The World Cup has started, and with it, my productivity has fallen.

With their first victory against Senegal, the Dutch are well on their way to becoming world champions. For me personally, that means all hands on deck. Because as of now my ability to get things done is becoming catastrophically low.

Connected to the 17 million other Dutch nationals out there, I will undoubtedly watch every minute of every game religiously, hoping to share with them a sense of celebration and pride. As I sit in my Brooklyn office where I’ve installed a dedicated screen that shows all the games, I tell myself that if whatever I’m working on has merit and if I’ve been doing a good enough job so far, my efforts should survive even a month-long blackout.

For all the time spent immersed in digital environments, a few real-life experiences remain that I don’t think will ever be supplanted. One of them is watching the Dutch soccer team take to the field. It is simultaneously the most irrational and most satisfying form of entertainment I know and not even binge-watching sci-fi shows comes close to how distracting this one sportsball event is.

My entire career is centered around interactive entertainment that provides audiences agency and decision-making power in online environments. Yet I am defenseless to the overwhelming sense of interconnectedness I experience when watching this tournament. It renders me completely passive, able only to observe and consume.

Please expect a delay in replying to emails.

🇳🇱🇺🇸⚽️❤️

On to this week’s update.

BIG READ: Start rolling for initiative

Reality catches up with everyone.

In the same week Elon Musk spent a day in court explaining why Tesla needed to compensate him $50 billion, he also found himself re-hiring several of the people he fired a week earlier. It offers a moderate sense of karmic justice.

Musk’s decisions seem drawn from page one in the ‘New Management’ handbook. “I’m here now so everything is going to be different.” Walking into a functioning organization and immediately making drastic changes without first taking the time to learn its culture and how it does what it does makes you a shitty leader. If anything, you squander any goodwill that may have existed at the start. Making people feel like their (years of) hard work has been a mess until you showed up to light the way is both a bad idea and evidence of narcissism. Different venues require different communication styles. How people talk to each other on Twitter, the social platform, and what they do at Twitter, the company, are necessarily two different things.

Reality caught up with me, too. After previously comparing the FTX mess to similar cases of companies growing too quickly and losing oversight, I got word from a former Hasbro exec. He explained to me that the toymaker, in fact, “picked toys [over games] and in the process destroyed the interactive games business.” That was a long time ago, and since then the company has made a massive turnaround on interactive entertainment, with former President and CEO/COO of Wizards of the Coast, Chris Cocks, now in charge of the whole firm. So I’ll have to write it up as a case study in corporate mental inertia instead, which is a common theme among executive decision-makers who cannot see the future making any sense.

A reckoning has also reached gaming. After several years of pandemic-infused supergrowth, the tides are now turning. Market researcher NPD reported $12.3 billion in consumer spending on video games for 22Q3, a -5 percent decline compared to the same period last year. Niko Partners (disclosure: I’m an advisor) released its latest report on the Chinese games market, which included a -2.5 percent decline to $45.4 billion, the first fall in market revenue in two decades. And Newzoo changed its earlier forecast for the global games market of +2.1 percent y/y growth in 2022 to $203 billion down to -4.3 percent to $184.4 billion instead. Across the board, market researchers agree that we’ve reached a turning point in consumer spending on games.

Several sub-categories in gaming, like esports, are having a hard look at their numbers, too. Despite the crypto crash taking over the airwaves the past two weeks, I did manage to squeeze in one graph in my last newsletter showing how esports teams rely mostly on non-esports content to draw viewers. That’s a significant development and, perhaps, a necessary moment of sobriety for the overall category. At least, Riot seems to think so, as it announced the winding down of Wild Rift Esports and focusing its efforts solely on Asia. Competitive gaming is having an immensely difficult time convincing sponsors, despite their best efforts.

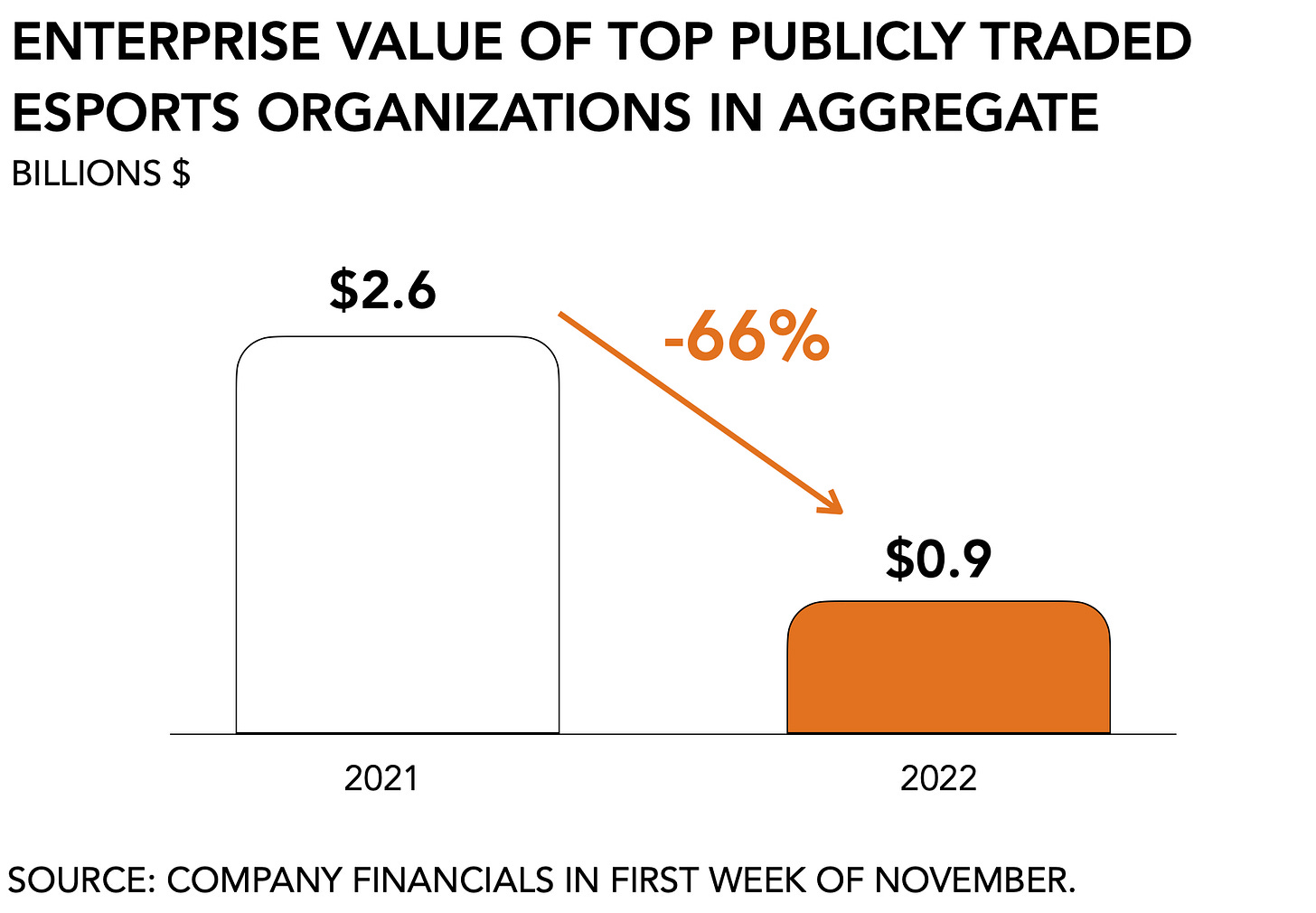

Among the publicly traded esports stocks there certainly isn’t much to celebrate. After a rally from $4 a share to $13, Esports Entertainment Group saw its value crater and now trades at $0.11 cents. The weighted average share price for esports firms is currently trading at about half of what it was in November 2020. Compared to a year ago, the largest esports firms have lost two-thirds of their combined enterprise value.

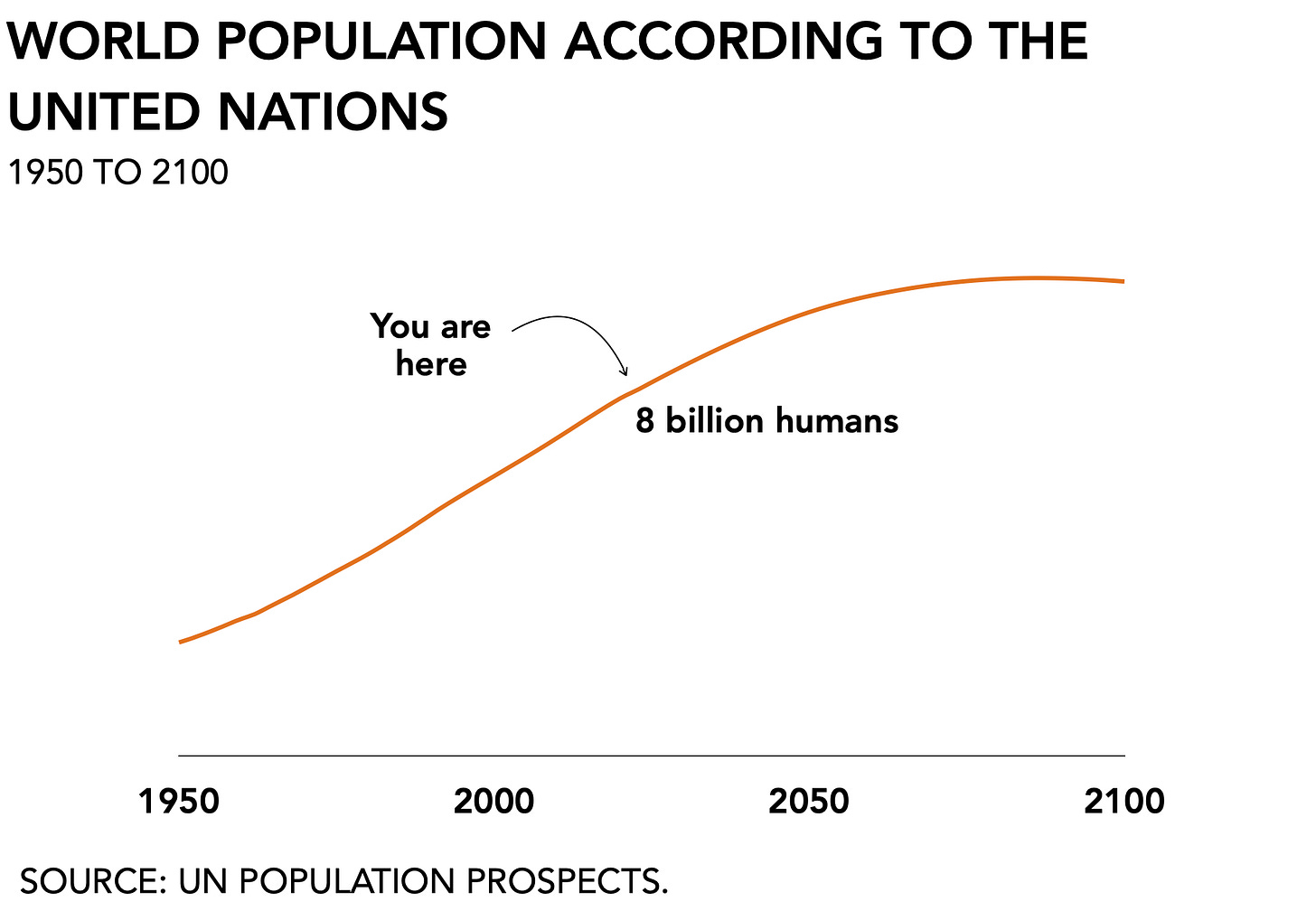

On a macroeconomic level, the games industry is about to get a more subtle reality check. The UN declared that the world population had reached 8 billion. That’s a lot of humans. However, contrary to the idea that more people equals more gamers, the industry will have to update its output. Up until recently, everyone wanted to “connect the world through play” (Zynga), “unite the world in play” (Spilgames), and “make fun and simple games for everyone” (King Digital). But that, too, is about to change.

As I’m fond of saying, more means different. According to the UN, the number of children—people under the age of 15—peaked last year while the number of older folk (65 and over) is expected to double from 783 million this year to 1.4 billion by 2043. The net result is an anticipated plateau in the population of around 10 billion humans by 2080. It is the aging of the world population, and not the increase in the total number of people, that will be the most significant demographic change in the decades to come.

For Matt Ball’s observation that “everyone born today is a gamer, which means there are 140 million new gamers every year,” to hold true, however, the industry will have to start making games for a broader demographic. I don’t expect there were a lot of pitches for games targetting an older demographic at Slush last week. But soon. “The coming decades will be marked by a rapid increase in the number of older persons, as the large cohorts born in the middle of the last century grow older,” according to the UN.

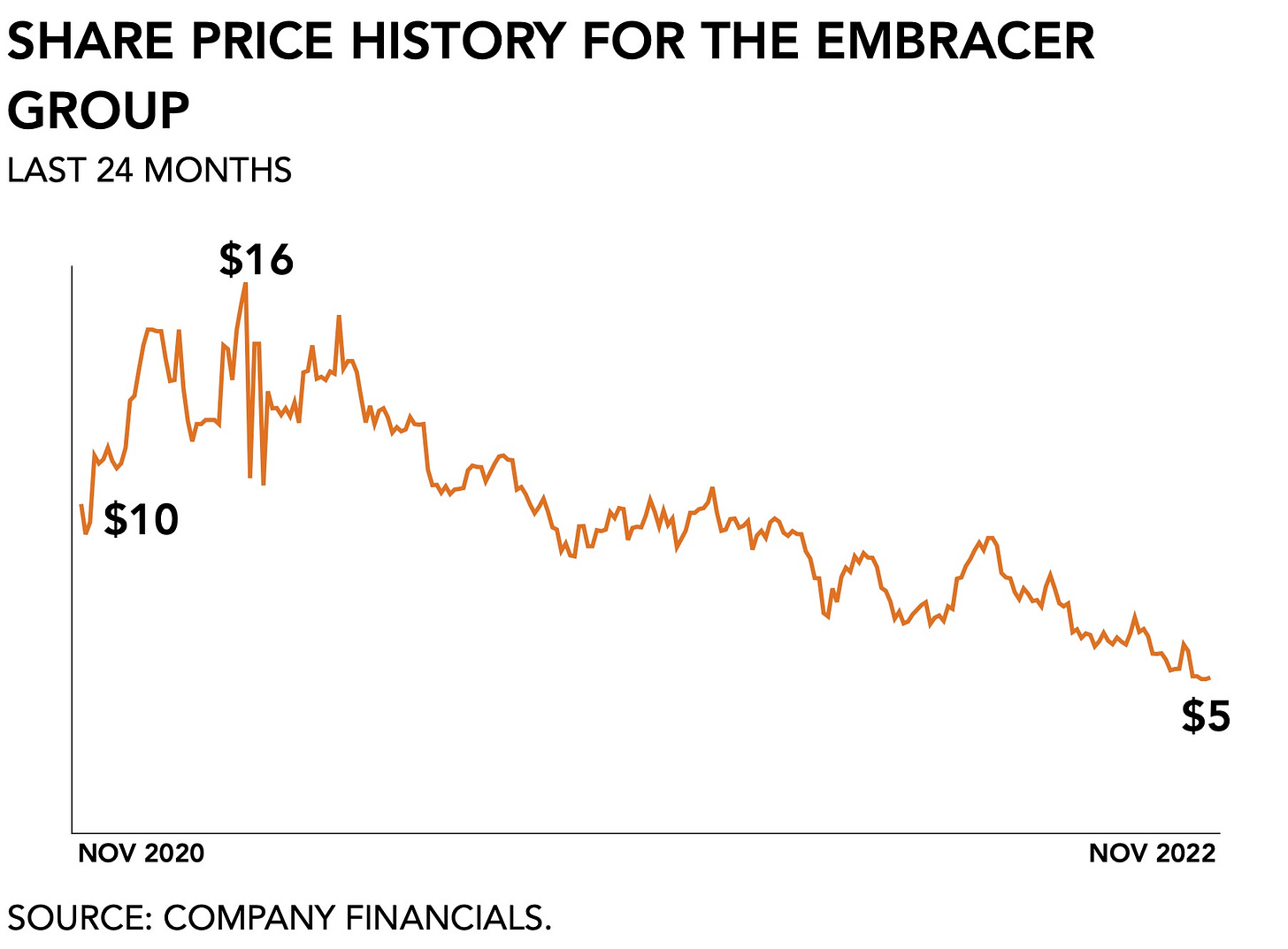

And speaking of size, following a buying spree, The Embracer Group is now talking about spin-offs and cuts. The European ‘get-big-quick’ gaming empire has reached the natural conclusion to its acquisitive strategy. After a four-year buying spree, management now blames the economy for turning “darker in recent months” and is launching a special review. You can’t make this up. Embracer has racked up a total of 22 deals since the start of the year for a total value of $4.6 billion, according to InvestGame’s recent report. That’s twice the amount of dealmaking reported for Tencent, which has announced 14 deals at a combined value of $2 billion over the same period.

It’s an insane notion that you could have so many people doing due diligence simultaneously on dozens of deals, and yet fail to look out the window. Throughout the games industry, there have been signals for well over a year that the pandemic had supercharged consumer demand and that the broader economic landscape was softening, despite the steady influx of venture capital and Saudi money.

With inflation at record highs, faltering financial leadership across major economies, widespread geo-political insecurity and unrest, supply chain issues and shortages, and a broader power grab by major platform holders across the ecosystem, who would have thought that spending all your time and money on buying other businesses would come back to bite you in the ass? Other, much larger firms have been issuing warnings and downgrades across the board.

My ‘I told you so’ is right here:

“As we enter a softer period, the cost of capital goes up as demand goes down. So far the industry’s solution has mostly been to acquire other, slightly smaller companies. But that costs money, too, as evidenced, for instance, by Embracer’s relatively high debt/capital ratio following a marathon of acquisitions. As the cold sets in who can afford to heat their house?”

Well, not Embracer, apparently. In response to being the only firm to get caught off-guard, the conglomerate has cut its forecasts for earnings, promptly lost 20 percent of its share price value, and now warns that spin-offs may be in the works when just three months ago it announced six new acquisitions. (More on this below.)

With forecasters predicting a softer market, esports losing value, the key demographic feature of the gaming audience shifting from size to age, and top firms indiscriminately shopping around and finding out, the corporate dexterity of all this ambition is going to be tested soon.

You may decide to check out of reality, but reality never stops checking in with you.

NEWS

NetEase and Activision Blizzard leave Chinese gamers hanging

After failing to come to terms and disagreeing on “material differences on key terms” both firms suffered the consequences. NetEase’s share price dropped -9 percent and Activision Blizzard will have to re-apply to distribute its titles in the Chinese market. (More on NetEase’s latest earnings below.) In recent years that process has become a key political tool wielded by the Chinese government which worries about the influx of foreign cultural influence and which has a long history of regarding video games with skepticism.

The rise of especially mobile and digital gaming audiences has propelled China to the foreground in the global games industry, both as a supplier and consumer of interactive entertainment. Large firms like Tencent and NetEase hold significant market share globally and have been actively acquiring and investing in studios throughout Europe and the Americas. Because of its size, the Chinese gamer market is key to any publisher with global aspirations. Both domestic game makers and the government in China have kindly leveraged their position to negotiate profitable deals with competitors from the United States and Japan.

With a possible shutdown on January 23rd of Overwatch, World of Warcraft, Hearthstone, Diablo 3, Heroes of the Storm, and the StarCraft series, which NetEase argued was the result of a “jerk” causing the relationship to suddenly snap, Activision Blizzard will see its annual income diminished by about $264 million, or about 3 percent of total earnings, according to the firm.

Epic and Apple are back in court

The two firms found themselves back in court to appeal the September 2021 decision by U.S. District Court Judge Yvonne Gonzalez Rogers, who determined that Apple was not operating a monopoly. This time the game maker stood side-by-side with the United States to address what they believed are several errors in the earlier judgment.

Although the earlier verdict forced Apple to allow users to use payment methods outside of the Apple ecosystem, thereby allowing app developers to keep a bigger piece, neither Epic nor Apple was happy. Epic Games felt the verdict fell short, and Apple argued that Epic had failed to provide proof, leaving the tech giant to argue that its platform’s security is paramount to sustaining a healthy ecosystem even if that comes with restrictions.

The case is expected to drag on but is likely to serve as a pretext for regulators who argue that the increasing complexity and intertwined nature of different ecosystem activities and platform responsibilities are precisely why they seek divestiture.

Co-creator of Sonic faces insider trading charges

Japanese prosecutors have charged famed designer Yuji Naka for buying $20,000 worth of shares in publicly listed studio Aiming in 2020 just weeks before his employer, Square Enix, announced the studio would be working on the next iteration of Dragon Quest. As one of Square Enix’s most popular mobile franchises, expectations were high and Aiming’s share price shot up 2.5x, increasing the value of Naka’s holdings by $30,000. According to prosecutors the designer and two other executives who similarly bought shares in Aiming were unable to outrun the law and got arrested.

I really love the level of scrutiny here. The Japanese don’t mess around, even for such small amounts. You thought you’d bought a few shares and hoped to supplement your annual income? No, you won’t. Meanwhile, 97 members of the US Congress reported trading in company shares that were directly impacted by their efforts. Integrity is important at any size and level of authority, of course, and while we may be tempted to turn a blind eye to creatives who are responsible for some of our favorite franchises, they, too, lead by example. But if regulators are going after a hedgehog in sneakers, then they also ought to have a look at Dr. Robotnik.

MONEY, MONEY, NUMBERS

Embracer, Europe’s second-largest game maker by headcount, reported $899 million in 23Q2 net sales, an +190 percent y/y increase that includes +35 percent organic growth, and above Wall Street consensus of $847 million. PC and console games are its biggest money maker at $385 million +107% y/y and +1 57% y/y organic), followed by Tabletop Games with $305 million, Mobile with $135 million (+67% y/y, +8% y/y organic), and Entertainment & Services with $74 million (69% y/y, but -15% y/y organic). It now has a total of 237 projects in simultaneous development and employs 15,731 people. Using 2021 full-year revenue of $1.2 billion, that means $75,761 per employee. By comparison, Ubisoft employs 20,665 people and generated $2.6 billion in revenue or $126,155 per head. Embracer adjusted its guidance downward from a range of $865 - $1,062 million for 23FY to $752 - $940 million.

Tencent reported $10.2 billion in earnings for its Value-Added Services division (-3% y/y), which included $4.4 billion in domestic games revenue (-7% y/y) compared to $1.6 billion in international games revenue (-3% y/y). Regulators have been cracking down on Tencent and its peers, resulting in a decline in its paying user count, especially for two of its most popular titles, Honor of Kings and Peacekeeper Elite. In compliance with China’s minor protection program, Tencent reported that game time among minors was down -92% y/y. The firm plans to double down on its popular franchises and expects VALORANT, Crossfire, and Clash of Clans (which is now the #1 mobile strategy title based on YTD grossing receipts) to pick up the slack.

Netease’s Gaming division generated $2.6 billion (+9.1% y/y) and represents the largest piece of the firm’s $3.4 billion total for the quarter (+10.1%). Its search engine business, Youdao, generated $197 million (+1.1%), Cloud Music $331.3 million (+22.5%), and its Innovative Businesses and Others clocked $276.7 million in revenue (+13.6%). Mobile gaming accounts for two-thirds (68.6%) of its online games group (a subdivision of its Gaming division that represents 93% of its total), compared to 31% for PC and console gaming. Considering how much money this company makes, it would be nice if they could hire someone capable of communicating their accomplishments without giving the rest of us a headache. NetEase continues to rely on its franchise Fantasy Westward Journey and its Online series for the core of its revenues. It noted its indifference regarding the breakup with Activision Blizzard, stating that “these licensed Blizzard games represented low single digits as a percentage of NetEase’s total.”

PLAY/PASS

Pass. Ticketmaster’s monopolistic tactics, which include dynamic pricing (like airplane tickets), resulted in a complete breakdown that prevented fans from buying tickets and now an investigation by the US Justice Department. More like Ticket-intern.