Is TikTok's game over?

Staring down a nationwide ban, the popular platform may have overplayed its hand

The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

The past two weeks I’ve flown precisely 13,269 miles between New York, Austin, and San Francisco, for a total of 28 flight hours to do a talk at SXSW, host a 200-person mixer at GDC, and another 30 or so scheduled meetings. This year’s objective was two-fold: (1) to reconnect with everyone I hadn’t seen since the before times, and (2) to field-test an idea we’ve been working on (more on this soon).

Austin, true to form, kept weird. The mix of different creative industries and techies has become fully corporatized but manages to maintain its serendipity. The programming related to gaming had noticeably expanded and there were more talks and panels on interactive entertainment. It is encouraging to see a broader array of the entertainment family express curiosity for its interactive cousin.

San Francisco, on the other hand, is a shadow of its former self. Between the falling sheets of glass and toppled trees due to a bomb cyclone crippling the city, downtown SF has regressed even further than Manhattan. Empty storefronts, trash, and an army of the unhoused have made the area surrounding the Moscone center grittier. With an expected 24,000 attendees, GDC is close to its former glory in many ways except for two important ones. First, the endless line for badge pickup seemed an odd new feature. Most developers have traveled thousands of miles, spent a small fortune, and suffered plenty of airport security only to have to queue around the block. Making them feel more welcome would go a long way.

Second, beyond the organizers' control are the microcosmic geopolitics playing out in the nearby hotel lobbies. Velvet ropes and reserved tables have turned in-person appointments into hallway meetings. The jam-packed experience makes everything less productive. My prediction is that soon we’ll see a GDC appear in a city perhaps better able to accommodate and closer to another one of the industry’s seats of platform power, like Seattle.

Nevertheless, you can’t help but learn new things. Major topics were generative AI, digital collectibles, and esports-washing.

There’s an odd symbiotic relationship between generative artificial intelligence and the endless amount of organic conversation we’re all having about it. The first rule of the gen AI club is that you talk about it incessantly and then feed it into a large language model so it can, too. Fortunately, I had several sobering conversations that reminded me that (1) even this fancy novelty is subject to the ‘garbage in, garbage out’ theorem (here’s a worthwhile research paper), and (2) AI has been part of game development for almost two decades as studios sought to find clever ways to create abundant content available for infinite exploration.

Next, after the collapse of digital currencies, the presence of the dreaded ‘crypto bros’ had subsided, much to the relief of everyone, apparently. It was not, however, gone, and that is precisely why I believe the category is in a transitional phase (see below). Succinctly, it is possible, of course, that some of the projects surfacing today are merely a delayed remnant of the conversations that occurred during peak crypto last year that are only just now materializing. Maybe. You’d think, however, that large firms like CCP, Nexon, and Sony would be capable of killing a project if they felt it would lead to nothing. But they didn’t.

Finally, the abundance of Saudi money for competitive gaming, especially with the announcement of Vindex’s acquisition by ESL/FaceIT right before GDC seems to suggest to some that something more nefarious is going on. Admittedly, it is difficult to rhyme the joy of gaming with the realization that Saudi’s head of state orders the assassination of reporters. But it’s okay, he’s a “massive gamer.” Ick. However, it’s hard to maintain the moral high ground here since that would also mean one shouldn’t play or participate in any Russian or Chinese games, right? Should we give up Overwatch now that we know about Activision Blizzard’s workplace issues? Hogwarts Legacy, anyone? Gaming is taking its place among other cultural industries where powers that be seek to exert influence through funding. It is the bread and games of our time.

I had a blast seeing everyone and for me, it was the best GDC in years. I’ve missed you.

On to this week’s update.

🎙 Games Industry Event @ MIT

On April 7th I’m doing a fireside conversation with Xbox CFO Tim Stuart at the MIT Sloan Gaming Industry Conference 2023. The conference line-up has everything from generative AI to venture capital and draws from industry veterans and pioneering academics. You should come!

NEWS

CMA sides with Microsoft on Call of Duty

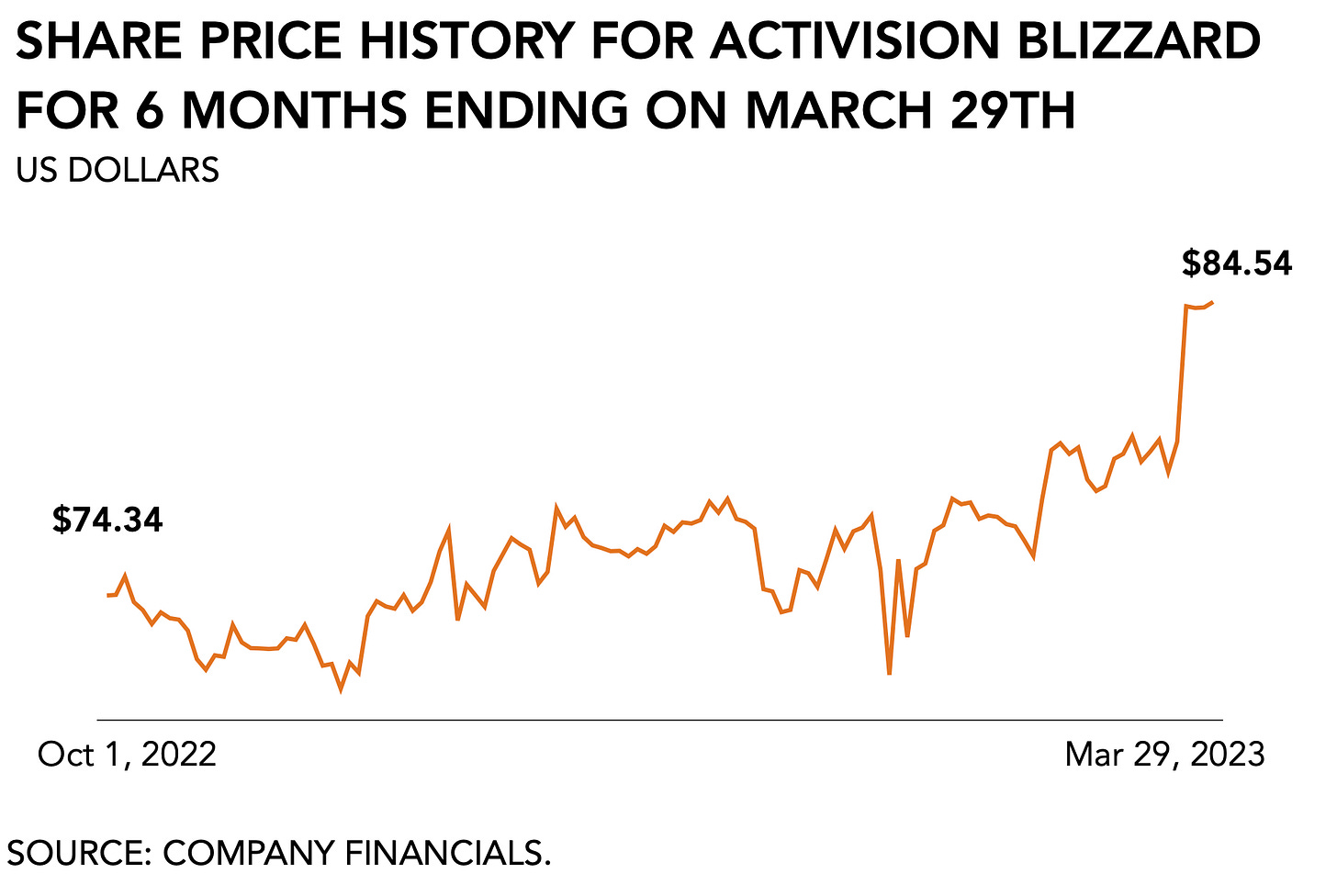

From the department of I-told-you-so. The UK antitrust regulator has narrowed the scope of its concerns around the proposed acquisition of Activision Blizzard. After initially raising concerns about Microsoft’s ability to disadvantage Sony once it gains ownership over the Call of Duty franchise, new evidence has convinced the CMA that, in fact, “the merger will not result in a substantial lessening of competition in console gaming services.” It now reasons that withholding the franchise from PlayStation “would outweigh any gains from taking such action.”

That’s a big win for Microsoft, obviously, and it improves the chances of the deal ultimately happening. (FWIW, I’ve argued from the start that this deal is happening, because the various concerns expressed against it suffer from a narrow perspective on contemporary interactive entertainment.) It leaves only the regulator’s reservations around cloud gaming unaffected by the newly presented data.

Finally, the keyword here is “provisional” since the regulator may yet change its opinion again, and hasn’t fully committed yet as the CMA’s final report is due on April 26. Even so, Activision Blizzard’s share price jumped from $80 to $85. That was more than it did in the wake of the latest release for Call of Duty and being the only game publisher reporting solid figures during its most recent earnings. Microsoft is a step closer than it was last month.

Tim Cook’s mixed reality plans mature

Apple is expected to first announce a new device featuring both augmented and virtual reality functionality as early as June this year. (BTW, my co-host Laine Nooney predicted this during our Unboxing podcast’s season finale.) In search of a new revenue source, the consumer electronics giant is hoping to capture market share in an emerging category it first entered in 2015. The launch sits at the center of a broader change in Apple’s corporate structure.

The departure of famed designer Jean Ives was part of a broader restructuring of the overall organization. Where previously Cook wouldn’t dream of going against Apple’s design team, he has now overruled its objections against releasing a novel device that hasn’t quite satisfied their vision. Relying for 52 percent of its hardware revenue on the iPhone, the firm is keen to expand into a new device category. The company has grown its income from $260 billion in 2019 to $394 billion in 2022 and generated $78 billion in services revenue last year. Launching new hardware would allow it to expand its services income as growth in the mobile games market has been starting to slow.

Does that mean virtual reality is finally going to happen? Unlikely. While I did see some clever applications during my travels over the past two weeks, none of it feels distinctly necessary. Zuckerberg already set the time horizon for more widespread adoption to 2025 and beyond, even after having sold an alleged 20 million units. But Apple’s entry will undoubtedly reinvigorate the category.

Blockchain-based gaming is back on the up and up

Yeah, I bet you didn’t want to hear any of that. You were hoping that all those crypto-bros had lost their appetite and digital wealth by now. But a string of announcements suggests otherwise.

Iceland’s maker of EVE Online, CCP Games, raised $40 million from VCs to finance the “full-scale development of a new AAA title utilizing blockchain technology, set within the EVE Universe.” (Disclosure: I’m an advisor to Makers Fund, one of the funds involved.) After quizzing CEO Hilmar Pétursson last weekend, I walked away convinced that if blockchain-based gaming is going to happen, this is the team that will make it so. Several decades of experience managing a full-fledged in-game economy makes CCP a convincing candidate, and Pétursson has done his homework on the nascent technology.

Sony filed a patent application for “transferring and using digital assets between game platforms.”It indicates that the dominant console manufacturer is getting serious about blockchain technology. Sony argues that “current systems are technologically inadequate for the owner to use the asset across different games and/or platforms.” Before you get too excited, filing a patent is a long way away from establishing a dedicated business unit and creative subdivision focused on digital artwork and items. Sony, in fact, files patents all the time, which is entirely normal for a consumer electronics firm. But, as it shifts its focus to expand its services and operate more like a media empire, the Japanese giant’s patent does provide some much-needed validation for the budding technology.

And finally, there’s the announcement of Nexon collaborating with Polygon to bring its much-loved MapleStory franchise to the blockchain. With over 180 million registered players and massive popularity in South Korea, this is a big win for Polygon. It also puts Korean gamers, once again, at the frontier of what’s next in gaming. It is here that free-to-play initially took hold, long before it became popular in western markets. It raises the recurring question of whether what’s happening in South Korea is a statistical anomaly or the shape of things to come. I’m personally confident it is the latter. Polygon is quickly becoming a de facto layer 2 solution for gaming. Since raising $450 million in February 2022, it has been on a rampage to bring as many titles to the blockchain as possible. The big question for Nexon, Polygon, Sony, and CCP is whether consumers will show up before the money runs out.

BIG READ: Is TikTok’s game over?

The most popular social media platform for audiences under 25 years old is facing a nationwide ban. This week', we witnessed the testimony from TikTok CEO, Shou Zi Chew, in US Congress, which was the culmination of several years of a government crackdown that first started in 2019 and materialized a year later when the US required federal agencies to remove the social media video application from all of its devices.

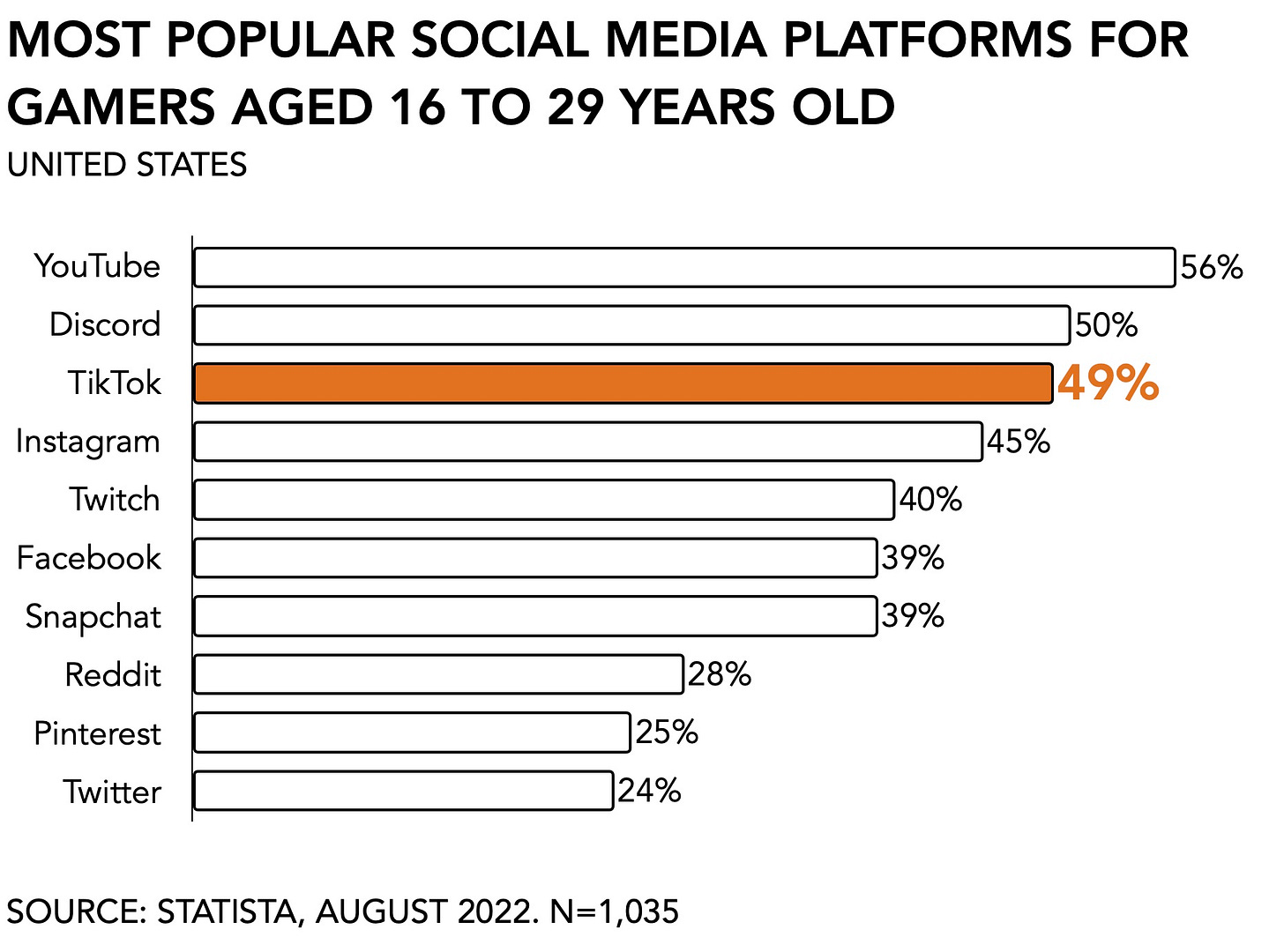

ByteDance has managed to insert itself into gaming in a variety of ways. First, TikTok’s entry to play a role in discovery came at an opportune moment as Apple disassembled the existing privileges under its IDFA policy, reducing advertisers’ ability to target users effectively. This pushed TikTok to the foreground for marketers hoping to reach younger audiences. According to a survey by Statista in August 2022, TikTok is the third-most-popular social media platform for US gamers aged 16 to 29 years old. However, unlike YouTube and Discord, which both have deep relationships with the games industry, TikTok lacks a strong connection to the supply side.

Second, ByteDance is also the parent company of two notable game studios. The first, Nuverse, developed published Marvel SNAP (developed by Second Dinner, a bunch of former Hearthstone devs. h/t Sean Lama), and acquired the second, Moonton, maker of Mobile Legends: Bang Bang for $4 billion in March 2021. According to AppMagic, the game has generated close to $1.1 billion since its release in August 2016. Like Tencent, ByteDance drew the ire of Chinese regulators as it clamped down on allotted game time for minors, forcing the company to cut “hundreds of jobs” in September last year. Mobile Legends: Bang Bang enjoys an engaged player base in South East Asia, as evidenced by the growing popularity of its competitive gaming circuit that took place this year in Singapore. Viewership peaked at 4.2 million concurrents during its elimination rounds.

And third, TikTok has come to play a significant role in the gradually emerging push behind cross-media initiatives. When Call of Duty: Modern Warfare II dropped in November last year, short clips showcasing its main protagonist Ghost accompanied by the song Limbo by Canadian rapper Freddie Dredd went viral, leading to a spike in the musician’s stream count on Spotify and Apple Music. As more music labels seek to cross-pollinate with interactive entertainment, TikTok plays an increasingly integral role.

The platform’s uncanny ability to create personalized recommendations based on an individual user’s behavior is part of the reason why it is so popular. Its push into gaming in pursuit of ad dollars promises an upside in the future. Currently, among the most popular gaming brands on the platform are influencer conglomerates like Gamelancer Media, which owns and operates 44 different channels and reaches a self-reported 38 million followers with basic-sounding TikTok accounts like @gaming, @gamer, and @egirl. Gamelancer’s revenue grew 153 percent according to its most recent earnings but remains in the single-digit million dollar range, suggesting plenty of room to grow. Micro-influencers, aspiring TikTok personalities, generate around $0.02 to $0.04 per 1,000 views on the platform.

Rookie Numbers

If TikTok were to be banned in the United States, it is unclear whether the games industry would suffer. There is no clear revenue model here yet that will change the financial prospects of any major publisher. In its attempt to grow large quickly, TikTok has skipped past the part where it makes itself indispensable for content-creating giants like game publishers.

Despite spending about half their budgets on marketing across different channels, many of the major firms are noticeably absent. Activision Blizzard’s official TikTok account has a little over 9,000 followers. Electronic Arts has barely 8,000. Interestingly, Xbox has 5.6 million, more than twice as many as PlayStation’s 2.6 million. A read on individual titles is no better. One of the all-time biggest games ever, League of Legends, 380,000. Call of Duty, 1.8 million. The title with the most followers I could find was Fortnite, with 9.7 million. Maybe I’m missing something. Or maybe TikTok forgot to make itself relevant to game makers.

That means the impact of the platform on consumer spending on gaming remains murky, despite the fact that gaming is the fourth-most popular topic and the second-most popular hobby among its users in the US. After initially hoping to play a part in the hardcore games market, ByteDance adjusted its expectations and instead started to focus on casual-style gameplay. It would, however, be a disappointment for younger audiences who have flocked to the platform.

This has raised a particularly vexing point for parents who have traditionally been at least partially in the loop when it comes to media consumed by their children. Heavily regulated in its domestic market in China, the absence of similarly strict rules in other markets has allowed it to enjoy spectacular growth. Curtailing, or even outright banning the platform, is gathering bipartisan support. I have no doubt, however, that with or without government intervention here or on the other side of the world soon another social app will formulate a newer, better, smarter, and even more exciting way to get our attention.

PLAY/PASS

Pass. Disney shuts down its Metaverse division. Somewhere, in the real world, a Matthew howls at the sky. 😉

Play. Valve announced the release date for CS2, promptly triggering a spike in viewership across Twitch and YouTube of 930,000 viewers for CS:GO and an all-time peak of 1.6 million concurrent players.

Great article. Marvel SNAP was developed by Second Dinner, a bunch of former Hearthstone devs. Nuverse is the publisher.