Mobile gaming’s new data monopoly

How a $300 million acquisition will reshape mobile market intelligence

The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

This year’s Game Developers Conference was a mixed bag.

I watched a pant-less woman casually ransack the sugar packets from the table next to me during a meeting. It is a normalized occurrence in a city that aspires to improve the human condition through a relentless focus on capital and technology.

GDC has also become a stretched-out event that starts earlier every year to accommodate the different constituencies. Venture capital kicks off over the weekend before with a rash of parties and performances. Then starts the cycle of business development and non-development activity, before, finally the actual conference begins.

It allows for a layered perspective on the industry. Venture money is now a mainstay as a form of alternative capital for developers who have historically relied on publishers and platforms to fund their projects. But it has become more conservative and quiet in its pursuit. There are large-scale parties at a16z, of course, which run well into the night and host an array of adjacent events. The more modest-sized game-focused funds were present but not nearly as visible.

Next, console incumbents showed up in force, but seemed weaker overall.

Team Xbox is adjusting to its expanded role as an industry leader. The firm holds significant real estate both on console and at conferences but comes up short on key metrics. The absence of updated Game Pass numbers does not bode well for the service, and both Redfall and Starfield clearly did not deliver the anticipated success. After 22 consecutive quarters, its prized mobile franchise Candy Crush Saga lost its place as the most popular match-3 mobile game to Royal Match since the Activision Blizzard purchase. I want them to succeed because I like the vision, but despite a combined $77 billion in acquisitions team, Xbox is having a harder time than expected.

Over at PlayStation, it was Jim Ryan’s last official week as CEO of Sony Interactive Entertainment. In the absence of a clear successor, it is highly unlikely that the Japanese console maker is going to take any risks, especially since the interim figurehead, Hiroki Totoki, is a CFO. Instead, it laid off 900 people, reduced its anticipated unit sales for the PlayStation 5, halted the production of the PSVR2, and does not plan to release any big IP until 2025. Now is not the time to make waves. A ray of light for Sony comes from Helldivers 2 which exceeded expectations and provided fuel for the firm’s desperately needed push into multiplayer gameplay.

But both had better hurry.

Eager disruptors like Amazon and Netflix lurk on the fringes. Big Tech persists in its attempt to create an entry point and establish itself as a gaming destination, mostly in the cloud. Netflix’s game plan is relatively well-known and humming along. I thought adding Hades was a good get.

One sleeper cell I expect to hear more from this year is Amazon. It’s been hiring to populate the expansion of its gaming service and is, I’m told, now active in eight countries worldwide. In the wake of a few less-than-successful releases, Amazon has kept rather quiet. Despite its strength in distribution and infrastructure, it still lacks a clear personality to set apart its offering.

But if there was ever a time to strike, it is now. Both Microsoft and Sony are visibly taking it slow as they’ve turned their focus inward to strengthen their businesses, improve profitability, and find efficiencies. I predict both to announce further layoffs shortly, allowing Amazon to scoop up the necessary talent and expand its footprint.

Finally, the development community showed up in numbers. Lines were long and sidewalks crowded. Their main topic of conversation was, predictably, the mounting number of layoffs. Some of the dismay manifested in a notable highlight: the GDScream event. During the conference, a group of devs gathered to draw attention to the state of the games industry by screaming for a full minute.

Despite gaming having become the quintessential form of entertainment, a distinct angst continues to characterize a subset of creatives. Perhaps they are the first generation of artists in human history to externalize the inevitable suffering that goes with creation. Maybe. But I struggle to imagine any other industry where its creatives would take to an open field during one of its largest conventions of the year to collectively scream into the void.

It’s a vibe.

On to this week’s update.

BIG READ: Mobile gaming’s new data monopoly

Sensor Tower, an app analytics firm, announced it is acquiring its main competitor, data.ai, in a deal that consolidates the mobile intelligence industry.

According to the firm, the acquisition will allow expanding its offerings and broaden its audience to any company participating in the digital economy. Its CEO, Oliver Yeh, says the buy marks “the beginning of a new and exciting chapter, not only for Sensor Tower, but for the digital marketing and mobile app intelligence industry as a whole.”

A new chapter, yes. Exciting, no.

And data.ai’s CEO, Ted Krantz, called it an “evolution” that “offers the best path to innovation, more insights across more channels, and ultimately, more value derived by clients.”

I disagree.

The data business—specifically, the for-profit activity of aggregating relevant audience information to help inform strategy and creativity—needs competition. Without it, mobile gaming faces a gradual decline when it comes to novel ideas and value creation.

In interactive entertainment, large organizations tend to innovate through acquisition. It is much more difficult to establish a corporate culture that fosters innovation and radical new ideas because people in large companies tend to worry most of all about how to not lose their job. That’s understandable and an important reason why corporations are risk-averse. Game makers similarly focus on expanding proven successes and have a documented habit of deprioritizing novel projects.

Moreover, in a platform-based economy where a handful of landlords control the distribution, monetization, consumption, and analytics of content, there needs to be a reliable third-party source of information. In politics, it is called the Fourth Estate, journalism. In interactive entertainment, it is the different data trackers and research analysts that evaluate corporate performance. Dominant firms in creative ecosystems like video games benefit from obfuscation. Transparency is its antidote.

The games industry already suffers from enough bottlenecks. I attended an analyst lunch during GDC only to find the same clique of industry experts. I bet you can guess the demographic profile. Most of them had earned their position, certainly. But it also means that, at least in the United States, analysis of the entire $261 billion games industry comes from barely two dozen lifelong number crunchers and forecasters. Despite their integrity, they depend on a healthy relationship with the firms they cover.

One of the great affordances of digitalization has been the widespread availability of industry information. The acquisition is a step back.

At the time of signing, the firm said it would absorb “part of the data.ai’s 400-person team” and announced a workforce reduction. Within two days, 200 staffers were laid off.

Half.

They cut 50 percent of data.ai’s team. The games industry has been collectively losing its mind over publishers laying off 9 percent of staff over the past year. Will we see a similar #GDScream event for data analysts at next year’s GDC? Unlikely.

And yet it will undoubtedly impact the mobile gaming ecosystem.

For one, mobile games data will get more expensive. That raises entry barriers and the ability to compete on equal footing for small and medium-sized developers.

Already mobile game companies have been spending an absolute fortune on marketing. The cost of success in mobile gaming has grown to new records. Titles like Monopoly Go! and Royal Match rely on marketing budgets ranging between $500 million and $1 billion. User acquisition in mobile has never been more expensive, and monopolizing the data feed that informs game makers provides leverage to claim a bigger piece of those budgets. Up until recently, competition between the two largest mobile data firms has kept rates lower, and that’s about to change.

Next, I predict that Sensor Tower will ready itself to go public.

Multiples for data companies tend to vary between 2-5x revenue. Techcrunch tells us that data.ai was generating $100 million a year, which is up from $66 million a few years ago according to my own sources. As mobile gaming has become more complicated and costly, better data increases in value.

Taking into consideration that the momentum in the mobile game sector is currently flat and the fact that Bain Capital provided credit-based financing with additional funding from Riverwood Capital and Paramark Ventures, the multiple sits at the lower end of the spectrum. It tells you that the total value of the deal likely sits around $300 million. That’s not a terrible outcome for data.ai, which raised $157 million in funding, but it’s not a blowout success either. With the acquisition, Sensor Tower has taken on debt and Riverwood Capital is now a majority shareholder.

That means the games industry’s single source of truth on mobile gaming data, has investors that will push for high-growth and a public exit. We should expect the firm to start lowering costs and look for new and clever ways to increase revenue.

Data firms and service providers generally stay out of the spotlight when it comes to large acquisitions. We tend to worry more about who owns the means of production and distribution of entertainment. But in a market where gatekeepers are all-powerful and, now, data providers consolidate into a virtual monopoly, creatives face even fewer alternatives.

Is that an exciting new chapter? My data says no.

NEWS

Apple bruised with lawsuits

The strategic decision staring Tim Cook in the face is to either loosen his iron grip on the Apple ecosystem or write off the mounting legal fees as the cost of doing business.

The luxury consumer electronics firm is facing a slew of legal disputes that take aim at what regulators claim is uncompetitive behavior. Last week the US Department of Justice (DoJ) filed a lawsuit alleging that Apple is monopolizing the smartphone market. It argues that Apple is imposing a prohibitive set of rules and levies on app developers and makes it unreasonably difficult for consumers to leave its ecosystem.

The DoJ specifically accuses Apple of preventing developers from offering cloud gaming apps on the iPhone. Since cloud gaming apps would allow users to play high-quality games without requiring a hardware upgrade, it is a threat to Apple’s business of selling new devices each year. The firm’s smartphone sales totaled $201 billion last year but declined 2 percent year-over-year.

The DoJ’s lawsuit alleges that Apple has hindered the growth of cloud gaming apps on the iPhone through various means. For years, Apple required each cloud-streamed game and its updates to be submitted as standalone apps for approval, increasing costs and limiting the number of games developers could offer. Additionally, Apple's rules forced developers to create separate iOS versions of their apps rather than a single cross-platform version, leading to increased development time and resources. The lawsuit suggests that Apple's conduct has made cloud gaming apps unattractive to both users and developers on the iPhone, effectively preventing their emergence on the platform.

In 2023, Apple generated $14.6 billion in app store fees from mobile game publishers, according to ALDORA, making it the fourth-largest game company in the world by revenues.

Reddit goes public

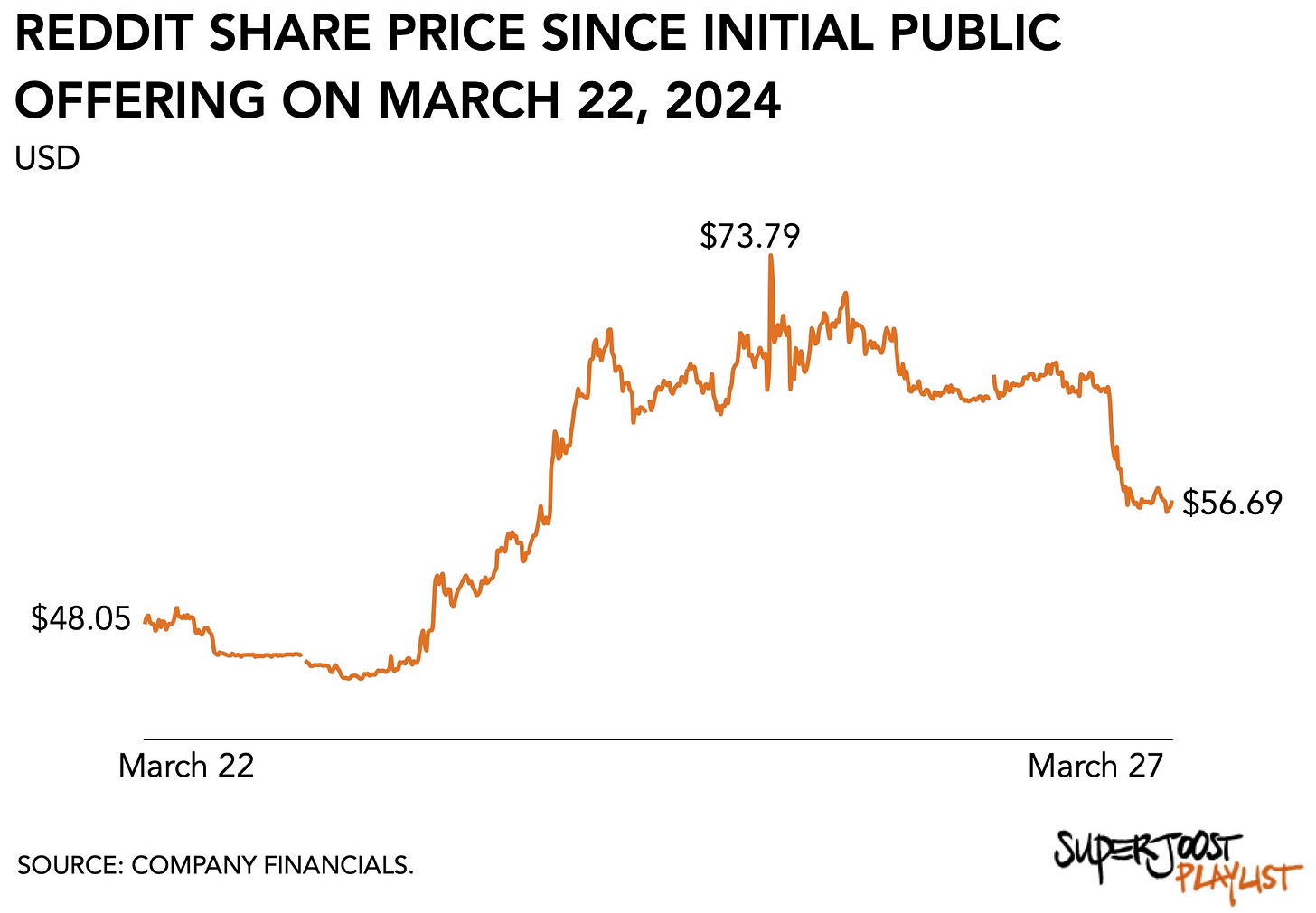

Social platform Reddit filed it initial public offering last week, raising close to $750 million. Focused on establishing fan-based communities, the firm promises continued revenue growth due to its widespread popularity.

It is early days, of course, and far too early to say anything meaningful about what the next few years will bring. Certainly, Reddit has everyone’s attention as one of the cool companies out there right now. It relies for 98 percent of its revenues on advertising. However, the prospect of licensing its vast amounts of data to train large language models suggests Reddit stands to become even more valuable.

One thing that stood out to me in its S-1 filing was the lack of mentions of entertainment other than gaming. A quick keyword search reveals that the term ‘film’ appears twice, ‘sports’ and ‘fashion’ each appear five times, and ‘music’ is not mentioned at all. Games, on the other hand, appear 13 times. Sure enough, that is still not a lot, but it deserves noting that video gaming is such an important category for Reddit where other forms of entertainment, apparently, aren’t.

Communities around specific franchises can be substantial. Take-Two’s Grand Theft Auto 5 subreddit has over 3 million members, for example. That is a healthy starting point fora any marketing effort toward Grand Theft Auto 6.

It also means that user activity on Reddit can fluctuate due to unexpected successes in game releases. It states that

“quarter over quarter growth for the three months ended March 31, 2022 was 7%, as a result of increased user activity due in part to r/ EldenRing and other gaming-related communities.”

Reddit’s revenues totaled $804 million in 2023, up 21 percent from $667 million in 2022 and $485 million in 2021.

Plans for Dragon Ball theme park emerge

Just weeks after the death of its creator, Akira Toriyama, Saudi Arabia’s Public Investment Fund (PIF) announced plans to build a theme park inspired by Dragon Ball near Riyadh. Qiddiya Investment, a PIF subsidiary is in charge of its construction as part of a larger entertainment project. The firm is also involved in building a Formula 1 race track and a 5,155-seat esports arena.

PIF holds a 6 percent stake in Toei Co, the parent company to Toei Animation, which produces Dragon Ball.

GameStop expected to collapse sooner rather than later

Following a rather disappointing round of earnings, the specialty retailer is on track to run out of options before 2030. It reported $1.8 billion in 23Q4 earnings, well below $2.2 billion from a year earlier and consensus of $2.1 billion. Overall software sales were weakest with a 31 percent decline year-over-year, followed by Collectibles (-25 percent y/y) and Hardware (-12 percent).

The retailer has been cutting costs, including laying off 3,000 full-time employees (like data analysts, video game retail workers fall outside of the vocal sympathy afforded to laid-off game devs), and closure of 287 stores worldwide. Reinventing itself is proving to be costly both in terms of time and money.

Back-of-the-envelop math suggests that its current cash reserves can sustain GameStop for another decade. That is not likely as its annual losses are expected to increase as it invests in new revenue streams.

PLAY/PASS

Play. RollerCoaster Tycoon turned 25 years old. A classic.

Pass. Larian Studios CEO Sven Vincke told an audience at GDC that there will be no expansions or DLC for its popular Baldur’s Gate III. That’s a bummer.

Bonus: Play. Workers at SEGA have just ratified a union contract, including minimum annual pay increases and benefits. It’s the first at a major US-based game maker.

🔥💚🎮

Can we foster competition in the mobile games data market to keep the fun (and fairness) alive? How?