Video game layoffs are a feature, not a bug

Deep-dive on sales per employee for legacy publishers

The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

“No. I, not.”

It’s how my two-year-old daughter tells me she is not going to put on her coat.

I welcome, of course, her fledging attempts to claim autonomy. Making your own decisions is an essential life practice. But it is not entirely clear to me how to teach her when to trust her instincts and when to put on her coat because it’s March and freezing outside.

Investors also wrestled with the question of whether to hold their position or adjust. What to make, for instance, of NVIDIA’s rise from making fancy graphics cards for gamers to become the world’s third-most valuable company after Apple and Microsoft. Its most recent earnings catapulted the company into the upper echelon of the economy with a $2 trillion market value. The firm had benefitted from the rally in digital currencies in 2020 and 2021, but saw its share price collapse alongside it, from $330 in November 2021 to $120 a share in October 2022. Not much later artificial intelligence and its appetite for processing power revamped the firm’s momentum and it currently trades at $776 a share. Even if you can claim you saw this coming, you have no idea what’s next.

And speaking of volatility, Bitcoin is back to its historic peak. This week the digital currency broke the symbolic $60,000 ceiling and traded around $63,000. Does that mean crypto is back? Were all the naysayers wrong? Maybe. Web3 game maker Immutable managed to sync the release of its flagship collectible card game Gods Unchained on mobile with the renewed momentum. Seems like it still has some life left in it after all. Or, if the category was going to die off as a result of its supposed poor game design, demonstrable widespread fraud, and market manipulation, wouldn’t it have done so already?

Finally, Warren Buffet wrote in his annual letter to shareholders that even his wildly successful $905 billion conglomerate sees “no possibility of eye-popping performance” in coming years. Are you seriously going to go against the judgment of the “Oracle of Omaha”?

Deciding when to say no is perhaps one of the hardest things to learn. It is best then to start at a young age. I’ll bring her coat just in case she changes her mind.

On to this week’s update.

EVENTS CALENDAR

Here are my travel plans for the coming few weeks. Let’s hang out!

March 9—11, SXSW 2024, Austin. This year marks my fourth time presenting on the state of the video games industry at SXSW. That has been going exceedingly well, convincing the organizers to put me in front of my biggest audience yet in Ballroom A. It sets the tone for my year in terms of research objectives and allows for a much-needed dialogue with non-gaming executives looking to understand how to put interactive entertainment at the center of their business strategy.

March 18-20, GDC 2024, San Francisco. I’m hosting my annual party on Monday with my friends from Evercore. (N.B. Paid subscribers to the SuperJoost Playlist should have received their invitation.) I’m also scheduled to moderate a talk on “What’s New in Game History!” together with my illustrious NYU colleague, Laine Nooney.

April 21—29, SuperJoost Games Hangout, Leiden, the Netherlands. I’m combining a trip with the 11-year-old to see friends and family with hosting a games industry-focused event. It’ll be a mix of games journalists, brands, indies, and triple AAA studios.

BIG READ: Video game layoffs are a feature, not a bug

Following another big week in terms of headcount reductions, interactive entertainment is on track to shed a record number of jobs in 2024.

Before the news cycle had fully absorbed Sony’s announcement that it was letting go of 900 people, Electronic Arts released a similar statement regarding the termination of about 5 percent of its total headcount, approximately 670 jobs. Crikey.

What surprises me with every announcement is the widespread recoil among journalists and industry observers. There’s the understandable dismay about people losing their jobs, which I, too, believe is detrimental to the long-term health of the video games industry. Succinctly, projects populated by a diverse team of senior developers have the best chance of critical acclaim and commercial success. Layoffs at their current scale present a massive deterrent for younger talent, who may find themselves disenchanted by the prospect of hard work and little job security.

However, layoffs are the new crunch time. Where previously game developers would hire a temporary crew to pull a project across the finish line by having everyone work up to 70 and 80 hours a week, publishers instead let go of full-time employees during periods when the market is expected to be flat.

Certainly, after 2023’s breakneck release slate, the coming 12 to 18 months will be more modest. It presents an opportune moment to let go of 8 or 11 percent of your workforce, improve profitability, and brace for the next cycle without much pushback. For example, as part of its announcement, Electronic Arts indicated restructuring costs up to $165 million, consisting of $65 million for reducing its office space footprint, $55 million for employee severance, and $45 million for licensor commitment costs. Rather than taking on temp workers and running them ragged, game makers now absorb higher costs by letting go of regular employees and argue that the cost of development has gone up.

Layoffs have become a systemic practice in the games industry with precious few exceptions, and it’s time we accept it as an economic reality.

If you pay attention to the context, you can spot the pattern. Take Sony, for example.

As his own tenure comes to a close, Jim Ryan, President & CEO at Sony Interactive Entertainment, found himself tasked with announcing an 8 percent workforce reduction. This is despite Sony reporting $9.3 billion in revenues from its gaming division in its most recent earnings, an increase of 16 percent. It nevertheless lowered its full-year sales estimate for its PlayStation 5, from 25 million to 21 million units sold.

It tells you that the current console cycle has reached its final stage. All of the early adopters have seen their demand satisfied and console manufacturers turn their attention to more cost-conscious late-comers who prefer buying buying a discounted console bundled with a title they know will be worth their time. In addition, Sony is aiming to extend the current hardware cycle with the surprisingly popular PlayStation Portal, a handheld device that allows you to stream directly from your PlayStation console from anywhere.

Sony is also in the midst of a transition to become a media empire. In the absence of a new figurehead, who would necessarily have to craft a creative vision for the PlayStation, there are to be no major releases coming any time soon. Given the current preference for profitability, that means cutting jobs. In the absence of big releases, Sony will have to cut costs like everyone else.

First comes the revenue assessment, then the ‘managing of expectations’, and finally the job cuts.

Sony’s layoffs, while bitter, are hardly unique and very much in line with announcements from Epic Games, Microsoft, Riot Games, Twitch, and Unity. Each has let go of a similar portion of its workforce. Since the start of the year, there have been 7,800 announced layoffs so far in 2024, compared to 10,500 for all of 2023 and 8,500 in 2022. It would be naive to assume the bloodletting will cease any time soon.

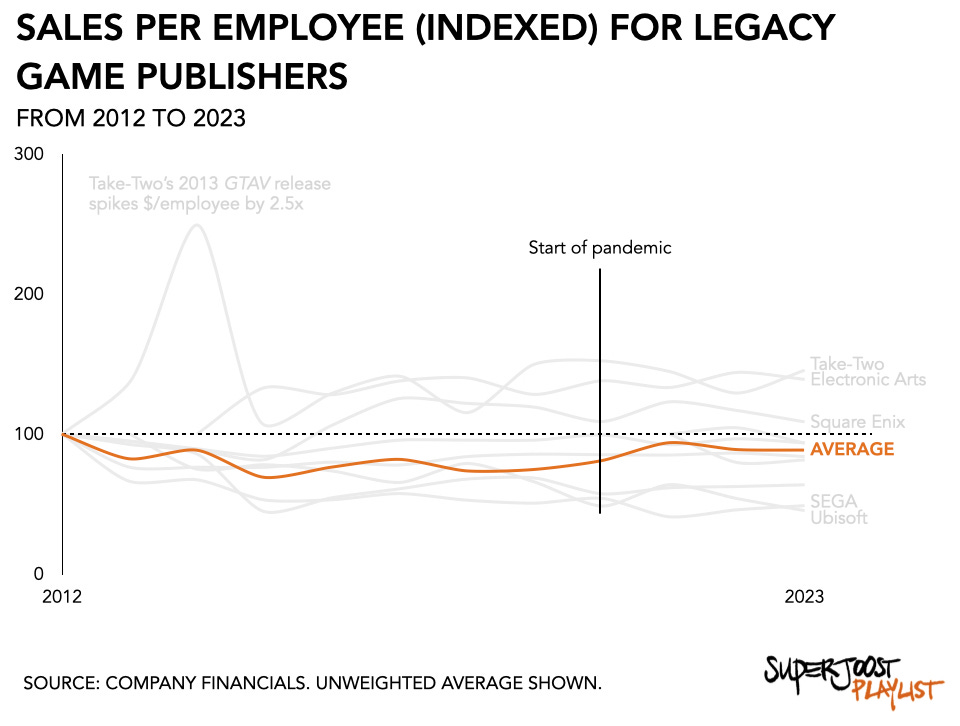

It’s tempting to point at a decline following the pandemic. The prevailing logic that we first saw an increase in consumer spending while we were all stuck at home, followed by a decline as we returned to offices and school, distracts from broader trends in gaming. The transition from a product-based business model has been incredibly challenging for, especially, legacy publishers.

Not every game maker has been equally successful at adapting to the new reality of digitally distributed content, micro-transaction sales, and live-services operations, or had the intellectual property that managed to differentiate itself from the onslaught of digital newcomers. Both Electronic Arts and Take-Two have so far transitioned quite brilliantly, despite their initial inertia. In their most recent earnings, the firms reported 91% and 95% of sales coming from digital channels, respectively.

The pandemic offered temporary relief from declining efficiencies that originated from the industry’s digitalization. A period of zero interest rate policies and supercharged consumer demand kept even the less efficient publishers humming along. Once that momentum ebbed away, you could see who was washed up and who wasn’t. And even then EA and Take-Two’s performance pales in comparison to an all-digital newcomer like Roblox, which earned $1.2 million per employee in 2023.

Over the past year investor sentiment has sobered, consumer demand has shifted from early adopters to risk-averse late-comers, and development costs are up. Keeping the average dollar value per employee steady will be a key metric to watch in the years to come.

Winners and losers

Publishers currently involved in developing the next iteration of a massively popular franchise are well-positioned. Take-Two Interactive is working towards the anticipated 2025 release of Grand Theft Auto 6, which will bolster its overall position as one of the last remaining independent game publishers. Electronic Arts is doing well, too. The initial success of EA Sports FC after breaking up with FIFA has been promising. EA is also fluent in effective franchising: management was eager to report a recent cross-over event between faltering Apex Legends and Final Fantasy VII Rebirth that delivered “two of [its] highest net bookings days over the fiscal year.”

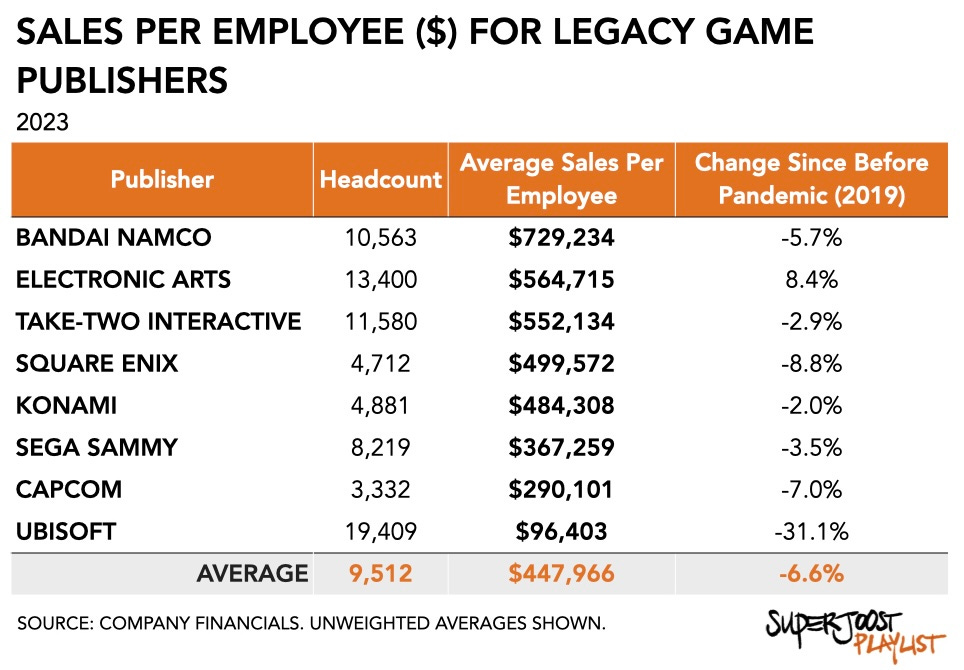

Average sales per employee for both publishers are on the higher end of the spectrum. On average, an employee at Electronic Arts generated $564,715 in annual sales in 2023, with an increase of 8 percent since before the pandemic. For Take-Two that number is slightly lower at $552,134, but here we find a 3 percent decline since 2019. Both firms sit above the average of $447,966 in their selected peer group.

The writing is on the wall for others. Ubisoft’s large workforce of 19,409 employees seems unsustainable in a market economy and investment environment where profitability rules all. Average sales are both by far the lowest at $96,403 per employee and show a massive decline of 31 percent since 2019.

There are really only two ways to improve this circumstance: either you increase revenue or reduce headcount.

It supports one interpretation that firms have been eagerly looking for more aggressive growth strategies. Ubisoft, after it became clear that Tencent wasn’t going to acquire it and instead just expanded its shareholder position, has been exploring novel revenue streams, including Web3.

Similarly, SEGA has gradually seen its sales per employee widdle to half, from $752,310 in 2012 to $367,259 in 2023. Since it acquired Rovio, it has only announced smaller layoffs, I expect it to be highly likely for the firm to reduce its headcount by 600 to 700 employees to keep pace with the rest of the industry.

The video games industry has always been and remains a hit-driven industry. Most publishers rely on only one or maybe a handful of wildly successful titles, and the rest of their portfolio creates little value. In her note regarding EA’s layoffs, Laura Miele, the publisher’s President of EA Entertainment and Technology, reiterated the sunsetting of several of its titles. They include Kim Kardashian Hollywood (a personal favorite), Tap Sports Baseball (obtained in the purchase of Glu Mobile), F1 Mobile (developed by Codemasters, another recent acquisition), and The Lord of the Rings: Heroes of Middle-earth. Electronic Arts is focusing on franchises that are highly successful and is clearly moving away from projects it deems inefficient.

As painful as layoffs may be, the current wave of workforce reductions serves as further proof that they have become a standard feature of the gaming industry rather than an anomalous bug. Companies have come to rely on the efficiencies gained by regularly tightening budgets and headcounts between peak demand cycles and major releases. While some point to economic troubles, the healthiest publishers like EA and Take-Two continue posting strong numbers even amidst job cuts.

Nearly every major gaming firm has now normalized periodic layoffs to maximize profitability between hits. The industry has fundamentally shifted—and companies as well as workers must adapt to this economic reality.

PLAY/PASS

Pass. A Norwegian study into the way children are pressured into buying in-game items to maintain their social standing is timely and relevant. I also don’t remember that being different from my own analog, offline childhood. Put differently, technology isn’t going to unilaterally solve social problems.

Play. I didn’t attend DICE this year but, apparently, managed to make an appearance in the best possible way.

Really interesting article on the situation of the gaming sector and the layoffs

That said, the comparison is not apples-to-apples. The Japanese companies in the list are, to a bigger or lesser extent, conglomerates where video games are only a part of their business, and their numbers would probably be a bit better without their arcade/toys/publishing businesses (except maybe Bandai Namco, they have better margins in the toys/hobby business, and it is actually a bigger part of their company).

In Sega's case, most of that reduction comes from the Pachinko business (that's why you see a reduction during the pandemic, that segment lost half their revenue)