Playing, fast and slow

Patient publishers surprise as the biggest innovators

The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

It’s been a week of mounting expectations.

Nintendo is making a live-action Zelda movie, a decade into the lifecycle of its predecessor Grand Theft Auto 6 will have its first official trailer in December, and Roblox hit a new threshold of daily active users (see below).

If all you did was play games, such a deluge in content would have you believe it was the best year in gaming yet. Having finally started Marvel's Spider-Man 2, which is awesome so far, I struggle to find time in my schedule to also play Blizzard’s Warcraft Rumble or even begin to think about Alan Wake 2.

All this takes place against a background of abundant layoffs among game studios and journalists.

After having to roll for initiative, various publishers are doing their best to show profitability. To accomplish that in the short term, they are cutting costs and letting go of people. That is short-sighted, of course. Beyond the internal value destruction, it also weakens long-term prospects. Epic Games recently cut well over 800 people to accommodate its transition to a novel business model centered on its distribution platform and the creator economy. Meanwhile, we learned just this week from its lawsuit against Google that the Epic Game Store still isn’t profitable. Bungie, in its own way, bumbled through layoffs. It doesn’t bode well for its primary franchise, Destiny, which has been forced to push back its various expansions. The developer says it’s to ensure the quality of its upcoming rollouts.

Despite some stellar earnings figures over the past few days, it is not immediately obvious to me how you make better games, or write better reviews, by cutting staff. The games industry is recovering, yes. But let’s be wary of what’s up ahead.

On to this week’s update.

BIG READ: Playing, fast and slow

The slowest-moving companies can surprise you as the biggest innovators.

Roblox, for one, has been around for a long time. First released in 2007, the whole ‘online playground for kids’ thing didn’t really take off until almost a decade later. Since then it has emerged as one of the most popular online destinations for young audiences. In its earnings this week, the company disclosed it now has 70.2 million average daily active users, up +20 percent from a year ago.

Similarly, Take-Two Interactive finally announced more details on the release of its hotly-anticipated Grand Theft Auto 6. The thirst is real: the tweeted announcement, not of the game, but of an upcoming trailer this December, so far has been reshared 350,000 times, liked almost a million times, and reached 60 million impressions. Within three hours.

(The upcoming release of GTA6 was first rumored based on earnings in May this year, btw.)

Understandably, Take-Two’s CEO, Strauss Zelnick takes a conservative stance. The risk profile of such a highly anticipated release is considerable. Zelnick knows this and is correct in managing players and investor expectations. His tendency to underpromise and overdeliver has served him well historically. Moving fast isn’t to the franchise’s benefit.

But perhaps the slowest-moving game company of them all is Nintendo. Often regarded with disbelief by investors who feel the firm can operate at a glacial pace when it comes to releasing more hit titles and updating its hardware offering, the Japanese juggernaut is seemingly only warming up.

After a strong first quarter, Nintendo delivered on its ability to cover the softer periods by building on its existing intellectual property. It reported a total of $2.4 billion in sales for its 24Q2, slightly down from the same period last year ($2.5 billion), but well above Wall Street’s expectations ($2.3 billion). Hardware revenue has come down 4% year-over-year to around $38 million and software down 10% to around $153 million. The new Pikmin 4 game sold 2.61 million units, much less than Splatoon 3's 7.9 million units last year. Its momentum from its Super Mario Bros. Movie, which has accumulated $1.4 billion in box office sales worldwide, and the recent release of Super Mario Bros. Wonder for the Switch sold 4.3 million units within the first two weeks.

What drove excitement, obviously, was its announcement of an upcoming live-action film based on "The Legend of Zelda” franchise. The film is a collaboration with Sony, which will oversee production and logistics. The producer, Avi Arad, is known for some of the most popular adaptations including Spiderman. (Bonus: I recently learned that despite his status as a star producer, Avi Arad exclusively dresses himself in swag from movies he’s worked on. I appreciate that type of dedication.) The franchise’s most recent release, Tears of the Kingdom, has sold almost 20 million units. Nintendo’s share price was up +6 percent following earnings.

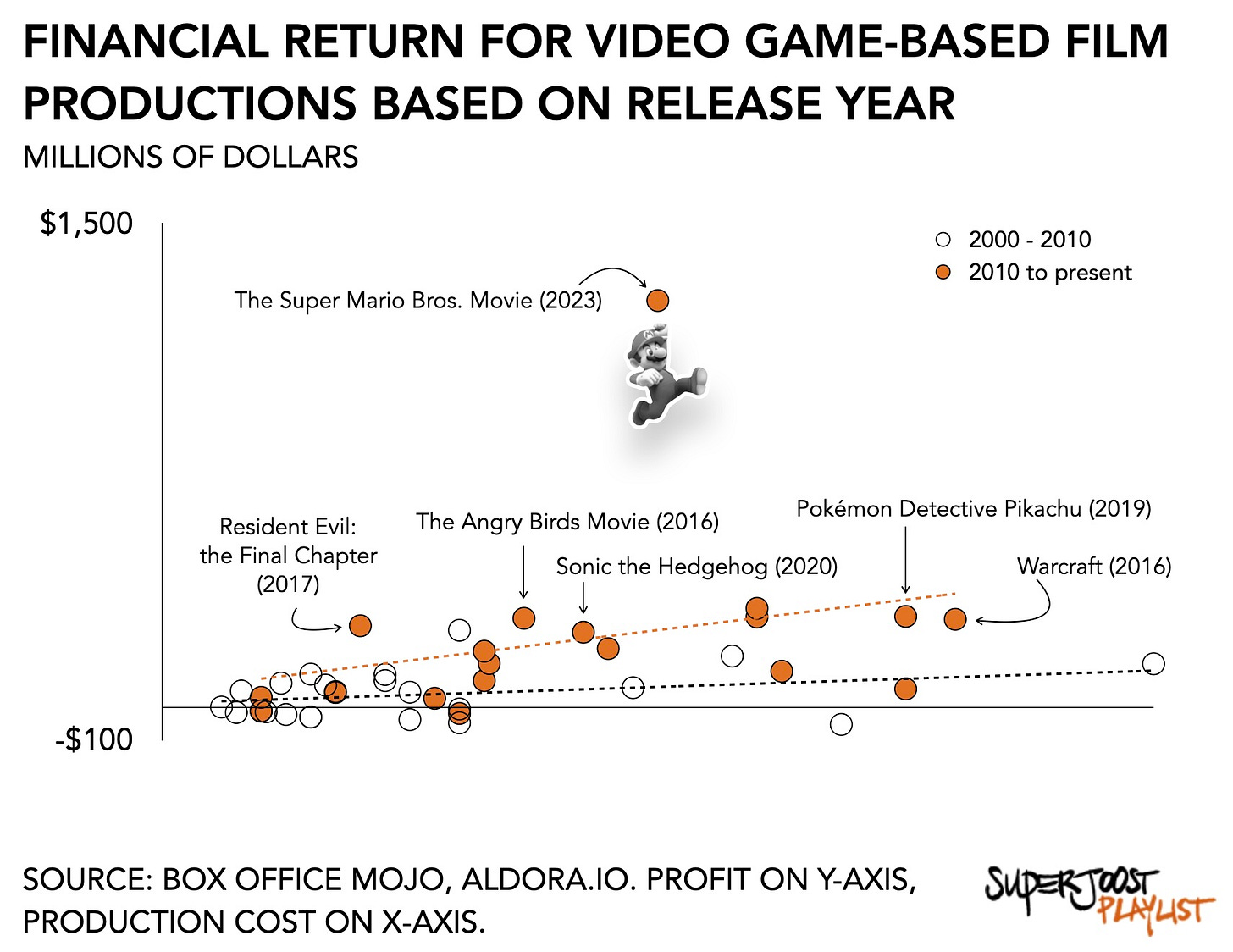

These are not incidental productions anymore. They are far too commercially successful. The Mario movie is this year’s second-biggest box office earner, bested only by Barbie. Consequently, Nintendo plans to release one movie every year, Mario and Zelda creator Shigeru Miyamoto told analysts Wednesday.

It speaks to a broader trend in which game companies are expanding their existing and new universes well beyond the boundaries of mere play. Nintendo opened up a theme park recently, and now it further drives the success of its franchises by releasing content and experiences that cater to its core audience and build on its strengths.

After seemingly being the slowest game company among its peers, Nintendo’s flywheel is starting to create its own momentum.

By comparison, Microsoft is going to have a much harder time producing non-gaming experiences based on its intellectual property. Even its recently acquired price, Activision Blizzard, has yet to produce a hit on the same level as Nintendo. Despite its widespread appeal and deeply loyal fanbase, the movie Warcraft generated $274 million in profits, compared to $1.2 billion for the Super Mario Bros. Movie. And while Sony fares much better because of its film production division, its anticipated transition to become a media empire is only just now starting to materialize. Despite its leadership position in gaming, or perhaps because of it, Sony now finds itself moving much slower while Nintendo races to the front.

My prediction is that in response to the current superhero fatigue, we’ll soon see a deluge of video game-based movies. Hollywood now has the proof it needs to invest in large-scale feature films. As it brings its own economic logic to the conversation, the companies that have been quietly building in the back quickly advance as their momentum climbs.

And those in front may soon be seeing a blue shell overhead.

NEWS

Lawsuit between Epic and Google kicks off

Following the fanfare versus Apple, Fortnite-maker Epic Games finds itself back in court. Three years ago, on August 13, 2020, the game maker decided to break the terms of engagement with its mobile platform holders. It reasoned that the value Apple and Google claimed to provide was nowhere close to what it was getting. In response, Epic Games offered ‘illegal’ payment options, was promptly kicked off of both platforms, launched a marketing campaign that positioned both platforms as looming platform overlords and took to court.

Given the outcome against Apple, it is unlikely that the case against Google will yield a different result. Fundamentally, Epic Games deliberately broke the rules to which it had agreed, regardless of whether they were fair or not. But the firm remains a lone maverick willing, and financially able, to take on these enormous conglomerates. The core of its argument boils down to the accusation that Google has managed to establish a series of partnerships with device makers and app developers that ultimately ensure the Play Store retains its dominant position in the otherwise allegedly open ecosystem.

More generally, the games industry has been spending a lot of time in court the past few years. Between ABK/MSFT and Epic’s cases against Apple and now Google, all this legal theater has provided an unprecedented abundance of teachings on the games industry. Unfortunately for the current case, there will be no documents disclosed.

Overwatch League shuts down at a cost of $120 million

After six years, Activision Blizzard is shutting down its proprietary Overwatch League and handing it over to Saudi Arabian state-owned ESL FACEIT Group. Competitive gaming has been an integral part of the Saudi’s big play in gaming. In 2022, MTG sold ESL Gaming to Savvy Gaming Group for $875 million, ending a 7-year run in esports after acquiring ESL in 2016 and merging it with DreamHack in 2021.

Dis-intermediating such activities makes sense, however. Vertically integrated organizations may find that their individual assets are having a more difficult time capturing value as part of a larger organization than they do as separate entities. However, it comes at great expense for the teams. On Wednesday Activision Blizzard confirmed what is now dubbed the “Death of the Overwatch League”. A majority voted to discontinue the league and each received a $6 million payout as a paltry recoupment of the millions they’ve spent over the past seven years in franchise fees and operating costs.

That sucks for the different teams and their owners, of course. I recall watching the first star-studded OWL championships here in Brooklyn and being encouraged by how ambitious Activision Blizzard seemed at the time. More generally, it feels like another nail in the esports coffin, The combined enterprise value of the major publicly-traded esports firms has declined by 75 percent, from $1.1 billion in 2021 to $269 million in 2022. The $18.5 million acquisition of FaZe Clan by GameSquare was a recent exclamation mark in the category’s cry for help.

I continue to be hopeful about the category because of the deep loyalty of its fans. But it’s clear that it is going to require new management.

MONEY, MONEY, NUMBERS

Roblox reported $840 million in bookings. It exceeded Wall Street’s expectations ($830 million) by growing +20 percent y/y. Following a reduction in infrastructure and personnel costs, its operating margin improved better than expected, and its EBITDA margin rose to 9.7 percent compared to 4.9% in 23Q2 and 7.3% in 22Q3. For the first time, Roblox broke the 70 million daily active user barrier. It continues to do well among older cohorts: the share of players between 13 and 16 years old grew +22 percent, 17 to 24 grew +27 percent, and 25 and older grew +25 percent y/y.

Take-Two’s net bookings fell -4 percent to $1.44 billion but still managed to exceed consensus. It expectedly boasted about Grand Theft Auto V and Online which has sold around 190 million units to date. The most recent release of NBA 2K24 sold over 4.5 million units to date. Now that Zynga is fully integrated, Take-Two is more exposed to the current drag in mobile and had to reduce the outlook for some of Zynga's mobile titles. Management nevertheless reiterated its net bookings guidance for fiscal 2024 $5.45 to $5.55 billion. Take-Two’s share price jumped +6 percent, reaching $147 a share, on (get this) the announcement of the release of the trailer for Grand Theft Auto 6. CEO Strauss Zelnick isn’t worried about a potential voice actor strike delaying the title’s release, stating "We are completely protected” and expressed optimism about reaching an agreement with the union.

PLAY/PASS

Pass. Graphic images from pro-Israel ads are appearing in children’s video games.

Play. I’m happy to see that Shannon Liao is now head of gaming at Inverse, and four former Kotaku writers have started Aftermath. It gives hope for the crew from the Escapist that just walked out.

Thanks for the great newsletter, as always!

Just a correction - Warcraft did not make that much profit. It cost $160 million, spent a further $110 million on marketing, and made the vast amount of its returns on markets outside the US and Canada (meaning the pie gets split far more) and it effectively bombed in the US domestic market, (it opened at under $25 million and made less than $50 million), analysts predicted it needed to cross $500 million to qualify as profitable. It did not, so technically, it made a loss.

Thank you!