The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

Greetings from Aarhus!

In preparation for a talk at the THIS 2023 conference in Denmark, I updated my numbers on the European games market to get a better sense of context. Especially since the United States and China so often claim the headlines.

Paradoxically, Europe is the place of origin for many of the world‘s best-known franchises that it no longer owns.

At a high level, Ubisoft, CD Projekt Red, and Embracer are the most visible game houses. They set the tone for the European marketplace. Ubisoft inserted itself in the industry’s largest-ever transaction and managed to convince investors last week that its future is brighter still. Polish powerhouse CD Projekt Red is doing better but is still on the mend. Hopefully, its new plans can give it the lift it deserves. And Embracer, despite owning several valuable assets, is currently going through a bloodletting to return to profitability.

The changing ownership structure tells a different story (see below). Instead of developing its own strength and independence, the European games industry stays relatively small because its biggest successes end up under non-European management. And if the EU is going to truly grow its recently discovered cultural industry, it needs to provide more resources and better infrastructure. Between being bought by the American and Asian juggernauts or bathing in a spring tide of oil money only to have it ebb away just as suddenly, the European games industry feels vulnerable.

Game makers find themselves in the uncomfortable situation of having to take checks from platform holders to continue development for their hardware. And while that’s generally a sound decision—creating content for an emerging and heavily marketed new device or platform affords an opportunity to get in before the big dogs show up—it also creates further dependencies. Apple is pushing further into high-end gaming with its iPhone 15 and its shiny new M3 chip. But it has yet to prove it cares about play more than profit. It dovetails well with some of the observations from Sergiy Galyonkin. (Mr SteamSpy recently left Epic Games and promised to provide more regular industry commentary. Welcome back!)

Following another string of layoffs this week, interactive entertainment has never been more financially successful and simultaneously faces a massive destruction of value for the long term. Navigating such a volatile market environment effectively is just as critical as making great games.

On to this week’s update.

BIG READ: The great Danish playbook

Visiting Denmark and meeting many of the major game makers there offered a glimpse into the best, and worst, of the European video games industry.

Arriving at the Copenhagen airport after an overnight flight felt like I had woken up in an alternate timeline. Most of the Danes are unnecessarily tall, bicycles dominate the streets, you find black licorice in every store, and the weather is wet and miserable. It resembled the Netherlands where I grew up but it isn’t. For one, I couldn’t understand a word they were saying and, unlike everyone else, I was cold the entire time.

It amounts to a specific cultural environment. Despite Denmark’s modestly sized population of around 5.9 million people, it has managed to produce some of the world’s best-known firms and franchises.

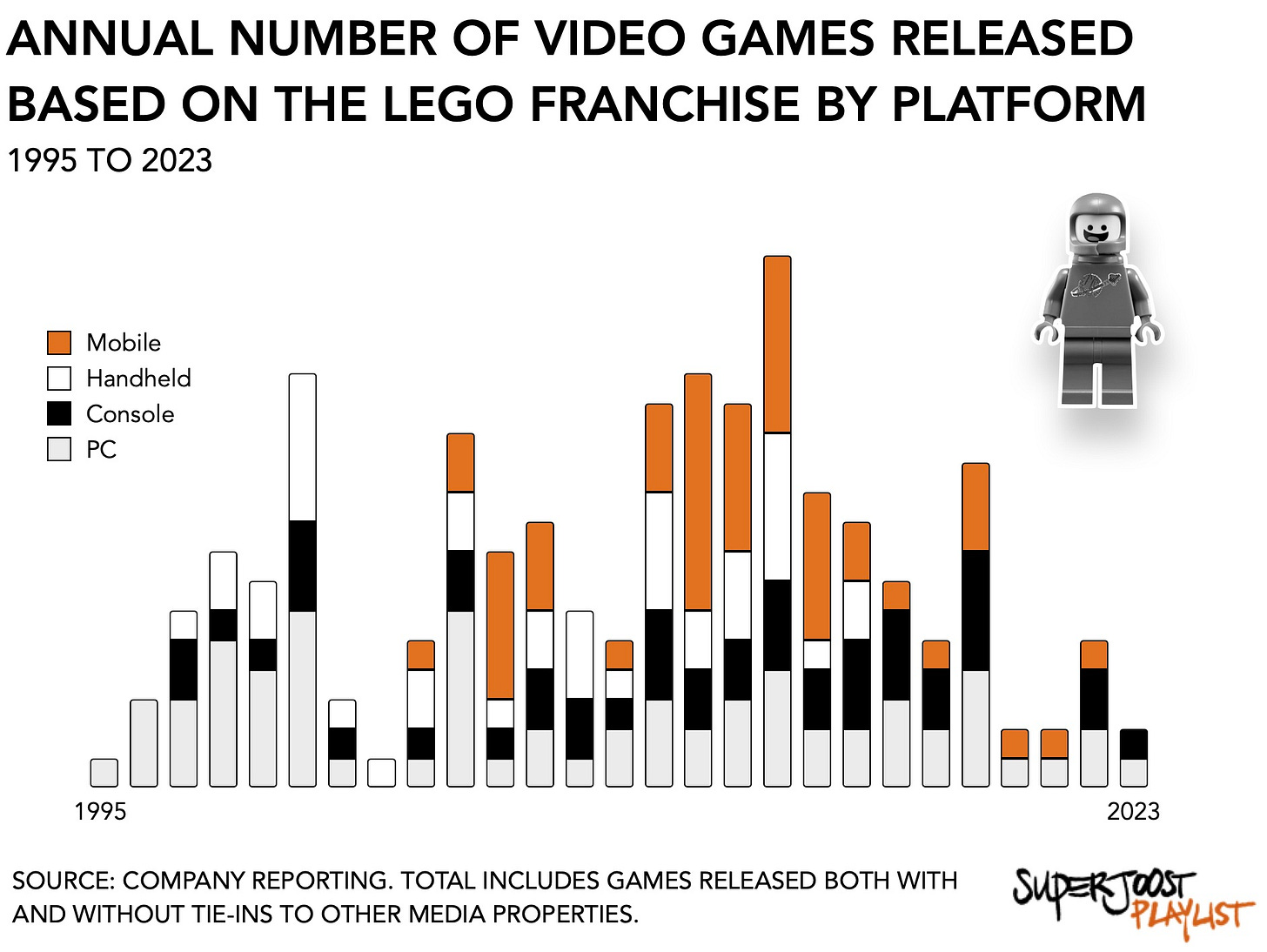

Perhaps its best-known mobile game is Subway Surfers. Co-developed by Kiloo and SYBO Games, the game has been downloaded over 4 billion times to date. It is one of those titles that manifested a genre. There is also IO Interactive, which is responsible for the Hitman franchise and was eventually acquired by Square Enix. Did I mention LEGO? The $8-per-pound plastic bricks that litter my basement are an institution among toys. Its widespread cross-pollination with film franchises and other properties has allowed LEGO to reach an audience far beyond mere builders (see chart). Its games are found on every platform. And there’s, of course, game engine maker Over the Edge Entertainment which would later become the better-known Unity. I suspect that after recent drama the Danes may prefer to surrender the firm and its cultural identity wholesale to the Americans. Nevertheless, the cultural impact that originates from Denmark is nothing short of remarkable.

Right before he went on stage to open the conference, I spoke with Aarhus’ Councilor for Culture and Civic Services, Mahad Yussuf. He admitted that he didn’t play much beyond the classics. It was his son’s affection for Counter-Strike and the startling realization that some players made a living from competitions and trading skins that had prompted him to see video games in a new light.

More generally, there is noticeably more attention among the different EU member states for the amount and quality of video game content they create. In recent years interactive entertainment has come to enjoy broader visibility and has managed to ascend to a relevant cultural industry.

However, the apparent win condition for European game makers is to be acquired by either American or Asian conglomerates.

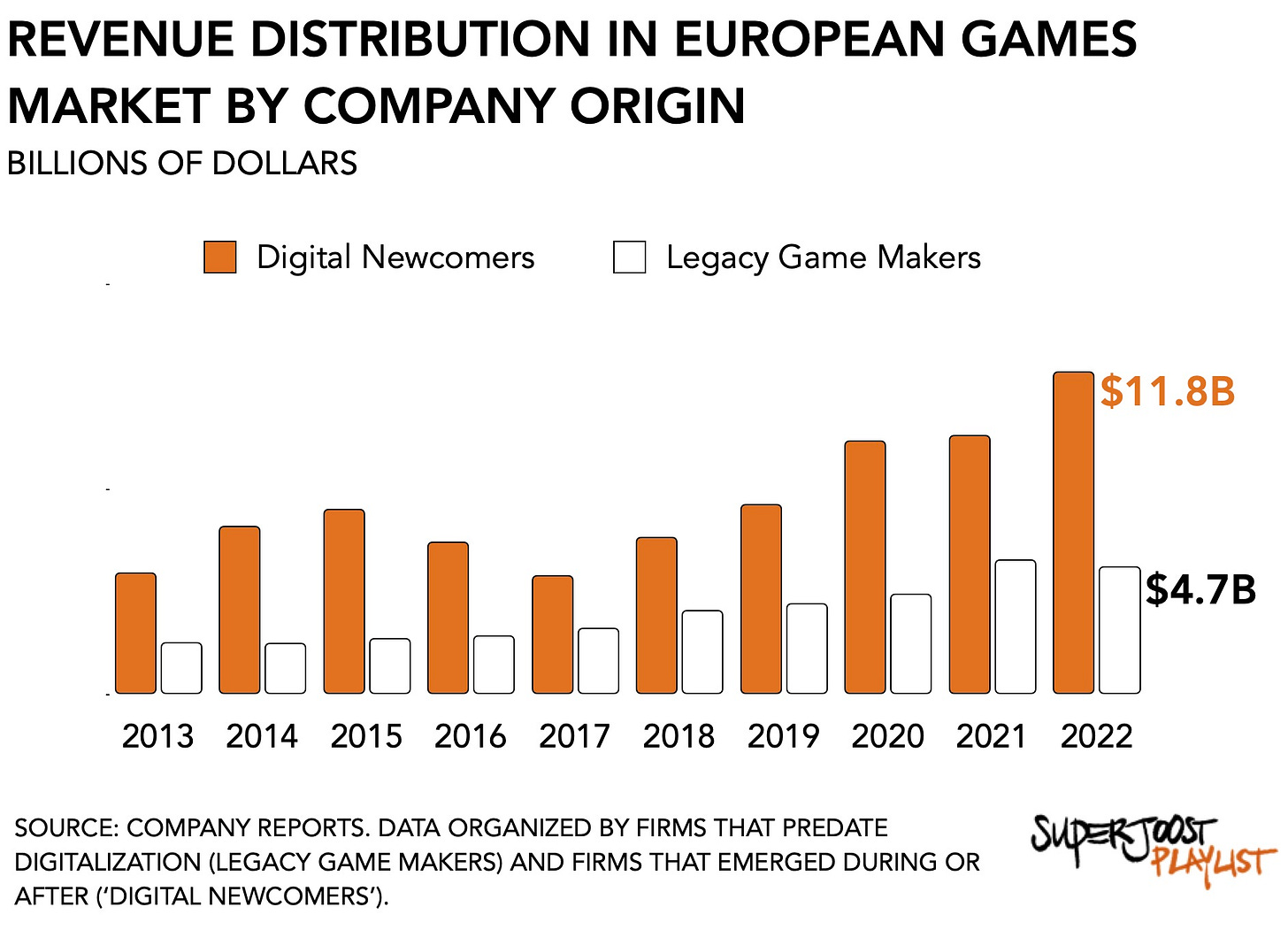

Here’s how that breaks down. Digitalization has facilitated the rise of newcomers. In the absence of apex predators the combined revenue for game makers under European ownership has increased from $6.4 billion to $16.5 billion in the past decade, an increase of +156 percent.

After existing in relative obscurity for a decade, the success of Candy Crush elevated King Digital and culminated in its $4.9 billion acquisition by Activision Blizzard. Dutch studio Guerrilla Games has ascended to become an integral part of the Sony industrial gaming complex. After accepting a $776 million take-over offer from SEGA, Angry Birds-maker Rovio is in the throes of calling its scattered collection of individual shareholders in order to close the deal. And, deservedly, Supercell is the pride of Finland; it is also owned by the largest Chinese game maker, Tencent.

Succinctly, instead of continuing its overall upward trajectory, the European games market shows a dip in the period between 2015 and 2019 as international game companies bought out its most valuable assets. Large firms mitigate risk by innovating via acquisition. As a result, coming under new management has implications for how these companies are run, how employees are compensated, and what novel innovations get funded.

Denmark offers a different perspective. Because of its modest size, there exists fierce competition over talent. Understandably, the pool of candidates is small as it is and Denmark’s studios develop in the shadow of the mighty Finns and others up North.

But what characterizes it is an amicable rivalry.

Like its well-known plastic building blocks, Denmark features a connected community of developers. Studios share what they can about platform partnerships, publishing deals, and performance metrics in the absence of greater market transparency. It is no secret that large platforms like Apple benefit from information asymmetries. Does it surprise you to learn that one of the best-performing Danish titles is Deep Rock Galactic, a multiplayer co-op shooter? A combination of geographic proximity and collective interests around industry resources has allowed Denmark’s development scene to become a closely-knit creative effort.

Visiting Denmark offered a view from the ground floor. Its dev scene is pregnant with promise and none of the pretense. It felt like its success wasn’t just their own but belonged to all the Danes. It is a perspective that serves as a counter-balance against the constantly growing power of platforms and acquisitive powers that be.

I call it the great Danish playbook.

MONEY, MONEY, NUMBERS

Ubisoft reports $588 million in bookings

The French publisher significantly exceeded expectations this quarter, with guidance at $371 million and consensus at $418 million. The publisher’s back catalog remains strong and attributed the strong quarter in part to Rainbow Six Siege and the successful launch of The Crew Motorfest and pre-sales of Assassin's Creed Mirage. It also acquired lucrative cloud streaming rights to Activision Blizzard titles for over $53 million upfront, a bet on long-term profitability. Despite slipping an unannounced major title into 2025, Ubisoft maintained full-year guidance thanks to outperformance this quarter and momentum across the business. The company highlighted its promising pipeline including Assassin's Creed Mirage and Avatar: Frontiers of Pandora. The quarter’s results pleased analysts who took it as confirmation of Ubisoft’s long-term growth trajectory.

Electronic Arts’ net bookings rise to $1.82 billion

Following the release of EA Sports FC, all eyes were on the firm’s ability to go it alone. Reporting 14.5M active accounts for the soccer game proved a good start. Electronic Arts (EA) continues to generate most of its money from console gaming, totaling $1.2 billion for the quarter, up +12 percent y/y, compared to $389 million for PC (down -10%) and $279 million on mobile (-6%). Given its relatively small footprint in mobile and its reliance on Ultimate Team, I’d expect EA to direct its attention to its major franchises at the expense of smaller initiatives. Following its $1.2 billion acquisition of Codemasters during the pandemic I expect EA to ramp up its effort in the racing game genre as Formula 1 racing is expected to finally successfully break into the US market this year with the Las Vegas Grand Prix.

PLAY/PASS

Play. The game Dead Cells, a “roguelike-Metroidvania game”, has sold 5 million copies in mainland China, according to Bilibili Games. It’s one of my favorites. You should play it.

Pass. Epic Games is back in court after the Ninth Circuit determined a celebrity choreographer’s claim of Fortnite stealing one of his dances was plausible.

Fantastic newsletter as always! : )