one is a worker who invested in the vision, but is now left footing the bill for strategic bets that remain unrealized. Xbox’s aggressive push into subscription models, cross-platform distribution, and mobile expansion was meant to futureproof its position, but the strategic return remains incomplete. What we’re seeing now is the cost of that overreach being borne by workers.

More broadly, it reflects a maturing phase for the industry, as the excesses of the growth era give way to a distribution-led correction. The next chapter in gaming will reward firms that can align operational efficiency with ecosystem depth, not just scale. And as platforms like Xbox confront the limitations of commoditized content and eroding moats, sustainability—not splash—will define who leads.

Next: While the top of the market is shedding jobs and retreating from overreach, the story looks very different further down the stack. In my next write-up, I’ll unpack new data on privately held studios—and why their hiring patterns suggest the real future of gaming isn’t shrinking. It’s shifting.

NEWS

South Korean government looking to sell its Nexon stake

After inheriting (!) about 30 percent (about 852,000 shares in total) of perhaps South Korea’s most prominent publisher in 2023 as payment for inheritance tax, the government is making a third attempt to sell its stake.

Specifically, it owns shares in NXC, the holding company behind Tokyo-listed Nexon, valued at approximately $3.5 billion. Indicative bids are due by the end of August 2025, with the stake to be placed in one or more tranches.

The renewed push to offload public holdings follows two prior failures to find qualified buyers, highlighting the persistent challenges of aligning strategic fit with regulatory clarity in cross-border gaming M&A. It also arrives just as market chatter suggests Tencent may pursue a separate 44.4% stake in Nexon—an outcome that could significantly reshape regional platform dynamics if realized.

The backdrop is telling: the Korean government is keen to shed ownership in non-core sectors, while global platform players are hunting for scale and influence in Asia’s mature gaming markets. For Tencent, a deeper foothold in Nexon would complement its sprawling global portfolio and reinforce its influence across mobile and PC segments.

Let me get my checkbook.

PLAY/PASS

Pass. The EU decided that game companies have no responsibility for ensuring their games remain accessible. It is coincidentally a topic Laine and I discuss at length on this week's UNBOXING episode.

Pass. Three Ubisoft managers received suspended prison sentences for workplace harassment.

MORE, PLEASE

If this was useful, go read “No kings left in gaming,” which dissects how even the most dominant publishers—EA, Microsoft, Sony—are now confronting growth ceilings and making hard strategic trade-offs. It pairs well with my 2023 piece “Sony’s new media empire,” which argues that the Japanese giant’s long-term pivot from electronics to content distribution is finally paying off as it becomes a full-spectrum media company.

Great read as usual. One thing I'm curious about though - you mention:

> Where competitors like Nintendo treat games as cultural events, Xbox has leaned into commodification, relying on distribution innovation without corresponding content quality.

While of course there is some minimum bar of content quality required for any distribution innovation to pay off, I wouldn't have guessed that Xbox was so far below it. After all, the Xbox/PC ecosystem covers the vast majority of AAA titles. If the problem really is one of content quality, then doesn't that question whether this is all entirely due to a distribution-led correction?

I feel like the reality is more that there are several factors all hitting the industry at once - lack of new distribution innovation certainly is one, but so is lack of new content innovation (no new genres since battle royale? autobattlers?), lack of business model innovation (how many monthly battle passes am I seriously going to buy?), hangover from overhiring assming COVID growth curves would continue, etc.

I don't disagree that there is a renewed focus on distribution that is driving some of the industry malaise (and these cuts), but it seems like that's only part of the story.

Love the summer story, same for me with my 7 and newly minted 4 year old!