Cloud gaming, post-mortem

The afterlife of defunct cloud services

You can’t really blame people for losing their cool.

It’s been a harrowing ride the past few months. Everything is more expensive now. Yet one firm after another announces their latest gadget or service as if the good times are still rolling.

I appreciate that optimism. To build and grow you necessarily have to have a sense of modest arrogance that keeps you equal parts working hard and defiant. No business has ever been successful because someone was too afraid to get moving. But to do so you have to ignore the facts. A little.

It is no secret that European consumers are having an even harder time than their American counterparts. The Dutch are expecting to see their heating bill triple this winter. Germany, the continent’s largest and one of its most robust economies, is staring at a 10.9% inflation rate. Scheisse.

The idea that video games are somehow recession-proof remains largely unproven. Sure enough, gaming bloomed in the wake of the 2008 downturn, but that had less to do with existing business models and more with the rapid popularisation of smartphones and their accompanying free-to-play revenue model.

It means companies that make entertainment would be wise to fix the leaks in their roof. Or rather, they should have by now. When the cost of capital was low, the legacy publishers padded their balance sheets. It’s generally best to raise capital when you don’t need it.

Now that things aren’t looking so hot, debt will become a critical component in formulating a strategy to survive and thrive. After hearing inflation would be transitory for months, only to be told it wasn’t, I’d be skeptical of anyone claiming to know how long it will take for the sun to come back out. That leaves firms with debt out in the cold.

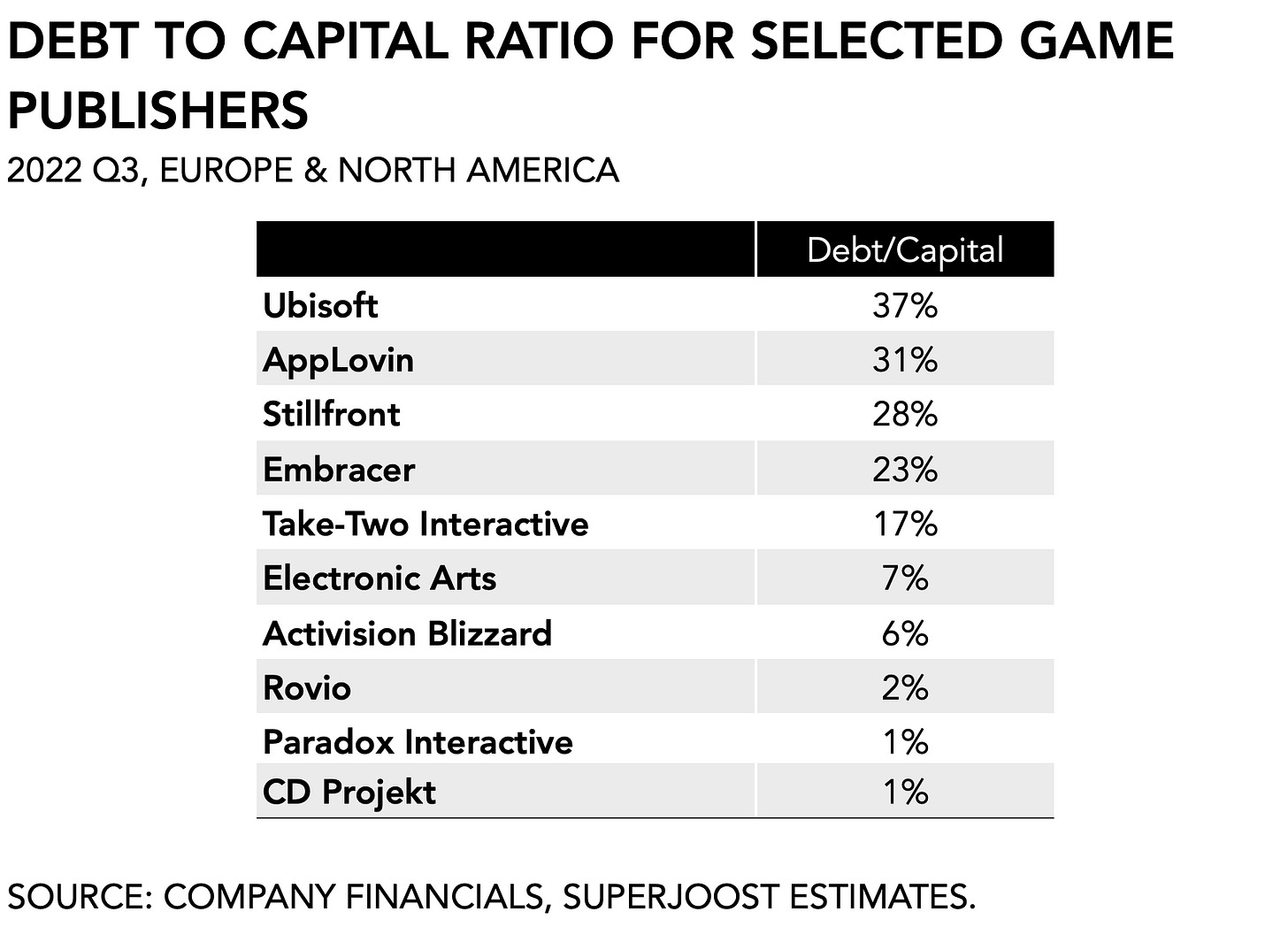

One handy metric in this context is the debt-to-capital ratio, which calculates the amount of debt a publisher has on the books and determines the risk for a lender.

As we enter a softer period, the cost of capital goes up as demand goes down. So far the industry’s solution has mostly been to acquire other, slightly smaller companies. But that costs money, too, as evidenced, for instance, by Embracer’s relatively high debt/capital ratio following a marathon of acquisitions. As the cold sets in who can afford to heat their house?

Sure enough, the games industry has changed a lot over the last decade. Let’s see if it is more, or less, resistant to a downturn than it was before it went digital.

On to this week’s update!

BIG READ: Cloud gaming, post-mortem

The recent news that Google is discontinuing its Stadia cloud gaming service has invigorated the skeptics and leaves a looming question: With Stadia gone, where does it leave cloud gaming?

Now that the initial fanfare is set to conclude with a fizzle, Google has, arguably, committed one of the worst infractions possible as a consumer-focused tech firm. After promising us the moon, its offering slowly came undone and ultimately fell apart. As one of the most visible firms to push into cloud gaming, we may very well ask whether Google damaged the average consumer’s expectations of what should be the next frontier in interactive entertainment.

However, now that Stadia is on its way out, it seems more likely that Google will offer its capabilities to content owners and infrastructure firms.

In 2021, telecom provider AT&T offered its wireless subscribers a free demo of Arkham Knight, and Control via a white-label version of Stadia’s offering. And in June this year, Google announced a partnership with Capcom that allowed people to play Resident Evil Village directly in a browser. It all led up to Google announcing its “Immersive Stream for Games” service earlier this year and suggesting what a post-Stadia may look like.

In the short term, such a strategy will allow Google to recoup some of its initial investment and to shift from what was a consumer-facing business to one that caters to other businesses. In the long run, however, chances are that this will multiply the amount of cloud-based offerings as major IP holders and telcos move to disintermediate and retain full control, and profit, over their portfolio. In an already cluttered digital market, consumers will become further alienated as they struggle to navigate a myriad of different accounts to a variety of either undifferentiated (e.g., the cloud-based handheld category) or highly specific, single-publisher services.

Video streaming showed something similar. Disney took its content off Netflix to start its own service, which has proven to be a massive success. However, Riot Games tried the same in 2016 when it announced a $300 million deal with BAMTech to build its own. The deal, however, ultimately dissolved two years later. This is remarkable because Riot Games was at its peak around that time, and the proposed purchase was widely regarded as an attempt to take back control over the programming of live-streaming League of Legends and long-tail content. This was years before it had to diversify and expand its offering from a single title to an array of spin-off projects. Disney proved more successful, among other reasons, because it had a wider portfolio of content allowing it to stand on its own feet as it broke with Netflix.

It will be similarly difficult for individual publishers to offer their own streaming service because they cannot aggregate enough of an audience to justify the investment. Electronic Arts, which in 2018 acquired the cloud technology assets from GameFly, an online video game rental service, has so far exclusively opted to make its EA Play subscription available via streaming services like Microsoft’s Game Pass.

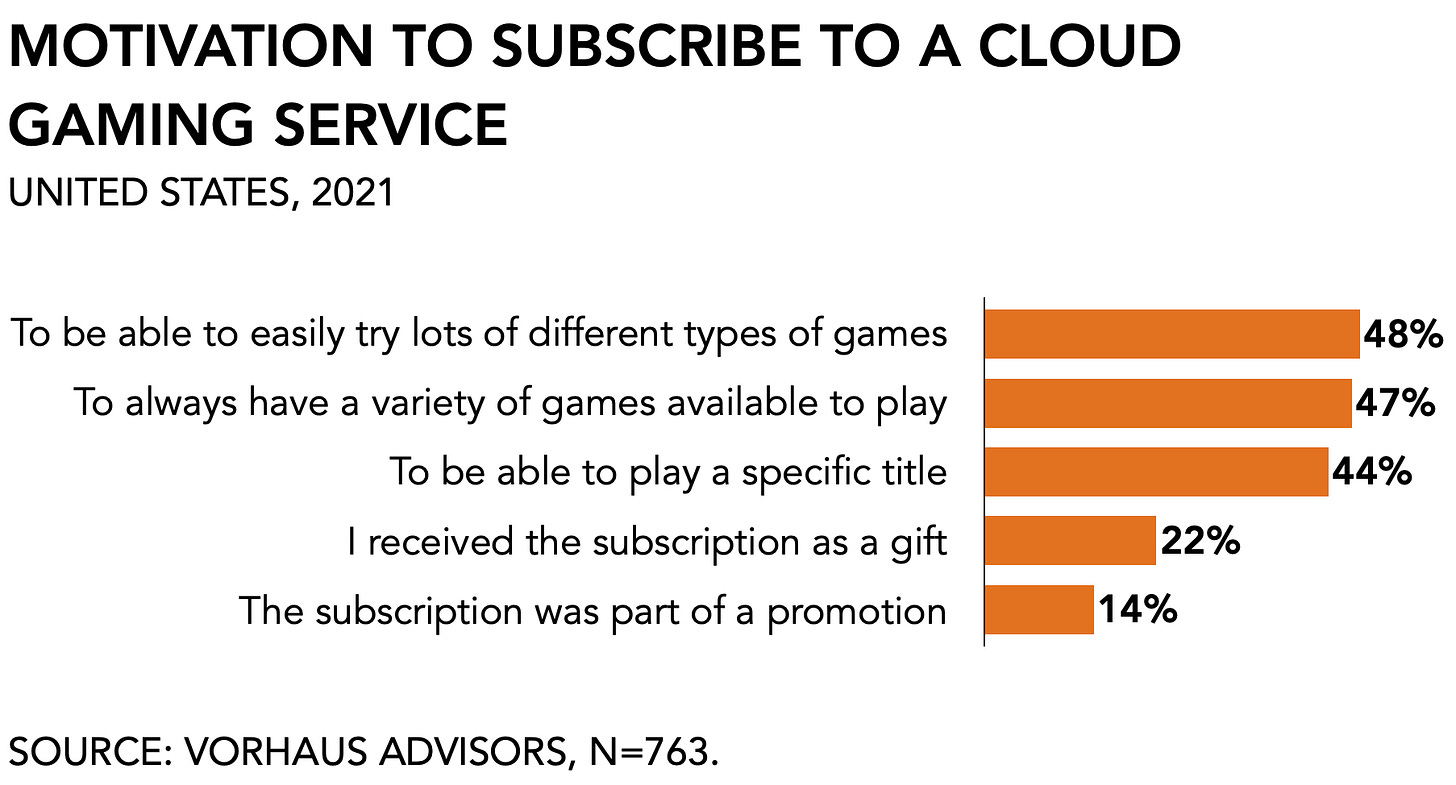

Consumers like having options. Cloud gaming promises to provide audiences with a wide variety of playable content without the need to commit money or time. Trying out lots of games and having a variety available are, in fact, the two key reasons why consumers are excited about cloud gaming.

Big Tech may well abandon the cloud streaming effort altogether. The zeal behind a winner-takes-most strategy as the ultimate win condition in platform economies means at this point the anticipated costs of building their own audiences will exceed the benefit. Amazon is having an equally bad time with cloud gaming. With little to show for its investments and acquisitions thus far, it is increasingly less likely that the online retailer will front the cash necessary to catch up to legacy platforms like Microsoft and Sony.

Google’s exit from the category will start a brief period in which several telcos and big publishers lean on its defunct platform to vertically integrate a cloud-based offering for their own customer bases, followed by the emergence of a handful of aggregators.

NEWS

Overwatch 2 launches, suffers DDOS attack, disconnects

The hotly anticipated and repeatedly delayed second installment in Blizzard’s marque shooter franchise, Overwatch, suffered a wobbly few first steps. Players had difficulty connecting and faced queues with thousands of others. According to Mike Ybarra, Blizzard’s president, a DDOS attack ruined the fun for everyone.

Having a bad first day isn’t a novelty for a major title release, of course. But it does feel a lot like a game of hot potato behind the scenes, as several directors on the project left over the last few years, and competition from VALORENT (Riot Games) and Apex Legends (Electronic Arts) currently dominates the category. Audiences may very well prove to be Overwatched Out.

FaZe Clan financiers default

According to a filing by FaZe Clan Holdings, a digital entertainment and esports brand, with the SEC, investors have defaulted on $71.4 million of its $100 million Private Investment in Public Equity, or PIPE, commitments. As a result, B. Riley, a major US-based financial institution that sponsored FaZe Clan’s public filing, is now on the hook and has guaranteed $53.4 million to replace the missing funds. Nevertheless, Faze Clan’s share price dropped -32 percent from $9.68 on Monday to $5.75.

That’s disappointing for a few reasons. Not in the least because FaZe Clan had seemingly cracked the code on how to transform a bunch of competitive gamers into a legitimate business. As a category, esports has always been popular but financially on the back foot. For years, the category has suffered from setbacks, ranging from racism, the pandemic, and the eagerness of IP holders to squeeze money out of budding esports teams. With $31 million in revenues in 2019, the firm had managed to grow to $37 million (+21% y/y) in 2020, despite being unable to attend in-person events, and reported $53 million for 2021 (+42% y/y). The success suggested that esports’ moment in the sun had finally arrived. And FaZe was one of the shiny examples of how video games are expanding beyond the traditional boundaries of playing at home and online and reaching audiences at real-life events.

Not quite yet, it seems.

Saudi gaming group to invest $38 billion

With another investment announcement coming from Saudi Arabia comes the increasingly alarming realization that (partial) ownership of people’s pastimes should be managed and owned by organizations that at the very least recognize human rights. One particularly vexing point is Saudi Saudi Crown Prince Mohammed bin Salman's approval of the operation to "capture or kill" Washington Post journalist Jamal Khashoggi in 2018.

It’s unlikely that video games will prove to be a moral lighthouse, for the same reasons that its close cousins film and music aren’t either. But as interactive entertainment becomes a more visible and increasingly global cultural effort, it is only a matter of time before people start asking questions about what goes on behind the scenes. Previously we saw how Activision Blizzard stumbled when it hurriedly took a streamer expressing support for the Hong Kong protest off the air (remember that?). With a growing number of people involved and invested in the frivolity of digital games, it makes only sense to raise questions about who’s pulling the purse strings.

Web3 gaming creeping in at the fringes

Over the past few weeks, there have been several news items that suggest blockchain-based gaming may have suffered through the worst of it.

First, there was the $40 million series A round raised by Horizon. The firm provides web3 game dev tools and published Skyweaver, one of the better-known and more successful applications of collectible card games to blockchain technology. Its list of investors is a who’s-who of legacy firms and venture funds but two stand out: Take-Two Interactive Software and Ubisoft. The latter was an early participant in blockchain-based gaming, then got blasted for it, walked it back, but, apparently, didn’t abandon the effort altogether. Take-Two has always been in the money business and doesn’t give two bitcoin for people’s opinions if it can figure out a new revenue stream.

The second was the entry of Mythical Games title Blankos on the Epic Games Store in September. Epic Games CEO Tim Sweeney initially spoke out against NFT games, calling "the whole field … an intractable mix of scams, interesting decentralized tech foundations, and scams," only to turn that into the observation that “developers should be free to decide how to build their games, and you are free to decide whether to play them.”

Let’s not forget about former Machine Zone CEO and the advertising world’s enfant terrible, Gabriel Leydon, which raised $200 million in late August for Limit Break, which proposes a free-to-own model. The press release oozes the kind of confidence that comes from experience. If his 2016 interview at Code/Media about the end of television advertising is any indication we’re in for a ride. (BTW, team Naavik did a proper write-up on the raise.)

And finally, Apple has seemingly agreed to allow the sale of NFTs in its App Store, provided that it gets its 30 percent cut as per usual. That is a notable improvement for NFT-peddling game makers because it put their games in front of 1.7 billion active Apple devices.

Sure, even lumped together it is not nearly enough to get too excited and claim the category is on its way back. It’s not. But it sure sounds different from the often ignorant negativity from a few months ago.

PLAY/PASS

Play. Kudos to CD Project Red for disclosing its 10-year roadmap. In the lead-up to Cyberpunk 2077, it hurt the firm to leave players in the dark. Sharing their plans will go a long way. (Bonus: page 13 has a cool example of a game publisher flywheel!)

Pass. Fining Kim Kardashian $1.3 million for promoting a cryptocurrency without disclosing that she was paid to do so means the SEC handed her 100x that value in free marketing. I’m sure she’ll never do it again now.