Harry Potter’s warted legacy

Expected to be one of the biggest releases this year, controversy surrounds the new boy wizard video game. Can we separate art from the artist?

This week I re-visited the NYU Game Center, finally.

CNN had reached out for an interview about the Harry Potter release (see below). My ego and I eagerly agreed, of course, and suggested we film it at the game center to have a cool backdrop.

It’s only a few blocks from my office in downtown Brooklyn, and I’ve been meaning to go for a while. There’s nothing quite like it because I watched it grow up. And it is where I grew up. Right around the time when I started teaching, the tiny seed of the department started to sprout at NYU’s Tisch School of the Arts. They had all the cool toys, trolleys with consoles, and massive screens. My students loved throwing down at the end of class with a few rounds of Guitar Hero.

A few years later it outgrew its Manhattan digs and moved to Brooklyn. Lots of light, space, and arcades everywhere. There’s something unique about working with and around creatives. Not just the chaos. But there’s this permanent excitement and energy. Seeing a novelty like Killer Queen debut during the school’s annual showcase and watching it grow into a massive success was inspiring.

Soon enough my classroom started to swell and I found myself relocating away from the Game Center to the larger classrooms at the Stern Business School. The draw isn’t that I get to teach more students, but now there’s a healthy distribution between students focusing on finance, game design, marketing, economics, and investing while sharing a love for video games. There’s nothing quite like it to me.

As the camera guy was setting up, I killed a few minutes by wandering through the old consoles and board games that had started it. During the interview, the reporter asked if people develop deep emotional connections to video games.

Yes, ma’am, like you wouldn’t believe.

On to this week’s update.

BIG READ: Harry Potter’s warted legacy

This week’s release of Harry Potter: Hogwarts Legacy by Warner Bros. is expected to become one of the biggest titles of the year. Based on the popular franchise, the game features an open world set in the 1800s as a prequel roughly two centuries before the arrival of the orphaned boy wizard. Early commercial indicators have been particularly strong, including its ranking as the top pre-order on Steam for the past several weeks, a top-seller on Epic Game Store, the best-selling title for PS5 and Xbox Series X on Amazon, and almost 1.3 million concurrent viewers of the early Collector's Edition on Twitch. Awarded the title of “Most Anticipated Title” at the Game Awards, Hogwarts Legacy is expected to sell over 10 million copies.

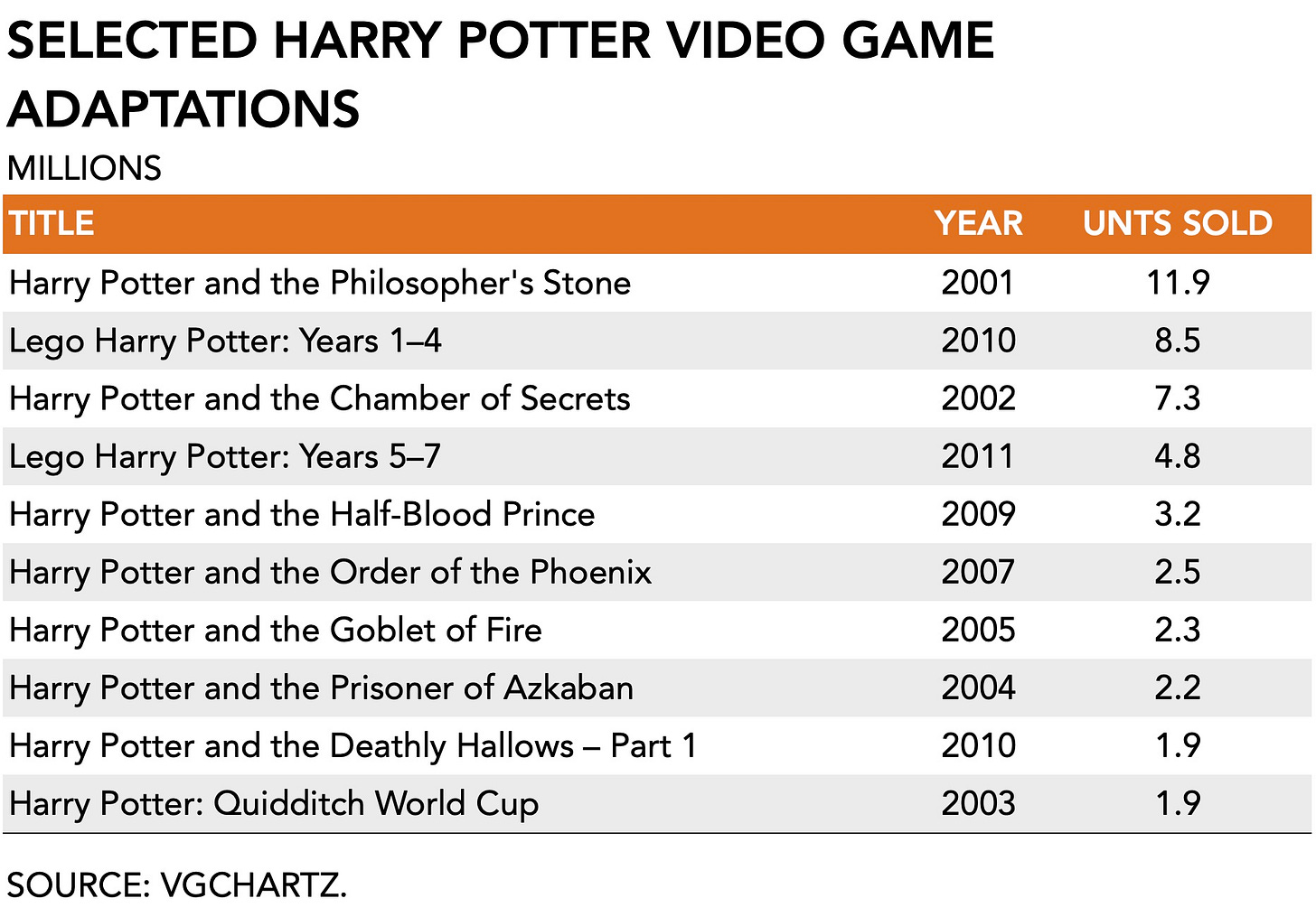

Since 2001 there have been many different video game adaptations based on the books which have sold a cumulative total of over 50 million copies across platforms. Standout releases include Harry Potter and the Philosopher’s Stone (2001) with 12 million units, Lego Harry Potter: Years 1-4 (2010) with 8.5 million copies, and Chamber of Secrets (2002) with 8 million. Leveraging the franchise is not a fail-safe, however, as Niantic Labs discovered in 2019 when its Wizards Unite adaptation did not live up to expectations.

The current release however looks to be a boon for Warner Bros. against a background of large publishers having a more difficult time with reduced consumer spending and a more costly marketing environment. Recent earnings from EA, Microsoft, and Sony have evidenced a broader weakness in video game spending. Despite its multiple delays and drawn-out marketing campaign, the release of Hogwarts Legacy is a textbook example of risk mitigation against classic publisher anxieties such as capital-intensive development and demand uncertainty.

Several risk factors remain.

First, the absence of a multi-player component seems strategically odd. The game offers an open-world, single-player campaign that can take up to 80 hours to complete with side quests and collectibles. But the lack of a strong social aspect goes against contemporary consumer behavior, as especially younger audiences (18 to 34 years old) show a strong preference (48 percent) for multiplayer gameplay over single-player experiences. By comparison, although Grand Theft Auto 5 was wildly successful as a stand-alone premium title, its commercial and cultural acclaim vastly expanded once Rockstar turned on the online multiplayer component. Adding a similar feature to Harry Potter: Hogwarts Legacy would seem obvious.

The cultural drag that accompanies the release is a second risk factor. J.K. Rowling, the author of the initial Harry Potter series, has made several comments that were harmful to trans people. There are several examples, which I don’t wish to repeat here. Among them, the writer tweeted in support of anti-gay, anti-trans, anti-abortion Catholic activist Caroline Farrow.

It has tainted the franchise.

Speaking to my students last week, it was clear that for many of them, Harry Potter was an important book series growing. Reading the books at a young age, they now feel conflicted about wanting to play the new game in light of J.K. Rowling’s politics. The inevitable conflation of an artist and their art can be deeply problematic when the two can speak to us so differently.

It is also not new. Many cultural icons are deeply controversial. German composer Richard Wagner, who revolutionized opera and is widely considered a critical figure in music history, developed a critical view on what he regarded as the “influence of Jews in German culture”, earning him a close and permanent association with German nationalism, Nazism, and Hitler. Spanish artist Pablo Picasso was a pivotal innovator in contemporary visual arts and also a known misogynist who engaged in a secret relationship with a 17-year-old, Marie-Thérèse Walter. And late last year, Disney heiress Abigail Disney went on record to say her great-uncle Walt Disney had been a “fascist” and had stoked anti-Semitism and racism. Did I mention Ye? I should.

Warner Bros. was quick to announce that J.K. Rowling was not involved in the game’s development. But what’s perhaps different here is the fact that, unlike my other examples, J.K. Rowling is a woman. Specifically, she is an incredibly rich white woman. As a fantasy writer who managed to dream up a universe filled with mythical creatures and magic where an orphaned boy finds his destiny, she could have chosen to champion those that have a difficult time finding acceptance in the real world. But didn’t.

You can guess where it goes from here. In the broader context of algorithmically governed news and information, media outlets are having a field day, arguing that “computer gamers and fan fiction people are not always the most grounded in reality.” Lovely. Never mind that, as I reported last week, the games industry is slowly but demonstrably becoming more diverse, as a recent study found that 5 percent of game developers identify as non-binary, even when other categories barely take note.

In spite of these concerns, however, early sales suggest that the boycott has mostly accomplished broader awareness of the title, allowing it to go viral on social media and leading to more sales. According to SteamDB, there was a peak of 489,139 people playing the game concurrently. Some legacy, indeed.

NEWS

UK regulator eyes divestiture as condition for ATVI/MSFT merger

On Wednesday the UK Competition and Markets Authority (CMA) released a 16-page document containing its provisional findings. It identifies the two major sticking points against the proposed ATVI/MSFT merger, and what it would accept as a possible remedy. The first pertains to what it calls a “substantial lessening of competition” in the UK console market because the merger would enable Microsoft to withhold specific content (read: Call of Duty) from other platform holders (read: Sony). The second relates to a more forward-looking category, cloud gaming services, which the CMA believes will be negatively impacted by the merger.

If you have not yet read my December submission to both the CMA and the FTC, you can find it here. (TL;DR, Regulators are taking a too narrow approach in evaluating the potential theories of harm related to the merger.)

Certainly, without a clear commitment to maintain parity of the Call of Duty franchise across all platforms, the proposed merger would indeed result in especially Sony losing relevant market share and eroding overall market competition. But after several months of posturing, the CMA seems to have toned down its stance substantially. Notably, rather than outright blocking the deal, it also issued a notice of possible remedies, describing that it would accept the merger if Microsoft agreed to divest the Activision segment. That would severely diminish the value of the overall deal, of course, considering Activision generated an estimated $3.5 billion in 2021FY at a 48 percent operating margin, compared to Blizzard’s $1.8 billion (38%) and King Digital’s $2.6 billion (44%). More importantly, however, is the observation that after months of much stronger language, the CMA now sounds a lot more willing to negotiate.

Rather confusingly, the CMA observes that offering Activision Blizzard’s content via GamePass would reduce the cost of access to consumers, and acknowledges that this was an important motivator behind receiving 2,100 submissions from the public. However, it then argues that the potential absence of parity on other platforms, despite Microsoft having already promised to maintain the status quo, counts heavier. Worse, whereas GamePass does offer new releases the same day they come out on consoles, rival Sony’s PlayStation Plus subscription does not. The Japanese firm has been quite clear on refusing to release its first-party titles in an equivalent manner, boasts roughly twice as many subscribers, and, according to its most recent earnings, subscriber count declined to 46.4 million, down from 48 million a year ago.

Meanwhile, leadership at both firms took to the airwaves. Activision Blizzard’s Bobby Kotick spoke to the Financial Times to say the UK would lose out if it did not approve of the deal and later compared the country to “Death Valley” on CNBC. Microsoft offered a more measured approach, with CEO Satya Nadella stating that

“we should probably look at Microsoft’s share of the console market in Japan and wonder why that is. Maybe they should actually start competing more. I hope that regulators take an approach that is truly beneficial to gamers and publishers.”

MONEY, MONEY, NUMBERS

Activision Blizzard generated $3.57 billion (+43% y/y) thanks to the success of the latest Call of Duty: Modern Warfare II release. Booking for Activision Publishing reached $1.85 billion, up 60% y/y and well above analyst expectations. Blizzard generated $794 million (+90% y/y) thanks to the strength of Warcraft, Overwatch, and Diablo which generated over $100 million each. Notably, Overwatch 2 set a franchise record for in-game bookings and grew its monthly active user base to 45 million, the highest it has been since 2017. And King Digital proved everyone else in mobile gaming wrong by increasing +6% to $727 million and Candy Crush Saga earning +20% y/y in 22Q4. Analysts are adjusting their expectations of the period ahead, however, mainly because of the firm’s problems in renegotiating its distribution agreement in China, which consumers generally perceive as a money-grab. However, the company retains almost $12 billion of cash on its balance sheet and is expected to benefit from increasing interest rates. Among investors, there seems to be an increase in the use of options for protection in case the acquisition by Microsoft falls through. Finally, Activision Blizzard agreed to pay $35 million to settle its lawsuit with the SEC over its handling of workplace misconduct.

Take-Two Interactive suffered a rare miss with $1.38 billion in bookings against a guidance of $1.41 - $1.46 billion. It’s always somewhat perplexing to hear a company report +60 percent of revenue growth and have it labeled a ‘bad’ quarter. Despite releasing several new titles including add-on content, management pointed to a change in consumer spending during the holiday season on blockbuster franchises and discounted games. It further divulged that Zynga was driving growth and had stayed on track with expectations and that its ad revenue had grown to $177 million in 22Q4. Recurrent consumer spending grew by +117 percent to $1.04 billion, affording the firm less volatility in its revenue cycle.

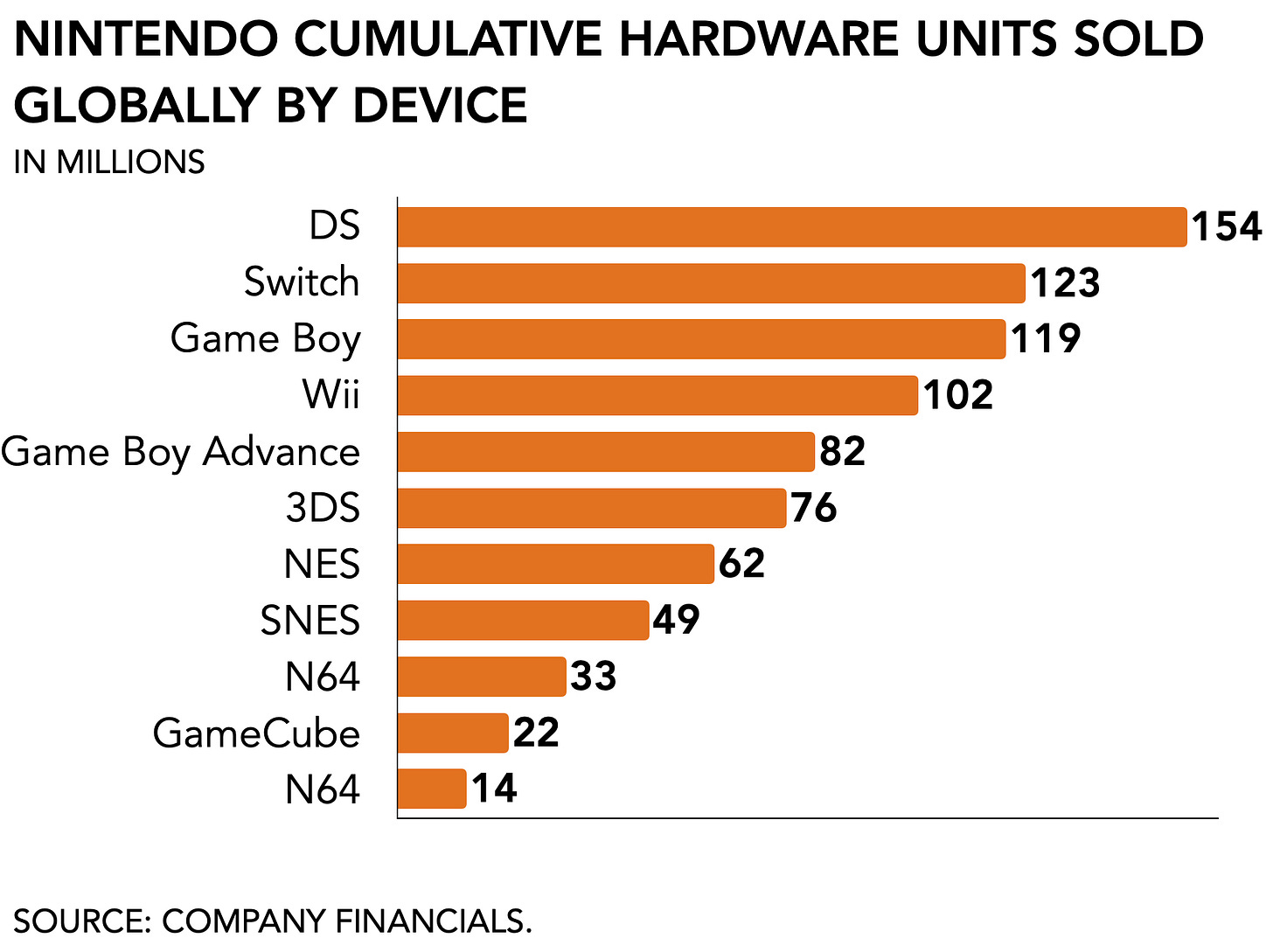

Nintendo reported $10 billion in sales, a decline y/y of -1.9 percent for the 9-month period ending in December 2022. It saw a drop in profits to $2.6 billion, down -5.8 percent y/y for the period April through December. A computer chip shortage resulted in fewer sales of its Switch device, forcing the firm to lower its FY profit forecast from a November projection of $3 billion to $2.8 billion. Nintendo now expects to sell 18 million units of its Switch console in the current fiscal year, after first aiming for 21 million and a recent cut to 19 million. Cumulative sales of the device have reached 122.6 million globally, outselling other favorites like the PlayStation 4 (117 million). Analysts blamed competition from recent blockbuster releases—Call of Duty: Modern Warfare II, and God of War—for softer sales of Nintendo’s evergreen titles. General consensus looks to May this year for a catalyst in sales when the long-awaited The Legend of Zelda: Tears of the Kingdom drops, in addition to the introduction of price cuts for the different Switch models (base, lite, OLED) as risk-averse late-adopters finally commit to the device.

PLAY/PASS

Pass. Nintendo accidentally listed the upcoming Zelda: Tears of the Kingdom at a $70 price point on its eShop. LFGO already.

Pass. Yuga Labs’ attempt at making a game, Dookey Dash, has come to a halt three weeks in due to rampant cheating. Oh lawd.